Some investors are avoiding Europe due to the Greek crisis. There are many European companies that are truly multinational firms with strong presence in emerging markets. Hence despite the current crisis one can be highly selective and pick quality stocks European stocks that offer not only stable growth but also high dividends.

Yesterday’s Wall Street Journal article Is It Safe to Buy Europe? discusses about investment options in Europe. From the article:

“The most successful investors, of course, spot opportunity where others see only danger—and possess the courage to rush in as everyone else flees. Most famously, in March 2009, with the Standard & Poor’s 500-stock index plunging through 800 toward a devilish 666, a few hardy souls placed buy orders among the stampede of sells—and were rewarded with the short-term rally of a lifetime. Miniversions of that historic turnaround play out frequently in markets around the world.

Investors with a contrarian bent are starting to tot up reasons to consider Europe now. Among them: Greece’s travails and the region’s overall economic sluggishness mean interest rates should remain low for an extended period of time. That could augur well for riskier investments such as European stocks, whose valuations seem favorable compared with other parts of the world. French and German companies, on average, trade at about 17 times their earnings per share, while U.K. companies fetch about 14 times earnings. That is much less than the 22.5 and 19 found in the U.S. and China, respectively.”

European blue chip companies generally have higher dividend yields than U.S. companies. For example, the current yield of the S&P 500 is just 1.87%. But the MSCI’s European Index has a dividend yield of 3.40%.

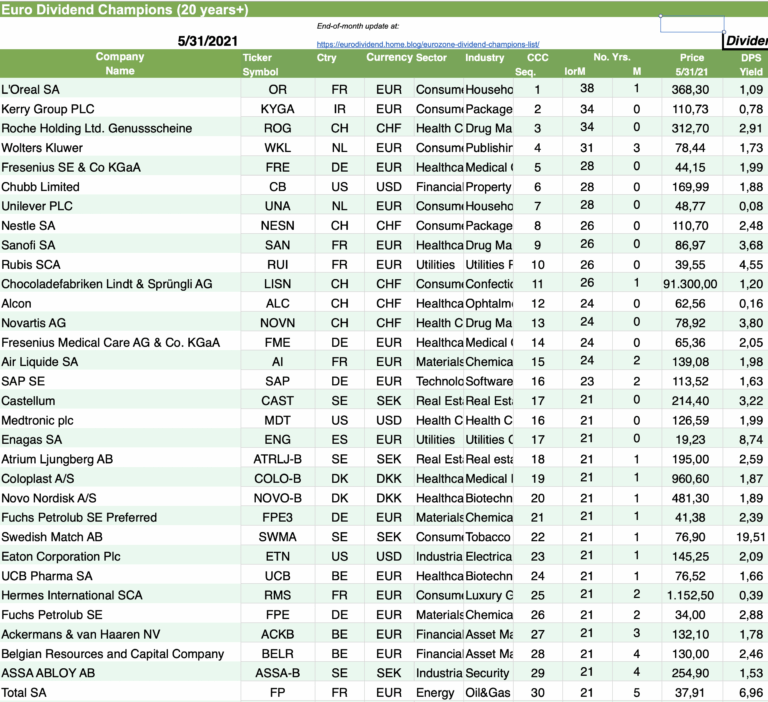

Morgan Stanley has identified a list of 33 European high and secure dividend paying stocks. These top dividend stocks are shown below:

[TABLE=415]

Italian utility A2A is engaged in the production and distribution of electricity. It also markets natural gas and is involved in the trash collection business. It has a P/E of 12 and prospective dividend yield of 7.4% on the shares traded local exchange. The company generates plenty of cash to cover dividend payments. Spanish telecom giant Telefonica (TEF) generates the majority of the earnings from Latin America and the British-based Vodafone (VOD) has significant presence in many developing countries.

Among the utilities listed, Germany-based RWE AG (OTC: RWEOY) has a forecast P/EÂ of 9.2 for this year and is a consistent dividend payer. The world’s largest chemical company BASF (OTC: BASFY) is also an industry leader and continues to expand into new markets.

Other stocks noted above in the drugs, insurance, retail and tobacco sector are also excellent choices for investing in European companies.

you neglected the p/o,growth,years paid and financial status.

t m

Good points. That was an article quoting the source. I will list these figures next time. Thx.