One of the ways of diversification is to allocate one’s portfolio assets across countries. Since the economic systems, political systems and wealth of natural resources vary between countries the equity markets also tend to perform differently. For exmaple, when crude oil prices are soarding the Russian equity market performs well as the economy is dependent on oil. Similarly rising copper prices are a boon to the Chilean equity market. So in order to capture the benefits of diversification it is not only important to divesify across asset types or sectors but also across various countries. In today’s globalized world it is simply not wise to invest all assets in one country such as investor’s home country.

The year-to-date return of select equity markets from around the world shows the wide difference in performance:

UK’s FTSE 100: 3.3%

France’s CAC 40: 5.2%

Germany’s DAX Index:7.2%

Spain’s IBEX35 Index: 8.3%

China’s Shanghai Composite: 8.4%

India’s Bombay Sensex: 19.0%

Brzail’s Sao Paulo Bovespa: 21.3%

Russia’s RTS Index: -2.8%

Chile’s Santiago IPSA: 20.0%

Mexico’s IPC All-Share: 9.7%

Meanwhile the S&P 500 Index is up 9.94% YTD.

Source: WSJ

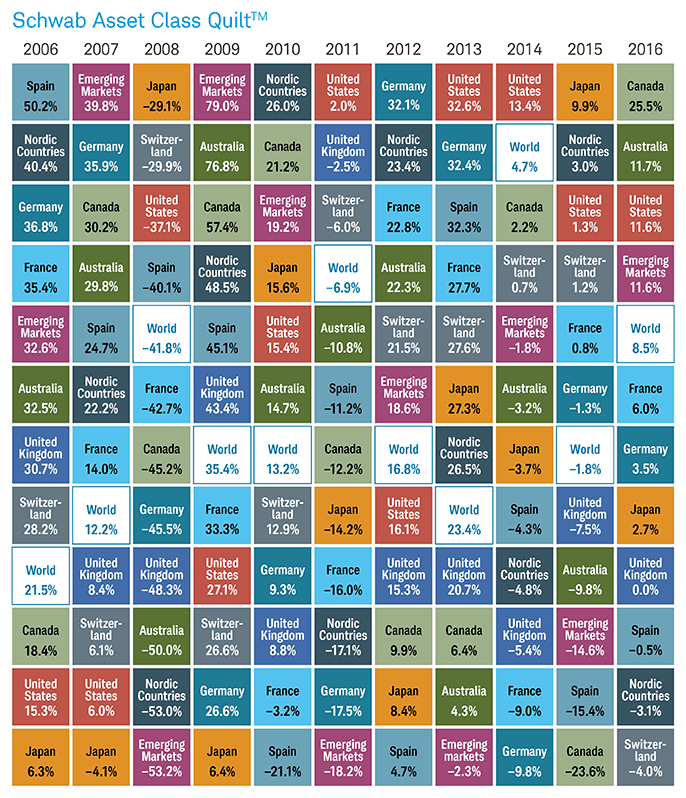

Recently I came across the following chart from Schwab showing the benefits of diversification across borders. Canada was the worst performer in 2015 but was the best performer the following year. Since 2006 the US market was the top market only in 3 years.

Click to enlarge

Source: Why Global Diversification Matters by Anthony Davidow, Charles Schwab

The above chart clearly shows that the benefits of global diversification cannot be under estimated.