Earlier this year Murray Leith of Odlum Brown, a British Columbia,Canada-based financial services firm made a presentation in which he suggested the theory that Canada is a play on China. He stated that”the Canadian stock market really hangs on China’s fortunes.” I wondered if his theory is indeed correct.

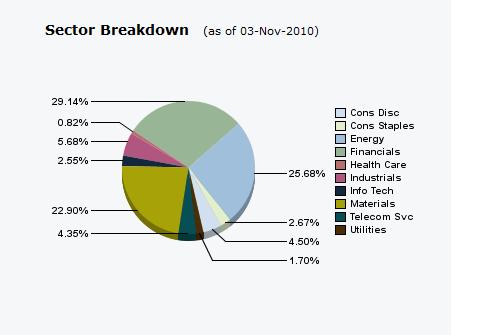

Murray noted that the Canadian stock market is not well diversified like the U.S. markets. The composition of the S&P/TSX Composite Index is shown below:

About 49% of the index is made of the resources sector and 29% is concentrated in financials.Together they makeup more than three-quarters of the Canadian markets. So when compared to the US S&P 500, the Canadian market is highly concentrated on just two sectors.

Murray said that “Financials are not directly tied to China like Resources, but they are from an indirect perspective considering that China’s resource demand has a major influence on the overall health of our country.” The Canadian financial sector has more exposure to Latin America, the Caribbean and the U.S. than China. Hence even if China imports a large amount of Canadian resources, the financial system is more likely to be impacted by the economic situation in Latin America and the U.S.

It is a well known fact that Canada is the largest trade partner of U.S. Thru August this year trade between Canada and the U.S. exceeded $346 billion while trade between U.S. and China totaled $285 billion.In 2009, total trade between U.S. and Canada was $429 billion.

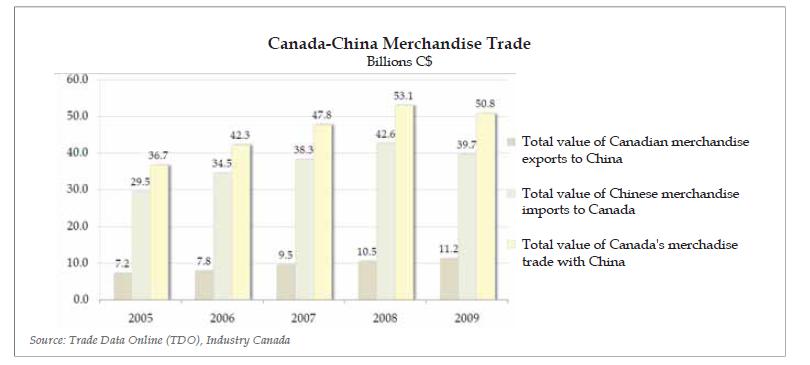

Last year Canada exported just over C$10 billion to China but imported goods worth C$39 billion from China. The majority of the exports were oil seeds, fruit, grain, woodpulp, paper or paperboard scraps, ores, slag and ash. In the first half of this year Canadian exports to China exceeded C$5.5 billion.

From The Canadian Chamber of Commerce report titled “Canada–China: Building a strong economic partnership”:

“Two-way trade between Canada and China continues to expand, albeit at a slower pace following the 2008 financial crisis; the total value of two-way trade was C$50.8 billion in 2009 versus C$47.8 billion in 2007. A 2009 Fraser Institute study found that despite this growth,Canada’s two-way trade with China remains well below potential.

Indeed, while China is Canada’s third-largest trade partner and third-largest export market, Canada’s trade with China still represents only seven per cent of our country’s overall merchandise trade. Only three per cent of Canada’s merchandise exports went to China last year, versus 75 per cent to the United States. It is clear there is room to achieve substantial growth in Canada’s commercial exchanges with China.”

Click to Enlarge

Hence based on the analysis noted above I do not agree with the view that Canada is a play on China. China is dependent on Australia and other economies in Asia for trade and economic growth than Canada. Despite the Chinese demand for many commodities that Canada has, our northern neighbor’s fortune is still dependent on the U.S. economy.

Sources: Asia Pacific Foundation of Canada, U.S. Census Bureau and others

David,

You have missed my point.

It is widely accepted that China is the marginal price setter for commodities. When China’s demand for commodities is strong, commodity prices are firm and Canada’s resource sector does well. If China is the marginal price setter for commodities, then it is China that has the greatest influence on Canada’s resource sector regardless of where the oil and other commodities are shipped.

With regard to the Canadian banks, I never said that Canada’s banks had a lot of direct exposure to China. However, the Canadian banks are hugely influenced by the health of China’s economy in a number of indirect ways. The logic follows: Canada’s banks have done relatively well through the financial crisis and its aftermath, in large part because the Canadian housing market has been robust. The buoyant resource sector has contributed in no small way to the health of Canada’s housing sector. The Canadian housing market has also been helped by the Bank of Canada’s low interest rate policy, which has been influenced by high commodity prices and the associated strong Canadian dollar. The Bank of Canada has held interest rates relatively low, and lower than warranted based on domestic conditions, in large part due to a desire to offset the negative effect of the strong dollar on our manufacturing sector. Canadian banks are doing well, and much better than their American counterparts, mainly because Canadian consumers are confidently borrowing and spending (note: consumers are much more inclined to borrow when their house is going up in price). Canadian consumers are so confident that they have run their debt-to-income ratio all the way up to levels on par with American consumers. Our banks may verify income, but they are still accommodating consumers who want to take on American style leverage. If China wasn’t driving commodity prices and our dollar higher, the Bank of Canada would not be offering rock-bottom interest rates that encourage Canadians to borrow and buy homes. And if that wasn’t happening, our banks wouldn’t be doing as well.

Money supply is growing rapidly in China, largely because China restrains the value of its currency and thereby adopts the stimulative monetary policy in the United States, which in turn drives capital flows into the Canadian economy in general and the real estate sector in particular. This is yet another way that China has a big influence on Canada’s housing market, consumer confidence, and our love of leverage. It’s a grand party and our banks are prime beneficiaries.

Considering that more than 75% of the S&P/TSX Index is geared to resources and financials, we better hope that China’s economy remains robust.

China is a great story and I think there is a reasonable chance that its economy will remain robust. Still, I think it would be foolish not to appreciate that our stock market’s fortunes are closely tied to the fate of the Chinese economy.

Murray Leith,CFA

VP & Director, Investment Research

Odlum Brown Limited

Hi Murry

Thanks a lot for the detailed clarification. I did not think in terms of China’s resource demand setting the prices.I agree with your point.

Thats correct.You did not mention that Canadian banks have lots of exposure to China.Again I agree with your theory on why Bank of Canada is keeping the rate so low and how that is impacting home prices and consumers’ leverage.

While I have studies the trade between Canada and the US and other countries, I have to do more research on the indirect relationships you mention between China’s economy, commodity demand and the health of the Canadian economy party.

Thanks again for your clarification.

-David