The Canadian economy is one-tenth of the size of the U.S. economy. The Canadian banking system was largely unaffected by the global credit crisis and the country is in a relatively strong fiscal position than the U.S.

The outstanding public debt of Canada stood at$563,068,532,455.00 CDN (or) C$563.0 billion as of July 22, 2011.

The total outstanding U.S. public debt stood at 14,342,884,944,996.28 (or) $14.3 Trillion as of July 21, 2011.

The Canadian government spent $33.3 billion dollars or 2.2% of the GDP in 2007-08 to service its debt. Only about 15% of Canada’s public debt is held by non-residents. Along with the US, France, UK and Germany, Canada also maintains the coveted AAA rating by S&P. While the debt-to-GDP ratio for Canada is projected to increase to 84% this year it is expected to jump from 62% in 2007 to 100% this year in the U.S.

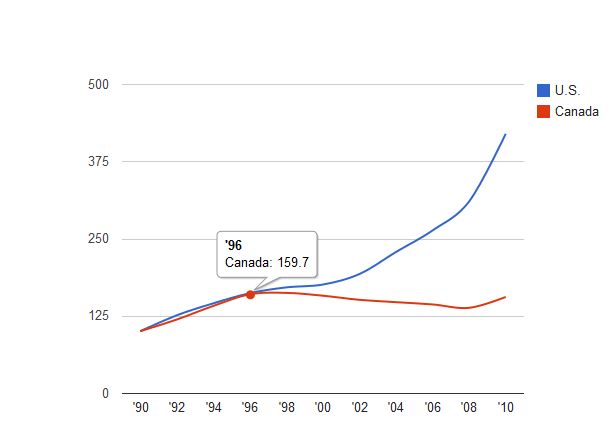

The chart below shows the growth of debt for US and Canada from 1009 thru 2010:

Note: Numbers noted represent percentages with 100% as the base in 1990.

Note: Numbers noted represent percentages with 100% as the base in 1990.

Source: Canadian Business

From an article in Canadian Business:

Since 1990, U.S. federal debt has more than quadrupled while Canada’s debt rose by about 55%. In the 10 years ended in 2010, Canada’s debt showed a moderate decline and U.S. debt doubled. Why the differences? Statistics show that Canada has made an effort to reduce debt and paid off over $90 billion from 1997 through 2008. The recent increase was entirely due to the global recession. U.S. debt has consistently risen, especially in the last 10 years. Major drivers of the increase over that last decade according to the PEW Center were: recession related revenue declines (28%), defence spending (13%; cost of the wars on terror alone were over $2.4 trillion to the end of 2009 according to Homeland Security Research), Bush tax cuts (13%), increases in net interest (11%), and other non-defence spending (10%).