Emerging markets are hot this year as global investors are attracted to their for their higher growth potential and yields in some cases. With growth stagnating in the developed world especially in Europe it is not surprise that investors are turning their attention back to emerging markets. In the past few years emerging market stocks have been poor performers and many investors were disappointed when these markets failed to deliver due to the crash in commodity prices. For instance, emerging markets as represented by the MSCI Emerging Markets Index yielded negative returns in the past three years. However the perception that these markets are not worth the time and effort has changed. according developing markets are outperforming developed markets by a wide margin. The MSCI EM Index is up by 14.63% year-to-date as of Aug 19th compared to just 4.15% increase for Developed Markets represented by the MSCI World Index.

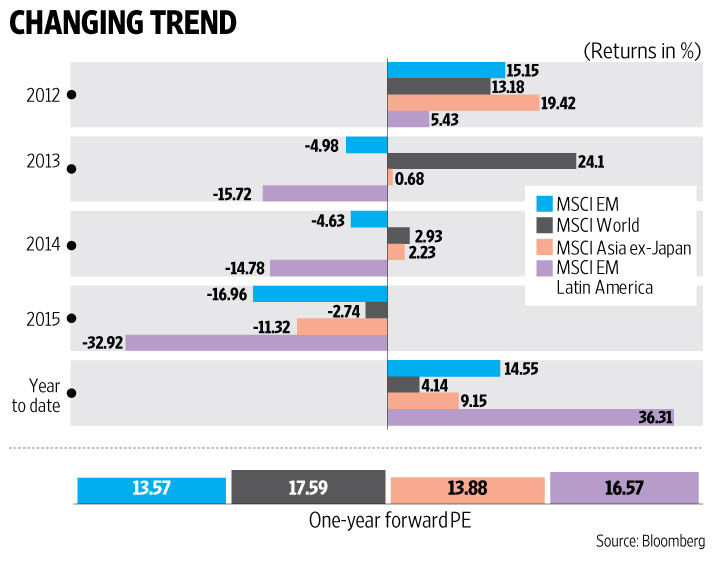

The graph below shows the yearly performance of major MSCI indices:

Click to enlarge

Note: Data shown above are as of Aug 18, 2016

Source: Emerging markets are back in favour, Livemint, Aug 19, 2016

From the above article:

What has changed? First, it could just be simple rotation—valuations are much higher for the MSCI World Index than for the MSCI Emerging Markets Index. Second, Brexit led to funds moving out of the UK and to some extent Europe. Third, the fears of an interest rate hike by the US Federal Reserve have been pushed to the background and risk assets have rallied. Fourth, commodity prices have moved up from their lows, as China stabilizes its economy. And finally, market participants could also be deriving optimism on EM economies from the recent International Monetary Fund global growth outlook report, which says the pace of gross domestic product growth in EMs is likely to increase every year for the next five years, while growth in DMs will stagnate.

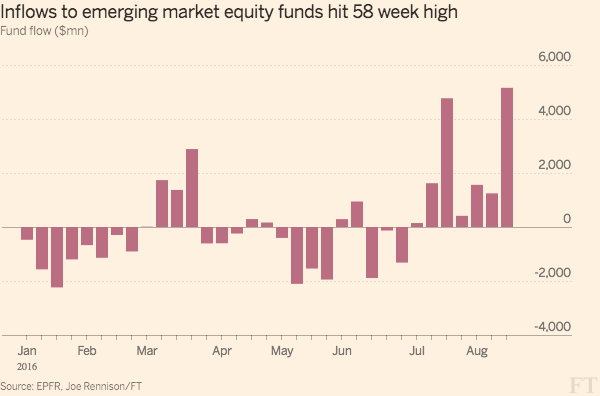

Inflows into emerging market equity funds has also reached a 58-week according to an FT article.

Click to enlarge

Source: Emerging markets back in vogue, FT, August 20, 2016

Since emerging markets underperformed in the past and commodity prices are on the upside, the current run in emerging markets can continue for while. Investors looking to profit from the growth potential of these markets can consider adding these stocks. But as these markets are riskier than developed markets, investors should not allocate a high portion of their assets to emerging stocks.

Ten emerging markets to consider are listed below with their ADR tickers and current dividend yields:

1.Company: Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 2.58%

Sector: Electric Utilities

Country: Chile

2.Company: Credicorp Ltd (BAP)

Current Dividend Yield: 1.45%

Sector: Banking

Country: Peru but company based in Bermuda

3.Company: HDFC Bank Ltd (HDB)

Current Dividend Yield: 0.60%

Sector: Banking

Country: India

4.Company: Ultrapar Participacoes SA (UGP)

Current Dividend Yield: 1.96%

Sector: Oil, Gas & Consumable Fuels

Country: Brazil

5.Company: Banco Santander-Chile (BSAC)

Current Dividend Yield: 4.90%

Sector: Banking

Country: Chile

6.Company: Fomento Economico Mexicano SAB de CV (FMX)

Current Dividend Yield: 1.37%

Sector: Beverages (Nonalcoholic)

Country: Mexico

7.Company:Philippine Long Distance Telephone Co (PHI)

Current Dividend Yield: 5.71%

Sector: Telecom

Country: Philippines

8.Company: PetroChina Co Ltd (PTR)

Current Dividend Yield: 1.98%

Sector: Oil

Country: China

9.Company: China Life Insurance Co Ltd (CHL)

Current Dividend Yield: 2.65%

Sector: Life Insurance

Country: China

10.Company: Ambev SA (ABEV)

Current Dividend Yield: 2.37%

Sector: Beverages

Country: Brazil

Note: Dividend yields noted above are as of Aug 19, 2016. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long No Positions