The Shanghai Composite Index is down 14.2% YTD compared to a rise of 10.6% for the S&P 500. Chinese stocks have lagged their emerging peers such as India, Brazil, etc. as well this year as investors avoid investments in the country due to fears of a massive bubble. However many Chinese IPOs continue to be listed on the US markets making China of the hot markets for investment banks. While some of the IPOs have performed well many have not met expectations of success. Yesterday Chinese movie distributor Bone Film (BONA) opened flat at the IPO price of $8.50 and then lost 22.4% to close the day at $6.60. According to Dealogic this decline was the worst this year.

Despite most investors’ worries about China, one US fund manager likes Chinese stocks. From a report in UK-based Trustnet:

Investors and managers are at risk of missing investment opportunities as they get distracted by the “noise” of economic data, according to RENN Universal Growth Investment Trust’s manager Russell Cleveland.

“There is a lot of noise around Ireland, Greece, and China, and that can mean you miss the melody of what’s really happening,” he said.

He added: “Economic policy from the US, worries on the Eurozone and fears on a China bubble dominate the news, but often these factors have very little impact on my portfolio.”

The Dallas-based manager invests in small, innovative Chinese companies which are listed in the US. He prefers companies which are led by their founders, and who have a significant holding in their own business.

“There are more than 300 China-based companies which are traded in the US, so it’s a good universe we’ve got to pick from. Accessing China through the US is a more stable way to get exposure to the growth in the emerging markets country,” he said.

Speaking on the possibility of a bubble in China, Cleveland says property might be cyclical, but it won’t necessarily mean anything to investors.

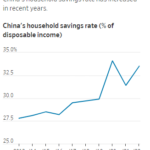

“There are too many apartments in China, that much is true, and real estate will be a cyclical sector, but not the whole country. China is very strong financially. The rate of growth might slow, but that’s not a bad thing,” he said.

One way to identify some of the promising Chinese companies is to use the recently-launched BNY Mellon China ‘Xia Yi Dai’ or the “Next Generation” ADR Index. This index is comprised of the “Next Generation” of Chinese growth companies from sought after industries, including Internet, alternative energy and media.

Some of the features of this index are:

- Companies’ primary listing is to be in the form of Depositary Receipts (DRs) traded on a U.S. exchange.

- Constituents are subject to both liquidity screens and a minimum free-float market capitalization of at least $100 million.

- Â The index is modified capitalization-weighted and adjusted for free-float.

The 30 constituents of the BNY Mellon China ‘Xia Yi Dai’ Index are listed below with their DR tickers:

[TABLE=855]

Duoyuan Global Water (DGW) and VisionChina Media (VISN) are down about 65% YTD.

Hotel-chain operator 7 Days Group (SVN) is up about 92% YTD. Companies such as China Real Estate Information (CRIC) can be avoided as it is a real estate play.

Disclosure: No positions