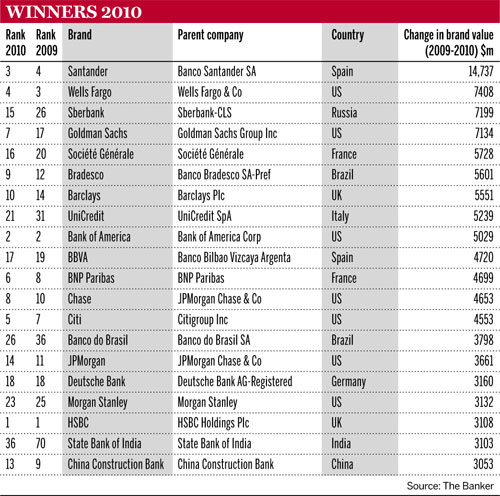

The Banker magazine has released the Top 500 Banking Brands of 2010. The top 10 banks are listed below.

“The methodology employed by Brand Finance in this Top 500 Banking Brands listing uses a discounted cash flow (DCF) technique to discount estimated future royalties at an appropriate discount rate, to arrive at a net present value (NPV) of the trademark and associated intellectual property: the brand value.”

Top 10 Global Banking Brands for 2010 listed in ascending order:

1. HSBC (HBC)

2. Bank of America (BAC)

3. Santander (STD)

4. Wells Fargo (WFC)

5. Citi (C)

6. BNP Paribas (OTC: BNPQY)

7. Goldman Sachs (GS)

8. Chase (JPM)

9. Banco Bradesco (BBD)

10. Barclays (BCS)

The highest ranked banking brand is HSBC Holdings of the UK. Bank of America of the US and Santandar of Spain came in at the second and third places.Among the emerging bank, Brazil’s Banco Bradesco and Banco do Brasil, India’s State Bank of India and China’s CBC, China Construction Bank and Bank of China all increased their brand values.

The complete list of 500 banking brands can be downloaded here.