The Argentina stock market is one of the best performing market so far this year. The benchmark Merval index is up 39% year-to-date. As a frontier market Argentine stocks are highly volatile and most global investors avoided them until last year. Years of political and economic chaos made Argentina the pariah of the international investing community. However all that changed last year when a new government was formed under President Mauricio Macri and the country’s economy stabilized.

Though the benchmark Merval Index is up 39% this year, emerging markets investment guru Mark Mobius, executive chairman of Templeton Emerging Markets Group stated that Argentina stocks are cheap but raised concerns about liquidity in an interview to Bloomberg. From the Bloomberg article discussing the interview:

Almost a year after a new government swept into Argentina promising to loosen capital controls and lure foreign investors, Mark Mobius is betting on the country’s stocks. But he says the options are still limited for traders looking to ride the rally that made the Merval one of the world’s top performing equity gauges this year.

Mobius, executive chairman of Templeton Emerging Markets Group, which has $26 billion under management, says he will remain focused on American depository receipts of Argentine companies as long as rules require that portfolio investments stay in the country for 120 days, a policy that he says limits market liquidity.

“It’s difficult for us to invest if there’s no guarantee we can get the money out at short notice,” Mobius said in an interview from Dubai. “We invest in countries for a long time, but it’s part of our obligations to investors. The currency is already pretty stable, so it all depends on how things go with the foreign exchange rule. That will give more confidence to us and other investors.”

Argentina’s stocks have surged 41 percent this year after President Mauricio Macri was elected in late 2015 on a pledge to reinvigorate an economy damaged by years of government interference including currency controls and capital restrictions. Even after the rally, the Merval’s price-to-adjusted-earnings rating is just two-thirds of the level for Brazil’s Ibovespa.

Source: Mobius Says Argentina Stocks Cheap, But Liquidity Still a Drag, Bloomberg

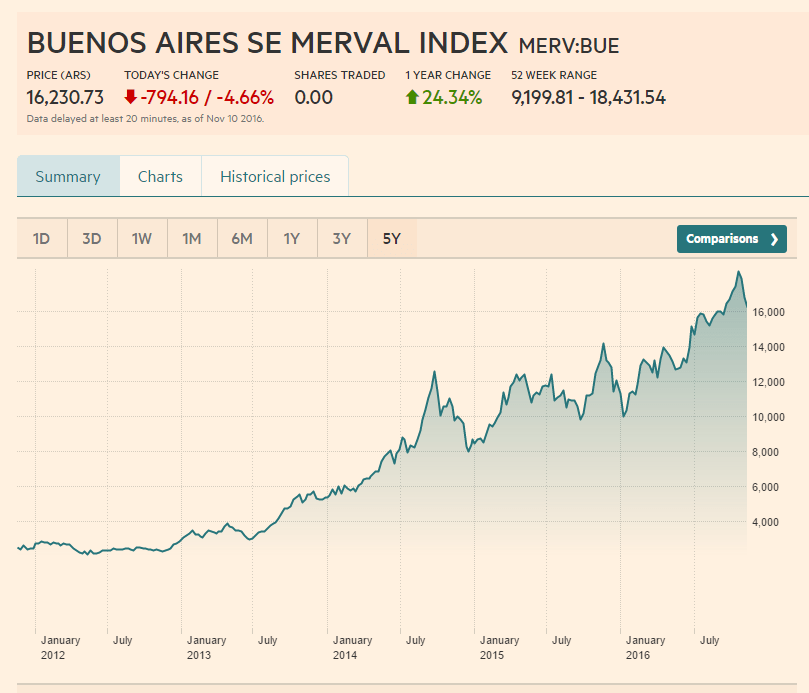

The five- year return chart of the Merval is shown below:

Click to enlarge

Source: FT

How to invest in Argentina?

The simple and easiest way to access Argentina stocks is via ADRs or ETFs. Currently less than 20 Argentine firms trade on the US markets. Among the major companies, investors can consider BBVA Banco Frances(BFR), Grupo Financiero Galicia(GGAL) and Banco Macro(BMA) in the banking sector and oil producer Petrobras Argentina S.A.(PZE). The complete list of Argentina ADRs can be found here.

The Global X MSCI Argentina ETF (ARGT) offers another way to easily invest in Argentine equities. The fund has net assets of over $88 million and has an expense ratio of 0.75%.

Disclosure: No Positions

Does anyone know what the tax implications of buying and sellling Argentinian stocks in an IRA? Specifically interested in MELI

Argentina will withhold 10% dividend taxes for trading Argentine stocks in IRA including MELI. SO better to own that in a non-qualified account like a regular brokerage account. Hope this helps.

-David