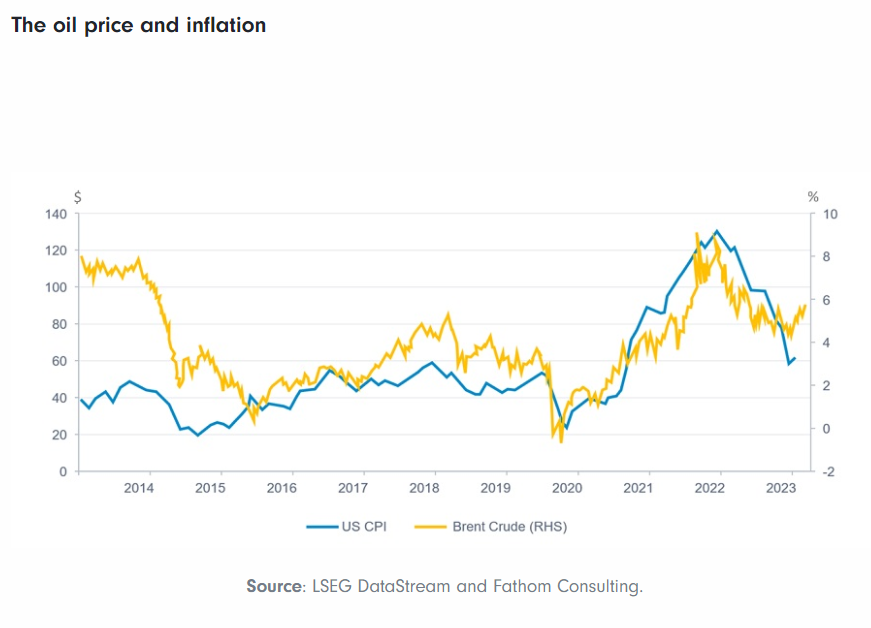

The S&P 500 Index is down 24.43% as of March 5, this year. The energy sector components within the index have fallen 21.11% in the same period. As the recession deepens, the consumption of gasoline has decreased. After soaring to over $140 last year, Crude Oil is now in the $40 range. Today the April delivery of crude oil trades at $44.25 per barrel.

Some experts have predicted that crude will fall to $30 level some time this year. However this has to be taken with a grain of salt since last year similar experts said that the price will cross over $200 per barrel.

In the US markets, 21 ADRs related to the oil& gas production, distribution and equipment service are traded. The following is the performance of these ADRs as of March 5:

[TABLE=141]

Chart (click to enlarge):

The only oil ADR that is in the positive territory this year is Petrobras (PBR) of Brazil. The giant oil companies – TotalFina (TOT), Royal Dutch Shell (RDS.A , RDS.B), British Petroleum (BP) – are all down over 20%. The worst performing stock is YPF of Argentina with a loss of 61%.

The recently listed EcoPetrol (EC) of Colombia is holding up well. Eni Spa(E) of Italy is an attractive play at current levels since it pays a dividend of 10.66% and operates both in the production and distribution of natural gas and oil.