The US equity markets have had another excellent year with the S&P 500 on track to close out 2021 with a total return of over 29%. This is the 3rd year in a row the index has shot up by double digit percentage points. It remains to be seen if the bull market will continue in 2022. With that said, it is important to not get too complacent. One of the key strategies I have repeated in this blog over the years is diversification. Investors should not put all their eggs in one basket instead diversify across many asset classes. Diversification can also include holding various assets across countries, regions, etc. The key point is not to YOLO one’s assets into some meme stocks like Gamestop(GME) or AMC(AMC) to strike it rich quickly. The meme stocks phenomenon is an aberration to say the least in the grand scheme of things.

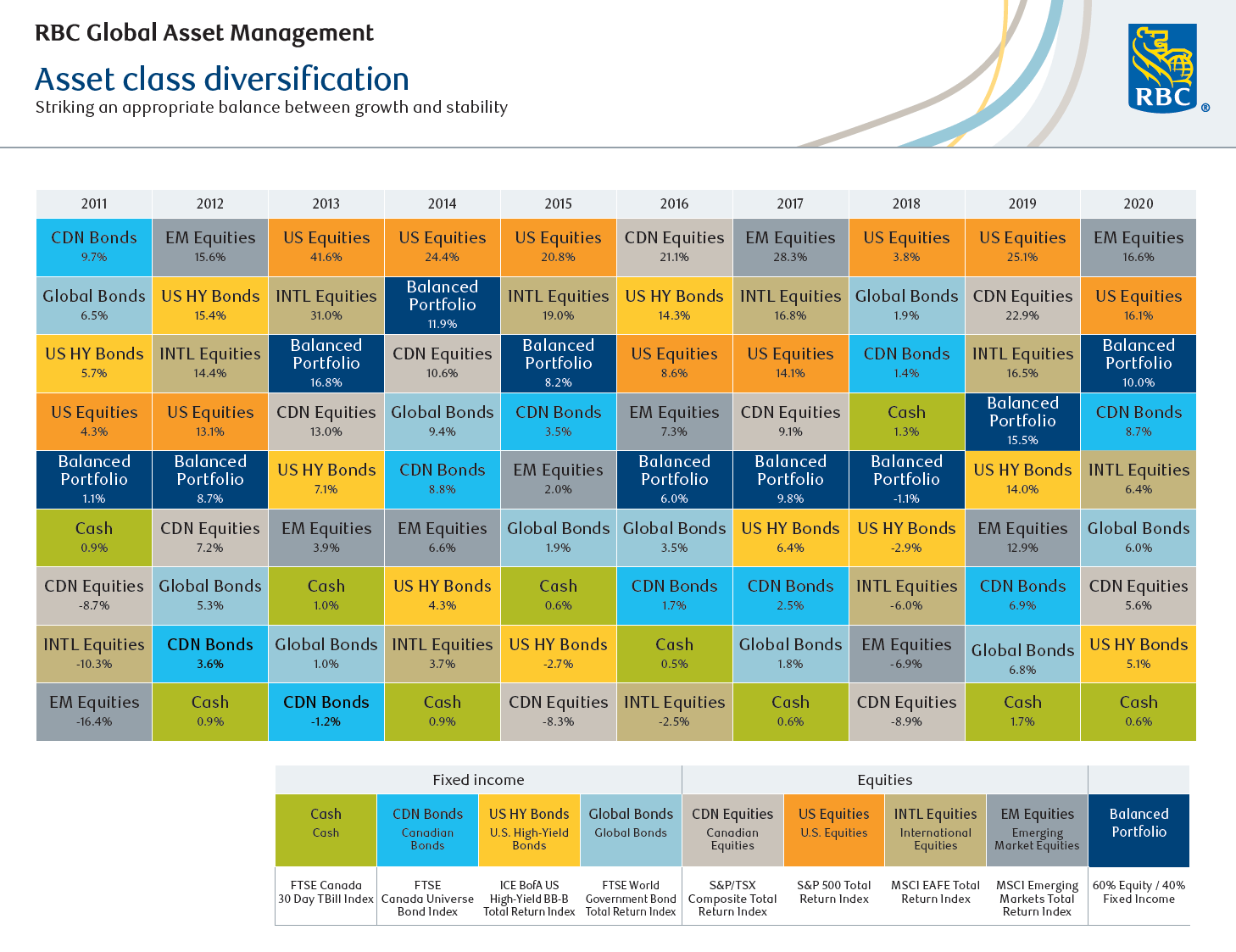

In any given year, various asset classes perform differently as expected. For example, in 2020 emerging equities were the best based on the MSCI Emerging Markets Total Return in Canadian dollars while cash was the worst with a paltry 0.6 return. US stocks were the top performers in 5 of the 10 year period from 2011 to 2020. Canadian equities had the best return only in one year in 2016 during the same period.

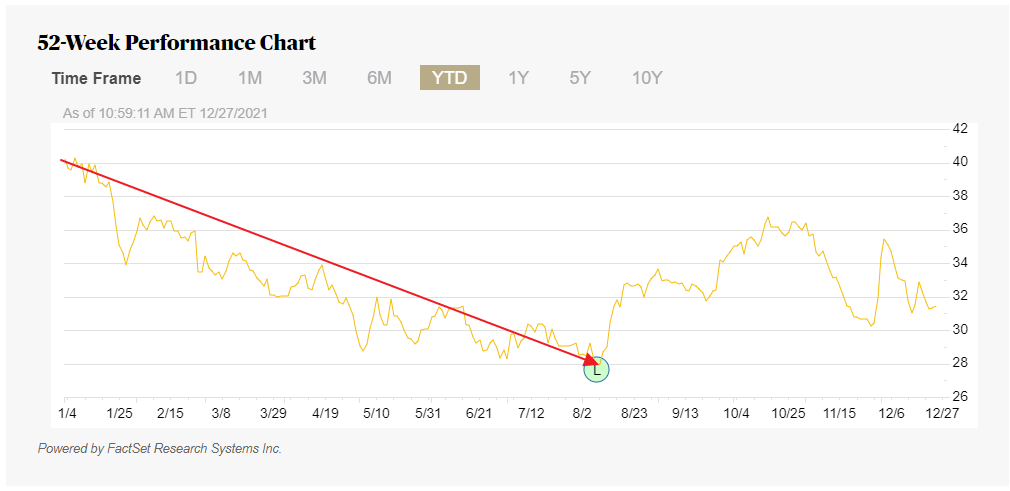

The following chart shows the returns of various asset classes from 2011 to 2020 in Canadian Dollars:

Click to enlarge

Note: US returns (S&P 500 Total Return Index) shown above have different figures since they are in Canadian Dollars.

Source: RBC Global Asset Management

For an interactive version of the above chart go to the RBC site.

Related ETFs:

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard MSCI Emerging Markets ETF (VWO)

- Vanguard Developed Markets Index Fund ETF (VEA)

- SPDR S&P 500 ETF (SPY)

- Vanguard Total Bond Market ETF (BND)

- SPDR® Barclays High Yield Bond ETF (JNK)

- iShares MSCI Canada Index Fund (EWC)

Disclosure: No positions