Global stocks fell heavily across the board yesterday.Panic selling in the markets usually presents buying opportunities. Investors looking to deploy capital during uncertain times can buy high-quality dividend-paying stocks at cheap prices.

Some of the reasons for investing in dividend-paying stocks are listed below:

- 90% of the U.S. equity returns in the past century has been delivered by dividends and dividend growth.

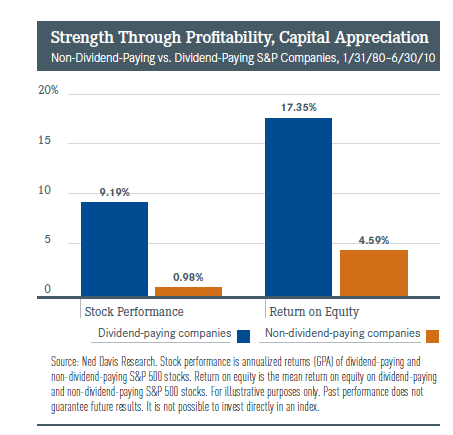

- Dividend payers usually have superior returns than non-payers as shown in the chart below:

- Since 1970, more than 80% of European returns have come from a combination of yield and real dividend growth.

- Over the past 30 years, well over 90% of UK, Germany and France returns have come from dividends and dividend growth according to research by Societe Generale.

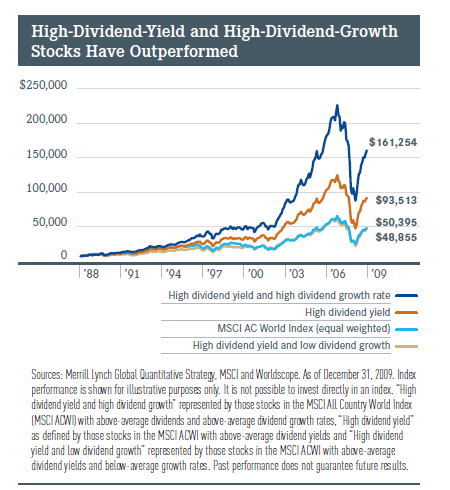

- Globally, high-dividend-yield and high-dividend-growth stocks have consistently outperformed the broad market while also handily outpacing simple high yield stocks as shown in the graph below:

- Foreign dividend stocks have consistently higher yields than U.S. stocks.

- In low-growth environments such as the one we are in now, high-yielding stocks have traditionally outperformed.

Source: Why Dividends Make A Difference, Blackrock

Ten randomly selected foreign stocks yielding more than 5% dividends are listed below for further research:

1.Company:Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 6.75%

Sector:Electric Utilities

Country: Chile

2.Company:National Grid PLC (NGG)

Current Dividend Yield: 6.01%

Sector:Electric Utilities

Country: UK

3.Company:Cpfl Energia SA (CPL)

Current Dividend Yield: 5.66%

Sector:Electric Utilities

Country: Brazil

4.Company:Telstra Corp Ltd (TLSYY)

Current Dividend Yield: 8.87%

Sector: Telecom

Country: Australia

5.Company:Aviva PLC (AV)

Current Dividend Yield: 7.22%

Sector: Life Insurance

Country: UK

6.Company:City Telecom (HK) Ltd (CTEL)

Current Dividend Yield: 7.21%

Sector: Telecom

Country: Hong Kong

7.Company: Philippine Long Distance Telephone Co(PHI)

Current Dividend Yield: 6.49%

Sector: Telecom

Country: Philippines

8.Company:Allianz Se (AZSEY)

Current Dividend Yield: 5.72%

Sector: Life Insurance

Country:Germany

9.Company:Stora Enso Oyj (SEOAY)

Current Dividend Yield: 5.17%

Sector:Paper & Paper products

Country: Finland

10.Company:Gdf Suez SA (GDFZY)

Current Dividend Yield: 6.99%

Sector: Electric Utilities

Country: France

Note: Dividend yields noted above are as of market close August 8, 2011

Disclosure: No Positions