When investing for income with dividend stocks one has to consider the impact of taxes since higher tax rates can significantly reduce the after-tax yield on the investment. In this post lets take a look at historical trend and current tax rates on dividends.

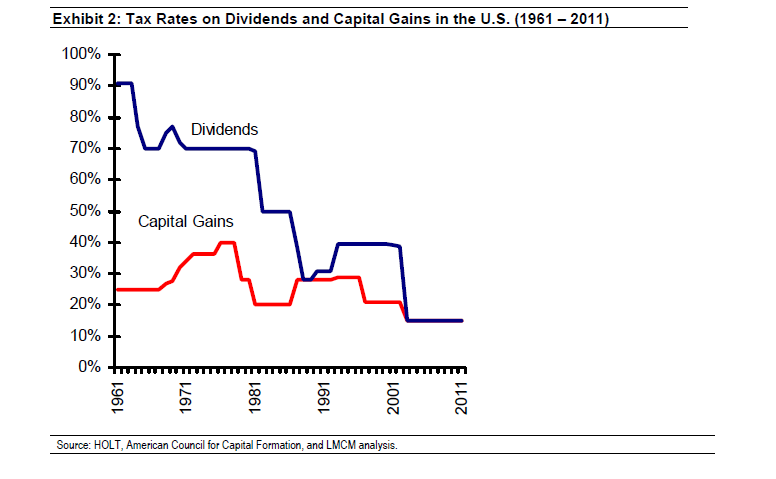

The graphic below shows the U.S. individual dividends and capital gains tax rates from 1961 thru 2011:

Click to enlarge

Source:

Real Role of Dividends in Building Wealth

Michael J. Mauboussin, Legg Mason Capital Management

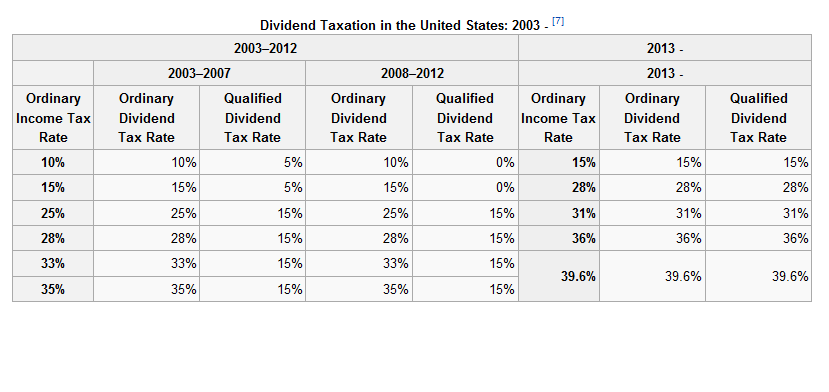

Dividends received by U.S. residents are assigned as either Qualified dividends or Ordinary dividends(non-qualified dividends). Ordinary dividends gets taxed at the individual tax bracket level while Qualified dividends are charged at a much lower rate based on the duration a stock is held and the status of the dividend-paying company. For example, dividends paid by REITs are considered as ordinary dividends. So though REITs have high yields, the actual after-tax yield to an investor may be much lower depending on one’s tax bracket.

The maximum tax rates for ordinary and qualified dividends will be 35% and 15% respectively thru 2012.

Source: Dividend Tax, Wikipedia

Source: Dividend Tax, Wikipedia

The current low tax rates on dividends are big boon to investors compared to the rates in the past. Hence investors looking to take advantage of the extremely volatility in the equity markets now can consider adding high quality dividend stocks.

Related ETFs:

iShares Dow Jones U.S. Select Dividend ETF (DVY)

PowerShares Dividend Achievers ETF (PFM)

Vanguard Dividend Appreciation ETF (VIG)

SPDR S&P Dividend ETF (SDY)

Disclosure: No Positions