In the journal article “Sins of Past Guide Asian Banks“, Peter Stein notes that Asian banks are well capitalized than their U.K. and European peers. Singapore banks have higher equity Tier 1 ratios based on the proposed Basel 3 standards than Chinese and Indian banks. Australian banks are just a notch above European and British banks.

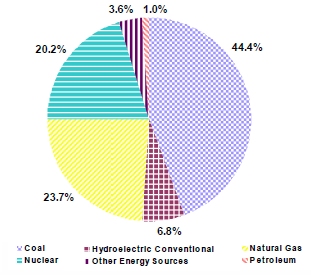

Chart

Related:

The Complete List of Foreign Bank ADRs Trading on the OTC MarketsÂ

The Complete List of Foreign Bank Stocks (includes Canadian Banks)