Many U.S. bank stock reached a new low in recent months yesterday. The argument for and against bank stocks continues among investors and Wall Street Pros alike.

From Bank Shares Take a Beating, and It May Not Be Over Yet in the New York Times:

For individual investors, who have long favored bank stocks as a source of dividends and at least the promise of stability, their recent performance has been a big disappointment. And few experts expect a turnaround anytime soon.

“I haven’t seen investor sentiment this bad in a long time,†said Jason Goldberg, a longtime bank stock analyst at Barclays. “Not owning the group has been the right call, and people are skeptical about getting back in.â€

By many measures, the sector is pretty cheap. Diversified banks are trading at about 9.4 times earnings, compared with a multiple of 12.4 for the broader S.& P. 500, according to FactSet Research.

But then, they may deserve to be selling at a discount. Besides the worries about a possible debt downgrade and the investigations into the role they played in the financial crisis, major banks are facing headwinds on many fronts.

For starters, federal regulations passed last year are set to cut deeply into revenue on everything from debit card transactions to trading on Wall Street.

From a related article in The Journal:

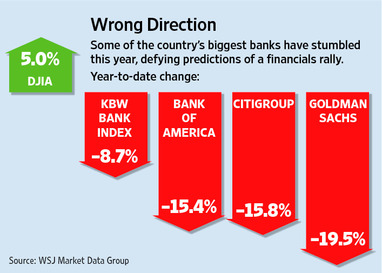

Banks were drubbed again last week as data showed the economy faltered in May. The KBW Bank Index of major U.S. banks fell 4.1%, compared with the Dow Jones Industrial Average’s 2.3% decline. This week could be rocky, too, some analysts said on Friday, because of worries that the Federal Reserve might force big U.S. financial institutions to sharply increase their capital cushions.

Despite the overall market’s recent struggles, the Dow still is up 5% so far this year. But Goldman has tumbled 20%, while Citigroup Inc., Morgan Stanley and Bank of America Corp. are each down by about 15%.

The decline in bank stocks could cast a shadow over the rest of the stock market. Wall Street lore says the overall market can’t rally unless bank stocks gain. The Dow has fallen 5.2% from the three-year high touched at the end of April.

“The financial sector is an integral underpinning of the economy, and it’s going to be very difficult to get a continuing rally without participation from the financials,” says Alan Gayle, senior investment strategist with RidgeWorth Investments. He prefers the industrial and technology sectors.

Banks may be losing their importance to the rest of the market, Mr. Gayle says, partly because the slide in their shares has reduced the industry’s market value.

Bank of America(BAC) closed at $10.83 yesterday on heavy volume.The 52-week low is $10.75 and the current dividend yield is just 0.35%.

In Europe, banking regulators have postponed the release of another round of stress tests. However the storm clouds are circling again over European banks due to the resurgence of the debt crisis in Spain, Greece, etc.

Among the U.S-traded foreign bank stocks, some are performing well. Eight foreign banks that are up by more than 10% YTD are listed below:

1.Bank:Swedbank AB (OTC:SWDBY)

Current Dividend Yield: 1.91%

YTD Change: 24.68%

Country: Sweden

2.Bank: ING Group NV (ING)

Current Dividend Yield: N/A

YTD Change: 18.90%

Country: The Netherlands

3.Bank: BNP Paribas SA (OTC: BNPQY)

Current Dividend Yield:2.43%

YTD Change: 18.62%

Country: France

4.Bank: UBS AG (UBS)

Current Dividend Yield: N/A

YTD Change: 13.96%

Country: Switzerland

5.Bank: Nedbank Group Ltd (OTC:NDBKY)

Current Dividend Yield: 3.86%

YTD Change: 13.24%

Country: South Africa

6.Bank: Deutsche Bank AG (DB)

Current Dividend Yield: 1.86%

YTD Change: 10.93%

Country: Germany

7.Bank: Banco Bilbao Vizcaya Argentaria S.A. (BBVA)

Current Dividend Yield: 7.59%

YTD Change: 10.82%

Country: Spain

8.Bank: Toronto Dominion Bank (TD)

Current Dividend Yield: 3.29%

YTD Change: 10.11%

Country: Canada

Note: Dividend yields noted are as of June 6, 2011

Disclosure: Long TD, SWDBY, BBVA, ING, NDBKY

Related:

Rejuvenated Banks Raise Dividends