In this post lets take a quick look at the Top Foreign Stocks Traded in the New York Stock Exchange. Last year when I wrote an article with the same title there were 21 foreign ADRs. Many of them were bank stocks such as Barclays (BCS) , ING (ING), etc. The world of banking looks a lot different now after the credit crunch.

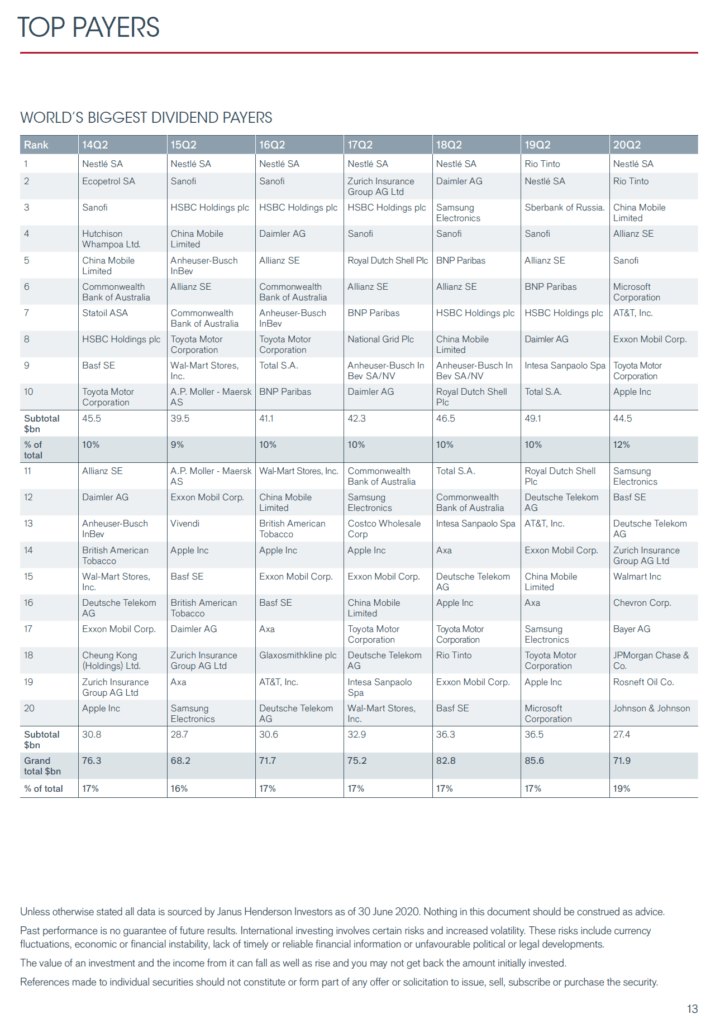

Traditionally foreign stocks have paid higher dividends than their US peers despite taking into consideration factors such as taxes, foreign exchange, transaction costs, etc. To identify the top dividend ADR stocks, I ran the stock screener with the following criteria:

1. Stocks must trade on the NYSE

2. Market cap. >= $25B

3. Must have dividend yields of at least 5% now

The search resulted in 9 ADR stocks that met the above criteria. These nine stocks are:

Company: Bank of Montreal (BMO)

Dividend Yield: 5.29%

Country: Canada

Company: BP plc (BP)

Dividend Yield: 6.43%

Country: U.K.

Company: Deutsche Telekom AG (DT)

Dividend Yield: 7.69%

Country: Germany

Company: Eni S.p.A. (E)

Dividend Yield: 5.79%

Country: Italy

Company: France Telecom SA (FTE)

Dividend Yield: 6.42%

Country: France

Company: Repsol YPF, S.A (REP)

Dividend Yield: 5.36%

Country: Spain

Company: TOTAL S.A. (TOT)

Dividend Yield: 5.42%

Country: France

Company: Vodafone Group Plc (VOD)

Dividend Yield: 8.00%

Country: Canada

Company: Royal Dutch Shell plc (RDS.A)

Dividend Yield: 5.86%

Country: The Netherlands

Except Bank of Montreal, none of the financial institutions made it to this list. BP, Vodafone,France Telecom, Eni Spa, Deutsche Telecom AG and Repsol were in the last year’s list as well. The three giant oil multinationals BP, Shell and TotalFina are strong long-term consistent performers. Now they have attractive yield also. Overall, the above nine companies are world-class companies with strong leadership positions in their respective fields.

None of the emerging market companies pay dividends greater than or equal 5% and have a market cap of at least $25B. Except the lone Canadian bank in the list above, all the rest of them are European companies.