The auto industry is one of the largest sectors of the economy in USA and Europe after housing. The industry is also important because of the multiplier effect on the economy. For example, one auto industry job indirectly creates many more jobs. According to one study, each auto job creates five jobs among suppliers.Others peg that number even higher. The Governor of Michigan Jennifer M. Granholm wrote in CNN.com last November that “The auto industry supports one of every 10 jobs in the United States”. The correct number is probably somewhere between 5 and 10. In addition to supporting many related jobs, the auto industry also creates economic activity such as retail sales, financing for cars, tax generation, etc. Since majority of car purchases are financed with credit, it has a direct relation to banks and other lenders. In a nutshell, it is important to keep track of the auto industry since it can be considered as the barometer of the economy in many countries of the world.

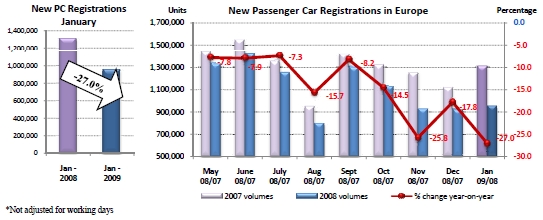

Despite having a good public transportation system, Europeans love cars. One way to analyze how the automakers may be affected in Europe is to review the registrations for new cars. Based on the data released by the European Automobile Manufacturers’ Association(ACEA), registrations of new passenger cars in Europe fell by 27% in January compared to January last year.

Figure #1: New Car Registrations in January (click to enlarge)

Source: ACEA

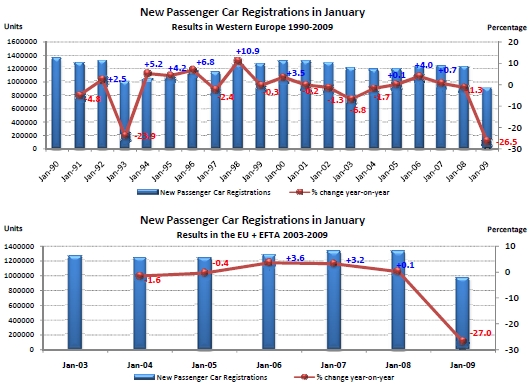

The data represents Western Europe and the new EU member states excluding Malta and Cyprus. In January 2009, just 958,500 cars were registered which is the lowest level in two decades as shown in the diagram below.This shows the severity of the credit economic crisis.

Figure #2: New Car Registrations in January since 1990 (click to enlarge)

Source: ACEA

The registrations for individual countries present a different perspective.

Western Europe:

Iceland = -88.1%

Ireland = -66.5%

Spain = -41.6%

Italy = -32.6%

UK = -30.9%

Germany = -14.2%

France = -7.29%

It is not surprising to see Iceland top the list since the whole country went bankrupt. The Irish economy is suffering worse than other Western European economies. Interesting to see that France is the least affected.

New EU Member States:

Overall the demand for cars dropped by 34%.

Romania = -53.2%

Hungary = -52.3%

Czech Republic= – 12.3%

Poland = -5.3%

Some of these former communist countries such as Hungary are facing serious economic challenges and are expected to receive emergency aid from The World Bank and the EU.Poland is holding up well than other countries.

The following are two interesting observations found in the ACEA’s Q&A page:

“1.Why is the crisis hitting the auto industry so hard?

The fall-out of the financial crisis hits auto manufacturers hard, as the credit crunch makes it more difficult for the sector to finance daily operations and, at the same time, also weakens demand for new cars. Consumers are increasingly hesitant to make large expenditures and find it more difficult to get their purchase financed.

European new passenger car registrations fell by 7.8% to 14,712,158 units in 2008, recording the sharpest decline since 1993. In the fourth quarter of 2008, registrations were down 19.3%.

The manufacturers have a model range that is well up to date and fuel-efficient. The drop in demand is clearly an effect of the financial and economic crises. In the firs half of this year, sales remained well on track. Our industry needs a functioning financial market, and governments can help by giving market incentives to restore consumer demand.

2. Are the situation of the US and EU automotive industries comparable?

The EU industry is in a different position in terms of restructuring, product lines and market demand, regulatory environment. EU vehicle sales only began to crash in July of 2008, where they have been in significant decline in the US for more than a year and are now travelling at 30-40% below recent levels. Unfortunately, EU sales forecasts are showing a similar downward trend line, so while we might hope that the recession will be shallower in the EU, it is premature to say that this will be the case.

In terms of vehicle markets, it is important to note that the US hardly have a diesel market for passenger cars. This is one of the reasons why the vehicle mix in both regions is so different. Another reason is the difference in petrol price. On average, because of taxation, petrol prices in the EU are two and a half times that of the US (approx US$5/US gallon compared to the current US average of about $1.80/gallon) This drives quite a different mix of vehicles sold. ”

As the exports of new cars continue to fall from European countries such as Germany and the domestic demand dries up in the EU, it will be interesting to monitor the developments in the coming months.