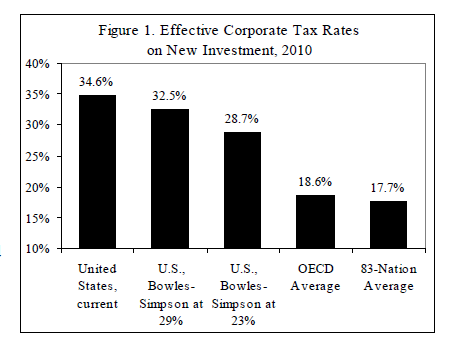

The U.S. has one of the highest corporate tax rates in the world. Only Brazil, Uzbekistan, Chad and Argentina have higher corporate tax rates than the U.S. According to a research study by the Cato Institute, the effective U.S. corporate tax on new investment was 34.6% in 2010. This was higher than the average OECD rate of 18.6% and the average rate for 83 countries at 17.7% as shown in the chart below:

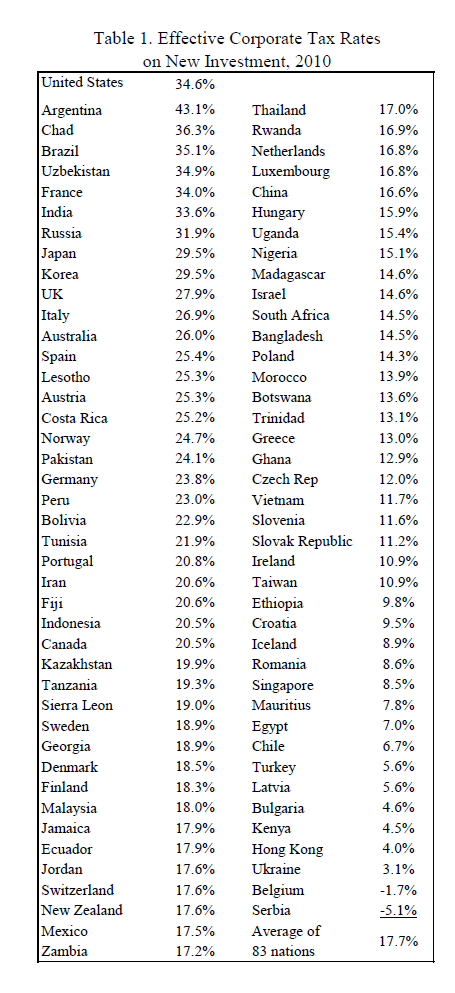

The table below lists the corporate tax rates on new investments by country:

From the research report:

Many industrial and emerging countries have reduced their corporate tax rates over the last decade or so. The largest rate cuts were in Austria, Bulgaria, Canada, the Czech Republic, Germany, Greece, Iceland, Ireland, Italy, Netherlands, Poland, Slovakia, Turkey, Egypt, Georgia,Kazakhstan, Lesotho, Mauritius, and Singapore. America’s largest trading partner, Canada, cut its statutory corporate rate from 43 percent to 29 percent, which helped to bring down its effective rate from 44 percent to 21 percent, according to our calculations. Substantial cuts were also achieved in Australia, Belgium, China, Denmark, Finland, Korea, Luxembourg, Mexico, New Zealand, Taiwan, and the United Kingdom. Taiwan cut its statutory rate from 25 percent to 17 percent in 2010, and now has an effective rate of just 10.9 percent.

The authors of the report propose that the current U.S. corporate tax rate must be reduced by at least 10% or even higher in order to be in-line with the OECD average. New academic study suggests that reducing corporate tax rates in high-rate countries will not cause significant revenue losses. In addition, lower tax rates will encourage U.S. companies to repatriate their profits stashed abroad and subsequently will lead to higher tax revenue collection for the government and stimulate more investment.

In conclusion, the authors suggest that the goal of tax reforms should be to make the U.S. corporate tax rate competitive relative to other countries. Hence a sharp reduction in the federal corporate tax rate of 10% of more would generate higher economic growth and ultimately more jobs and income.

Source: New Estimates of Effective Corporate Tax Rates on Business Investment, by Duanjie Chen and Jack Mintz, School of Public Policy, University of CalgaryÂ