Unlike its neighbor Singapore, the country of Malaysia is often overlooked by investors. The economy of Malaysia is commodity-based with palm oil, crude oil and rubber being the major exports. Among the Asian emerging markets, Malaysia has some unique comparative advantages. Some of the top reasons for investing in Malaysia are listed below:

1. The Malaysian banks was virtually unaffected by the global credit crisis last year that decimated many banks especially in the western world. The Top Banks such as May Bank, Public Bank, CIMB and Malayan banking (OTC: MLYBY) were not involved heavily in derivatives and weathered the crisis easily.

2. After the Asian crisis, Malaysia enacted many regulations which prevented the reckless flow of capital into and out of the country. These regulations require that capital invested in Malaysia stay invested for some years before they can be taken out.

3. As the world’s largest producer of Palm oil, Malaysia has a leadership position in providing cheap edible oil to many developing countries. Palm oil is a cheaper substitute for vegetable or sunflower oil which are used in cooking. There are many huge palm oil plantations in Malaysia which benefited nicely last year when palm oil prices soared. Kuala Lumpur Kepong which trades in the OTC market with ticker KLKSY is engaged in palm oil and rubber production among other products.

4. In 2008, Foreign Direct Investment (FDI) into Malaysia increased by 38% (RM 46.1 Billion) from the previous year. Australia was the largest investor followed by US, Japan and Germany. However this year, FDI plunged to just $13 B from January thru May. But in the future FDI may increase substantially as the government has announced many liberalization measures and the country holds potential in sectors such as renewable energy, manufacturing, etc.

5. Since Islam is the largest and official religion in Malaysia, the financial sector follows the principles of Islamic finance and take very low risks compared to banks in other countries.

6. Since Independence from the British, the country has been a Parliamentary democracy

with a stable government in most years. Hence political risk is low.

7. Corruption is lower in Malaysia relative other ASEAN countries such as Indonesia, Thailand and others.

8. In addition to palm oil and rubber, Malaysia is blessed with an abundance of forestry, fertile agricultural land minerals like copper, iron-ore,etc.

9. Crude oil and Natural gas were discovered offshore in the 1970s and today Malaysia subsidizes gasoline for domestic consumers and is a net exporter of crude oil. The famous Petronas Tower is owned by the national state-owned oil giant Petronas.

10. While Malaysia has failed to succeed in innovation based industries like IT, biotechnology, semiconductors, etc. it has been able to excel in the agricultural and commodity sector and more recently is heavily encouraging the growth of tourism, healthcare and education sectors. Genting Berhad (OTC:GMALY) is a major entertainment company that operates the famous Genting Highland Resorts outside of Kuala Lumpur, Sentosa Island in Singapore and others.

The following chart shows the 30 Most Valuable brands of Malaysia:

Click to enlarge

Source: Interbrand

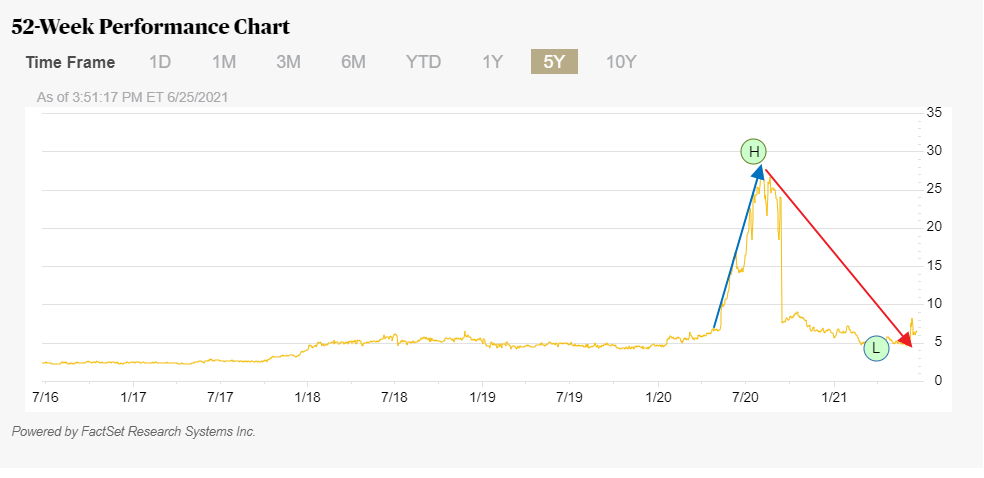

A simple and easy way to invest in Malaysian equities is via the iShares MSCI Malaysia ETF (EWM). It has about 50% of the assets in financials and industrials. This ETF has an asset base of $544 M and in 1 year has performed well with a growth of about 24%.