Last year investors welcomed a few frontier markets ETFs such as the MENA Frontier Countries (PMNA) by PowerShares, the Africa ETF (AFK) and the Gulf States ETF (MES) from Market Vectors and the Frontier Markets (FRN) from Claymore/BNY Mellon.These frontier market ETFs can be extremely volatile and are suitable for investors who can take high risks. Frontier markets can be defined as the ultimate wild west of the modern times.

One of the frontier markets is Colombia.Until recently there was no way to invest in Colombia via ETFs. Since only two Colombian ADRs trade in the US one could not get exposure to the major Colombian stocks easily. GlobalX Funds, a new ETF provider has launched the first ETF for Colombia.

The Global X/InterBolsa FTSE Colombia 20 ETF (GXG) seeks to track the performance of the FTSE Colombia 20 Index. The annual expense ratio is 0.86%.

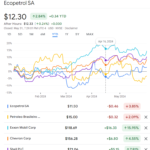

The two ADRs – Ecopetrol(EC) and Bancolombia(CIB) comprise about 39% of the 2portfolio. Ecopetrol is the major petroleum company in Colombia and Bancolombia is a bank. Ecopetrol is the largest stock in the main stock market index called the ICBC index. It is also the most widely held stock and can be considered the Petrobras (PBR) of Colombia.

As the ETF started trading on Feb 5, there is not much information about the ETF such as the total asset held, yield information, etc. The factsheet for this ETF can be found here.

GlobalX has also filed for Argentina, Egypt, Peru, and Philippines ETFs. We will review those when they start trading.