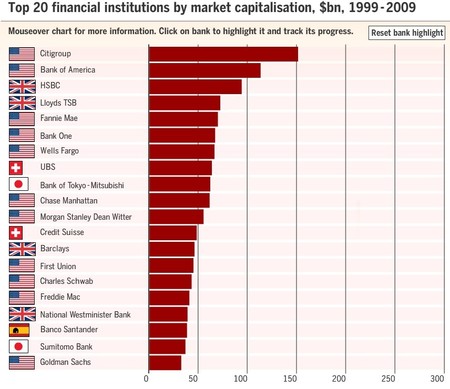

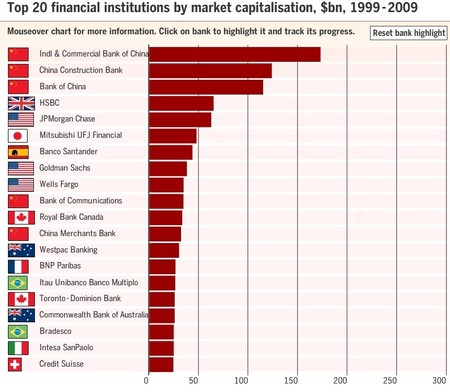

The following two charts show that US financial institutions are no longer the best in the world when compared to 1999.

Source: Financial Times

Though the above graphs were from March of this year it is worth reviewing. In 1999, out of the Top 20 financial institutions in the world, 11 were US-based.Some of the banks such a Bank One have disappeared in 2009 since it merged with Chase a few years ago.Interesting to see Citibank (C) at the top of the list at that time.Next in the ranking was Bank of America (BAC).

In 2009, the top three spots have gone to Chinese banks. Citibank and Bank of America are not even in this list. Two Canadian banks – Royal Bank of Canada(RY) and Toronto-Dominion Bank(TD) have made it to the list.Australia also has two banks listed. In addition to Chinese banks, the importance of emerging markets is confirmed by the presence of Itau Unibanco Banco Multiplo (ITU) and Banco Bradesco(BBD).