In a post titled “The Magic of Buy & Hold vs Trend” fellow blogger Barry Ritholtz noted the following interesting fact yesterday:

“On December 31, 1998, the last trading day of the year, the SPX closed at 1229.23. That is within 10 points (not 10 percent, but 10 points!) of where it is today.

Over the course of these dozen years, we have seen a 68% rally (to the 2000 top), a 50% sell off (March ’03 lows), a 104% rally (October ’07 top), a 58% drop (March ’09), and an 83% move up (April 2010 highs).”

I wanted to check how U.S. stocks performed relative to foreign developed and emerging markets in the last 10 years. So I reviewed the performance of the MSCI indices of the respective countries.

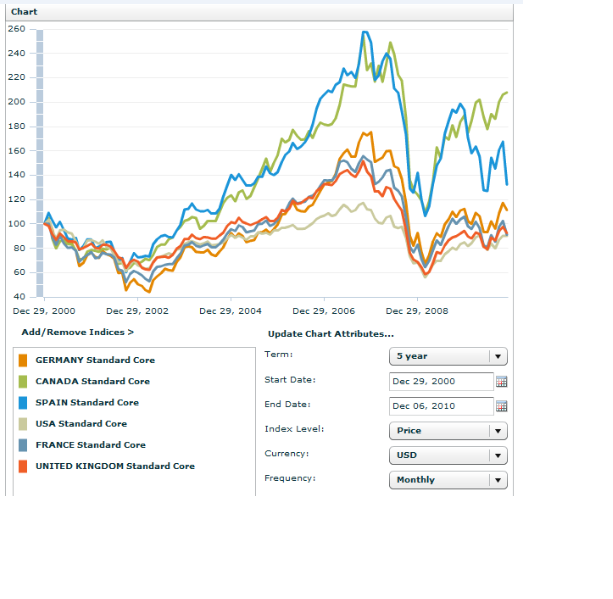

1. MSCI Index Performance – U.S. vs. Select Developed Markets:

Click to enlarge

In the above chart, US stocks performed the worst in the past 10 years. Canadian stocks performed better easily beating US, France, Spain, Germany and UK. Despite the recent fall in European markets, European stocks are well ahead of US stocks in terms of returns.Spanish stocks are also better performers compared to US stocks in spite of the recent debt crisis there. This chart shows how US investors can amplify their returns by investing in foreign stocks. Even investing in companies north of the border yields higher returns.

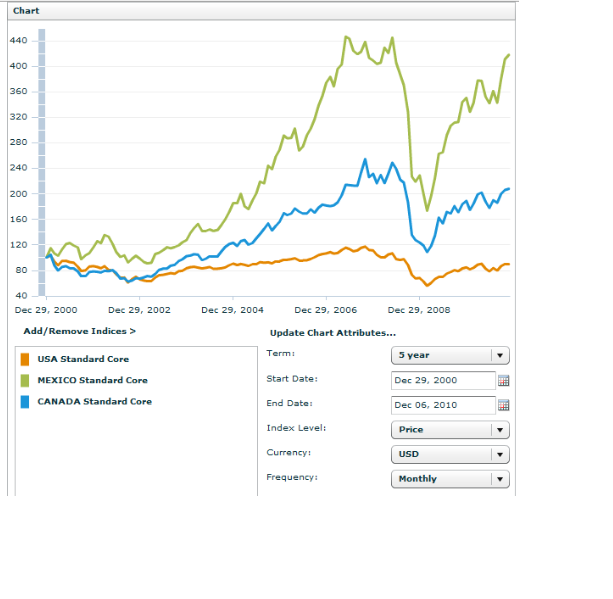

2. MSCI Index Performance – U.S. vs. Mexico, Canada:

While Canada performed better than US in the last 10 years, Mexican stocks yielded even higher returns as shown in the chart above.

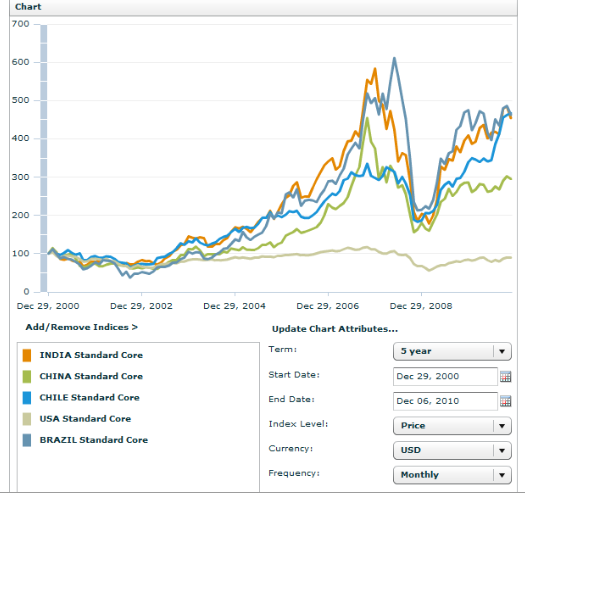

3. MSCI Index Performance – U.S. vs. Select Emerging Markets:

Source: MSCI Barra

This chart shows that the U.S. has lagged emerging markets such as Brazil, India, China and Chile in the past decade. US stocks (shown in grey line) have practically gone nowhere in this time period whereas emerging stocks have yielded incredible return to investors. Based on the returns of MSCI indices, Chile and Brazil have been better performers than China and India.

The above three charts clearly show that investors seeking higher returns have to look beyond the shores of the U.S. Hence instead of merely sticking to U.S. companies as in the past investors may want to expand their horizon and explore some of the high quality stocks elsewhere in the world.

Related ETFs:

Vanguard Emerging Markets ETF (VWO)

iShares MSCI Emerging Markets Index ETF (EEM)

iShares S&P 500 Index Fund (IVV)

iShares MSCI Canada ETF (EWC)

iShares MSCI UK ETF (EWU)

iShares MSCI Spain ETF (EWP)

iShares MSCI Germany ETF (EWG)

iShares MSCI Chile ETF (ECH)

iShares MSCI Brazil ETF (EWZ)

Disclosure: No positions