U.S. investors looking for foreign dividend stocks can find interesting opportunities in the British equity market. British stocks offer many advantages for American investors especially with respect to dividend withholding taxes. Unlike many other developed and emerging countries, the UK does NOT deduct withholding taxes on dividend payments from UK corporations to US investors. However a 20% tax will be withhold for dividends paid out by UK REITs.

Many large cap British firms in the FTSE 100 index derive high portion of their revenues from overseas markets. For example, mining firms mostly earn most of their revenues from countries outside of the UK. However due to the ongoing chaos in the commodity market mining stocks can be avoided. Some of the sectors that US investors can consider for hunting dividend payers include insurance, utilities, consumer discretionary, telecom, etc. Electric utilities for example are logical to own because they earn most of its revenues from consumers in the UK.

I came across an interesting article by Lee Wild at the UK-based equity trading firm Interactive investor that discussed the safest and riskiest dividend stocks in the FTSE 100. From the article:

Dividend income is still one of the biggest shows in town, and above-inflation increases in the annual payout are highly prized. It’s down to record low interest rates which make generating anything like decent income from other liquid asset classes incredibly difficult. But not all blue chip dividends are safe. In fact, some are downright dangerous.

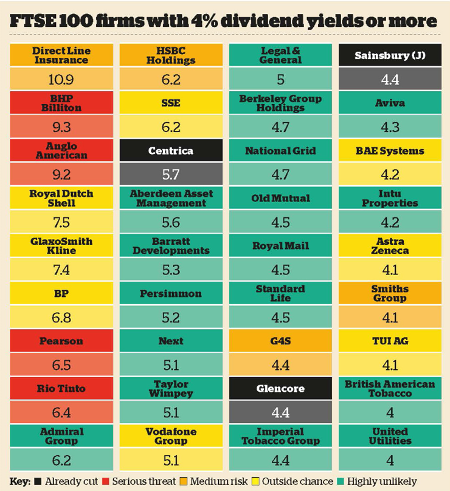

We’ve put together a colour-coded graphic (see below) which includes every FTSE 100 (UKX) company currently yielding 4% or more. It’s accompanied by some relevant data (bottom of the article), which together give us a pretty good clue whether dividends are sustainable, and who might be next to cut, or even scrap the payout.

Click to enlarge

We’ve included dividend cover as a key measure of affordability, of course. It tells us how many times a company can pay its dividend from profits, and is probably the first measure investors look at when judging a company’s ability to return cash to shareholders. Anything less than 1.5 times may cause sleepless nights.

Then there’s the payout ratio – the percentage of earnings paid out to shareholders as dividends. A figure of around 60% would be considered attractive, but a drop in profits may mean some companies pay out 100% or more. That implies they’re borrowing to keep dividend seekers happy, which is not a long-term solution.

It’s worth looking at return on equity (ROE), too. It shows how much a company makes with each pound of shareholders’ equity. But while it can be useful, the measure might not always tell us the whole truth. Either writing down assets, or raising debt would reduce book value, increasing ROE.

That’s why a lot of professional investors use cash return on capital invested (CROCI). It’s a valuation multiple which calculates how much free cash flow per pound is generated by the company from invested capital. It removes non-cash items like depreciation and amortization, and tells us a lot about management performance and how strong the underlying business is. Again, a higher ratio is better.

Color Coding in Chart: Red means dividend is in danger and green means safety.

Source: FTSE 100’s safest and riskiest dividends named, Interactive Investor Ltd, Nov 27, 2015

NOTE: The Dividend Yields noted above are for the common equity traded on the domestic market (i.e. they do not represent the yields on ADRs).

Some of the British stocks from the above chart that trade on the US markets are listed below with their current dividend yields:

1.Company: British American Tobacco PLC (BTI)

Current Dividend Yield: 3.99%

Sector:Tobacco

2.Company: United Utilities PLC (UUGRY)

Current Dividend Yield: 3.96%

Sector: Water Utilities

3.Company: BAE Systems (BAESY)

Current Dividend Yield: 4.07%

Sector: Aerospace and Defense

4.Company: Aviva PLC (AV)

Current Dividend Yield: 3.82%

Sector: Insurance

5.Company: Imperial Tobacco PLC (ITYBY)

Current Dividend Yield: 1.97%

Sector:Tobacco

6.Company: National Grid PLC (NGG)

Current Dividend Yield: 4.73%

Sector: Multi-Utilities

7.Company: Legal & General PLC (LGGNY)

Current Dividend Yield: 4.36%

Sector: Insurance

8.Company: Vodafone Group PLC (VOD)

Current Dividend Yield: 5.17%

Sector: Wireless Telecom

9.Company: GlaxoSmithKline (GSK)

Current Dividend Yield: 5.96%

Sector: Pharmaceuticals

10.Company: AstraZeneca PLC (AZN)

Current Dividend Yield: 4.11%

Sector: Pharmaceuticals

Note: Dividend yields noted above are as of Nov 27, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions