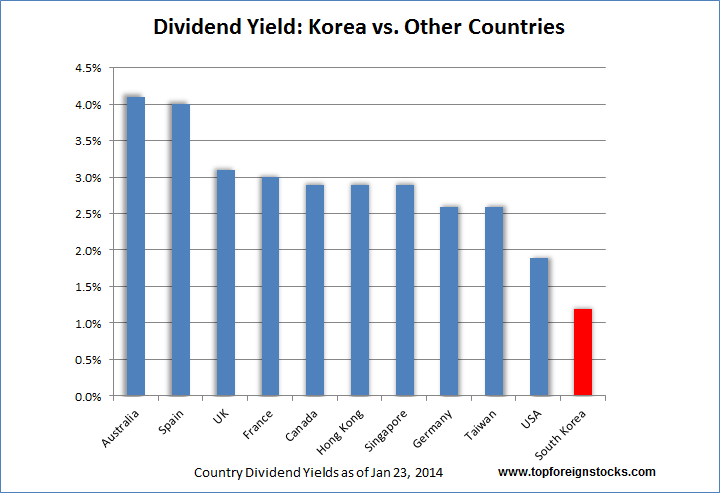

Korean companies were not known for their dividend payouts until recently. Korea had one of the lowest dividend yields when compared to other developed countries as shown in the chart below. Though the country is a developed country technically it is considered as an emerging market by MSCI.

Click to enlarge

Source: When Looking For Emerging Market Dividend Stocks Avoid Korea, TFS

However a while ago Korea passed tax reforms encouraging firms to share more of their earnings with shareholders particularly in the form of dividends.

Currently the Korean dividend withholding tax rate for foreigners is 20% according to Deloitte.

A February article in The Financial Times discussed about the potential for a re-rating for Korean stocks as a result of the dividend tax policy change. From the article:

Cash balances at leading Korean companies have swelled in recent years — Samsung’s net cash has reached nearly $50bn — given limited investment opportunities as the economy has slowed.

However, their miserly dividends have been behind the market’s depressed valuations, with the payout ratios of the country’s listed companies by far the lowest of any big Asian market.

The South Korean stock market is trading at about 10 times last year’s earnings, far below Hong Kong and Japan’s multiple of about 15 times. According to CLSA, Korean companies will pay out just 15.7 per cent of last year’s profits to shareholders, compared with 46.2 per cent by Hong Kong companies and 28.5 per cent by Japanese groups.

Optimists hope the recent dividend increases will help foreign investors regain their confidence in corporate Korea, after Hyundai’s $10bn purchase of land for new headquarters raised questions about corporate governance and capital management of the country’s big family-run business groups, known as chaebol.

Source: Higher South Korea dividends fuel hopes for Kospi re-rating, Feb 11, 2015, FT

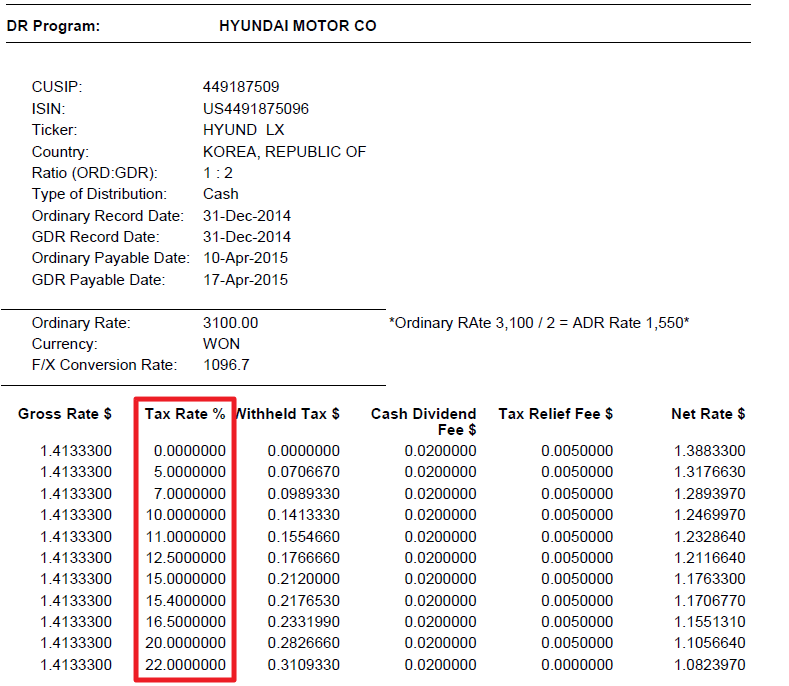

The dividend withholding tax rate for South Korea goes from 0% to 22% according to Citi Depository Receipt Services. It seems that if one can qualify for the Certificate of Residence a favorable tax rate is applied. From a Citi note:

A unique feature of the Korean Dividend payments is the multiple foreign withholding tax rates that are applied to nonresidents. We are required to supply a Certificate of Residence for holders that are entitled to a favorable tax rate. If such a certification is not provided, the Korean unfavorable rate of (22%) will be applied. Tax Relief at Source Processing Fee was applied for those electing the Favorable Tax Rates.

Here is how the ADR dividend for Hyundai Motor Co gets taxed at various levels:

Source: Citi

The dividend policy change is a big positive development for Korea in the eyes of foreign investors. However investors looking to gain exposure to the Korean market can wait and watch the payout ratios of firms before committing any capital for investment.

Disclosure: No Positions