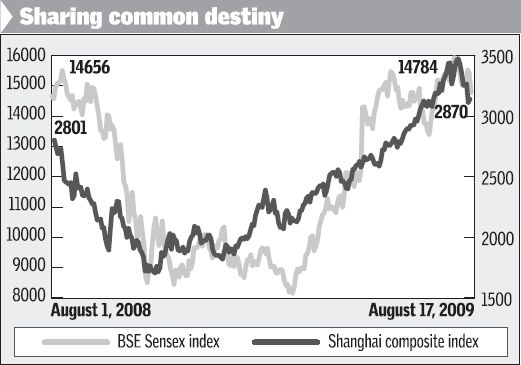

Sensex and Shanghai index show high positive correlation. The movements of Sensex and the Shanghai Composite Index show a high positive correlation at 0.9 in 2008 and 2009. This linear relationship appears to have strengthened in the decline since January 2008.Chinese curse on Indian shares

Shares in five Nigerian banks, which were bailed out by the government last week, have been suspended. Shares suspended in Nigeria banks

Fidelity’s John Ford says the prospects for further recovery have not been adequately priced into Asian equities.More buying opportunities of Asian shares over next 18 months

China received 5.36 billion U.S. dollars of foreign direct investment (FDI) in July, down 35.7 percent year on year, said Ministry of Commerce spokesman Yao Jian on Monday.China’s FDI falls 35.7% in July

After going into a tailspin for a year, the German economy is experiencing slight growth once again. But experts are divided over whether it is merely a temporary respite or a sign of genuine recovery.Is the Recession Really Over?

Despite the Bank of Canada’s most recent economic forecast that the current recession is over, diminished..Commercial real estate activity remains down: CBRE