Last year the financials in the S&P 500 Index was the worst performing sector with a loss of 56.95% compared to the index return of -38.49%. Some banks fared even worse or failed. Others such as National City, Wachovia, merged with much larger banks to survive. Large banks such as Citibank(C), Bank of America(BOA), Chase (JPM), PNC Financial Services (PNC), US Bank(USB) etc. had to access the Troubled Assets Relief Program (TARP) whether to stay afloat or strengthen their balance sheets.

So far 2009 is turning out to be another bad year to be in bank stocks. The S&P Financials are down another 28.98% year-to-date. Considering these facts most investors are staying away from banks now. However there are opportunities abound if one is willing to do the research and uncover the diamonds among the rubble. Many of the failed banks such as Wamu, IndyMac were not small sized banks. They were all huge banks that undertook highly risky lending activities or participated in the derivatives game.

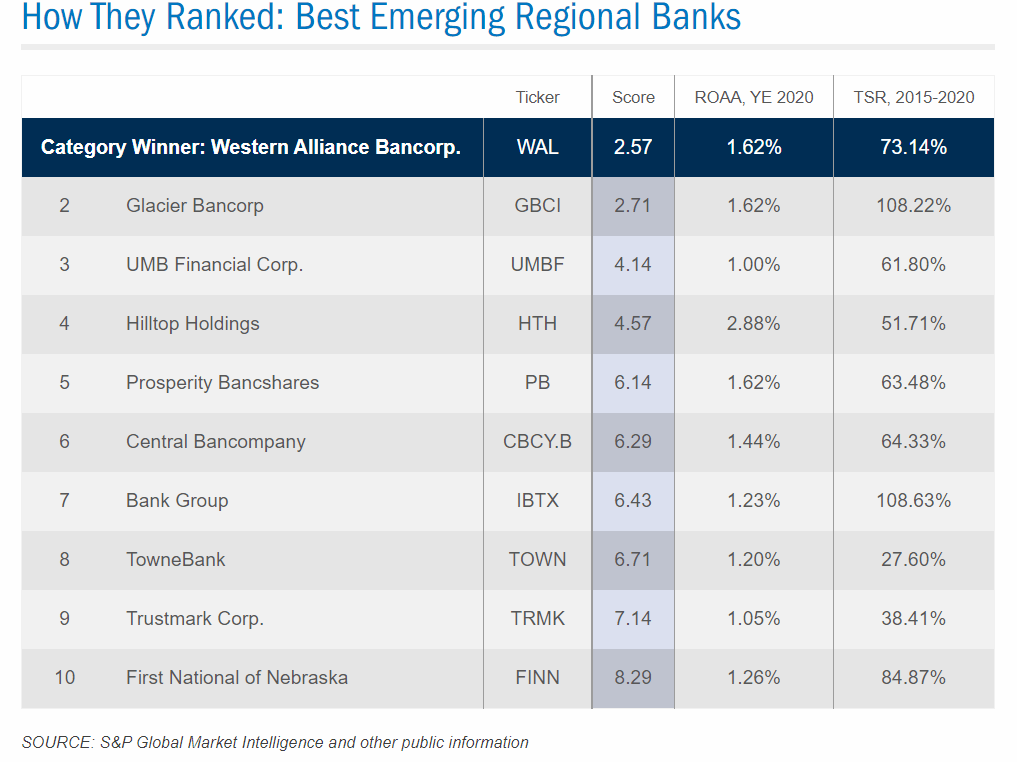

My research into finding small banks that are worth looking into now led to the recent issue of the Bank Director Magazine’s “The 2008 Bank Performance Scorecard: America’s Top 150 Banks” article. This piece lists the top banks based on a performance scorecard compiled by Sandler O’Neill & Partners L.P. These banks “maintain top standing in good times and bad—often with recurring high scorers.” The scorecard is based on six different metrics like Return on average assets (ROAA), Return on average equity (ROAE), Tier 1 capital ratio, the leverage capital ratio, nonperforming assets (NPAs) to total loans and “other real estate owned,†and loan loss reserves to total loans.

The Top Five Banks in this list are:

[TABLE=134]

1. Glacier Bancorp Inc (GBCI) ranks the number 1 bank in 2008. Based in beautiful Kalispell, Montana this regional multi-bank holding company operates 94 branches in Idaho, Montana, Utah, Washington, and Wyoming. Currently GBCI yields 3.27%. Glacier Bancorp ranked the top in all the six criteria of the scorecard analysis. In 4Q, 2008 the bank earned $17.014 million a decrease of 6% from 4Q, 2007. The NPA stood at just 1.46% as on Dec 31,2008.

2. The number two rank in the list is held by First Financial Bankshares Inc. (FFIN) of Abilene, Texas. This community bank holds “roughly 40% to 50% of the market share in such West Texas communities as Sweetwater, San Angelo, Stephenville, and Weatherford”. The strong economy of West Texas which is dependent on oil, natural gas, wind energy, agriculture helped the bank achieve impressive numbers. FFIN pays a dividend of 3.03%.

3. SVB Financial Group (SIVB) of Santa Clara, California “is the holding company for financial services firms that include $7.0 billion Silicon Valley Bank. In addition to operating 27 U.S. branches, SVB has offices in China, India, Israel, and the United Kingdom.” The Chief Strategy Officer Marc Verissimo commented “We don’t deal with developersâ€. SIVB does not pay regular dividends. The bank earned $2.9 in fourth quarter 2008.

4. Honolulu, Hawaii based Bank of Hawaii Corporation (BOH) ranked number 4 in the list. They had an excellent 23.24% ROAE (Return On Average Equity) in 2008. This traditional bank gains from the Hawaiian economy which has strong ties to Japan, tourism and defense spending. As tourism declines BOH will be impacted.

5. The number five in our list is Westamerica Bancorp. (WABC) of San Rafael, California.WABC pays a dividend of 3.42%. On Jan 22, they announced an increase in quarterly dividends by one cent. Chairman, President & CEO David Payne said that “This dividend increase recognizes Westamerica’s healthy level of profitability, asset quality, and capital.” which is echoed by the Bank Director piece.

To access the full list of Top 150 banks in the The 2008 Bank Performance Scorecard click here.

i just turn 19 and wondering what to invest in ? i have been watching a lot of the BNN channel and i been hearing a lot about US banks and wondering if that would be a good longer term investment ?

Yes. They can be good long-term investments but you have to very very selective and do lot of research before investing in any of them. Personally I wouldn’t advice you get into this sector since there is still too much risk at this time. Unless one can take risk and have substantial assets there are other sectors one can find good stocks. Thanks.