One of the best and easiest ways to invest in Taiwan is with an ETF since it gives an investor exposure to a wide selection of Taiwanese stocks.Investing in individual stocks such as TSM,UMC is extremely risky.

One of the best and easiest ways to invest in Taiwan is with an ETF since it gives an investor exposure to a wide selection of Taiwanese stocks.Investing in individual stocks such as TSM,UMC is extremely risky.

Taiwan’s major industry is electronics specifically contract manufacturing of electronic parts for other companies.Computer parts such as semi-conductor chips, keyboards,monitors,speakers etc. are made by hundreds of contract manufacturers there.So whether one buys a computer from Dell,Sony,IBM or any other company, it will have parts made in Taiwan. So in a nutshell a bet on Taiwan is an invest in the hi-tech sector.It is like investing in a bunch of silicon valley firms except that the Taiwanese ones are not startups or dot-cons.These are established long-term players with world-wide reputation for quality and efficiency.

The country has a population of 22 Million.China has the largest Foreign Direct Investment(FDI) in Taiwan. US is the next global trade partner.Most of the firms in Taiwan make products locally and export them globally.

The only country specific ETF available for Taiwan is the MSCI Taiwan Index Fund (EWT).

EWT Details (As of June 1st, 2008):

Country: Taiwan

Fund Type: ETF

Ticker: EWT

Price per share: $16.21

Expense Ratio: 0.68%

Inception Date: June,2000

Dividend: Paid Annually, Has increased each of the past 5 years.

Total Net Assets: $4.0B+

Number of stocks held: 126 (As of April 30,2008)

Portfolio Allocation: 54.68% in IT

The largest stock held at 11%+ is Taiwan Semiconductor Manufacturing – TSM. Some other popular companies in portfolio include Acer(Computers), D-Link(Routers) and Evergreen Marine(Shipping,Marine Svcs).

Fund Performance: Total Returns (Annualized)

1 Yr – 22.21 %

3 Yr – 15.60 %

5 Yr – 18.87 %

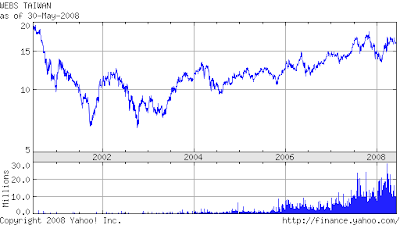

5 yr chart:

The above chart clearly shows how EWT slided to new lows when the tech boom melted in 2000.

Conclusion:

EWT gives good exposure to the hi-tech sector.Any rebound in that sector will be reflected in this ETF.Some folks think that the hi-tech stocks are holding well and growing in this volatile period since they are not affected by the credit crisis and have hoards of cash to invest in R&D.