The U.S. economy added no jobs in August according to the BLS report released on Friday. Based on official figures currently 14.0 million Americans are unemployed and the unemployment rate stands at 9.1%. Unofficial figures are much higher since the BLS data does not include the unemployed that stopped looking for work. Since the US economy is primarily a consumption-driven economy, the high unemployment rate does little to help a recovery. Even among the employed, one-third fear of losing their jobs according to a recent survey. So naturally this leads to reduction in consumption spending and increase in household savings further hurting the economy.

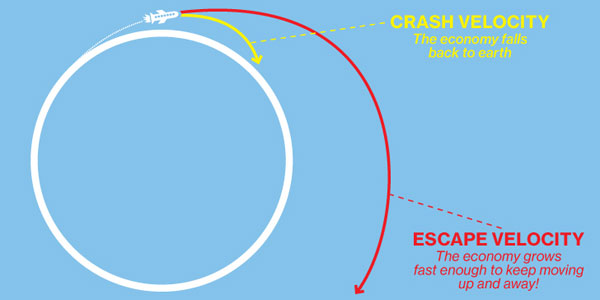

An article in Bloomberg BusinessWeek last month noted that “Slow growth may do more than just signal trouble; it may cause it”. From the article titled The U.S. Economy Feels the Pull of Gravity:

Source: Bloomberg BusinessWeek

Economics isn’t rocket science, but the U.S. economy is a little like a rocket. If it has enough thrust, it can escape the tug of economic gravity. Not enough, and it just might go into a tailspin. Economists at the Federal Reserve and elsewhere are studying whether today’s slow growth is a precursor to an outright recession—and if so, why.

It’s widely accepted that a slowly growing economy is more likely to tip into recession, for the obvious reason that it’s already too close to the line; any shock can knock it into negative territory. And today’s slow growth is at least in part a symptom of underlying problems such as consumer indebtedness, high energy prices, and the jitters induced by debt ceiling brinkmanship.

What’s harder to prove is the hypothesis that slowness is not just a symptom of trouble but a cause of it. In other words, some economists say, if the economy grows too weakly, that slowness itself could create conditions that lead to a recession. Why? Maybe the sluggishness undermines consumer and business confidence. Maybe investors lose faith in the recovery so stock prices, already down 9 percent from their April high, plummet. Or maybe lenders get nervous about borrowers’ ability to repay loans and start withdrawing credit. Any such reaction could cause the very downturn that’s feared. “When the growth rate gets low enough, certain factors may kick in, nonlinearly,” says Menzie Chinn, an economist at the University of Wisconsin at Madison and co-author of a new book, Lost Decades.

President Obama is expected to give his jobs speech before Congress next week. Some are hoping that he will announce new policy measures to stimulate the economy and job growth. If private-sector job creation continues to stagnate or further layoffs occur there is little hope of recovery for the US economy for the rest of the year.

Escape to where? We are an economic rocket locked inside our own personal hell hanger, 40 years as the fiat world reserve currency. Fuel? Thrust? your kidding

Thanks for the comment.

I agree. Our current economic system needs to make fundamental changes to get out of this rut.