The real estate sector in Brazil remained stable during the global credit crisis last year and is now projected to expand further due to the 2016 Summer Olympics related investments and the rising income of middle class families.

From an article titled “Brazil’s Coming Rebound” in BusinessWeek magazine this August,

“São Paulo – For years, Edilson dos Reis Rodrigues dreamed of owning a home. But the public school teacher and his wife together earn just $710 a month, so he could never set aside a down payment. Now, he’s finally getting the chance.

Thanks to a new government program called My House, My Life, Rodrigues will soon own a two-bedroom apartment near São Paulo. He’ll get a cash grant covering a quarter of the $52,000 price and a discounted 30-year mortgage, so he’ll pay just $220 a month—half what a conventional loan would have cost. “This is an incredible opportunity,” the 31-year-old says, smiling broadly as he hands in paperwork to seal the deal.

My House, My Life is just one of the stimulus measures that Brasilia has implemented to keep Latin America’s biggest economy from stalling. As a result, Brazil will likely be one of the first countries to emerge from the slump: The economy may grow slightly this year and by as much as 4.5% in 2010, helping lift millions of Brazilians out of poverty. “Brazil is emerging from the crisis, and next year we are going to have surprising growth,” President Luiz Inácio Lula da Silva said proudly in a July 28 speech.”

With an abundance of natural resources and wise government policies that encourage domestic growth, millions of Brazilians are enjoying the benefits of globalization. The income of middle class families in Brazil is growing as shown in the chart below:

The article added:

” “Brazil’s fundamentals are very strong—we don’t have any of the problems that created the bubble in the U.S.,” says central bank President Henrique Meirelles.

Just as important, though, is Brazil’s huge domestic market. While outsiders focus on the country’s shipments of iron ore, steel, and soy to China, exports are just 12% of Brazil’s $1.5 trillion economy. It’s the 190 million people and the fast-growing middle class—now more than half the population—that drive growth. In the past seven years a government program called Bolsa FamÃlia has helped nudge 24 million Brazilians above the poverty line. And 8 million jobs have been created since 2003, while the minimum wage has increased 45%.”

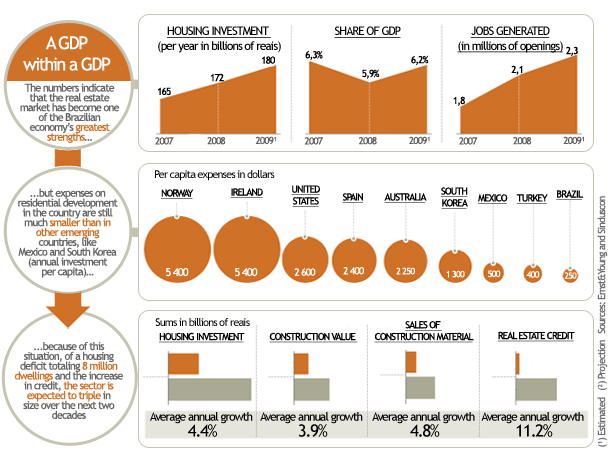

Graph – Brazilian Housing Industry:

Source: Exame

As the graph shows above the demand for housing is very strong and will increase as more middle class people buy apartments and houses. With the rise in housing sector, sales of consumer goods such as furniture, household appliances, etc will go higher as well. The growing resilience and strength of the Brazilian economy was confirmed by the two of the largest IPO deals this year. VisaNet was the biggest ever IPO in Brazil that raised $4.3B in June and Banco Santander-Brasil (BSBR) raised $8.0B last month when it was listed on the NYSE.

Gafisa is (GFA) one of the Brazilian home-builder stocks that trades in the US markets. The stock is up over 262% YTD. The complete list of Brazilian ADR stocks can be found here.