Olive: Hyperinflation fears on rise

Amazon’s move into Canada sparks cultural war with booksellers

The Wisdom of the Short-Sellers

The global financial crisis: Why were some countries hit harder?

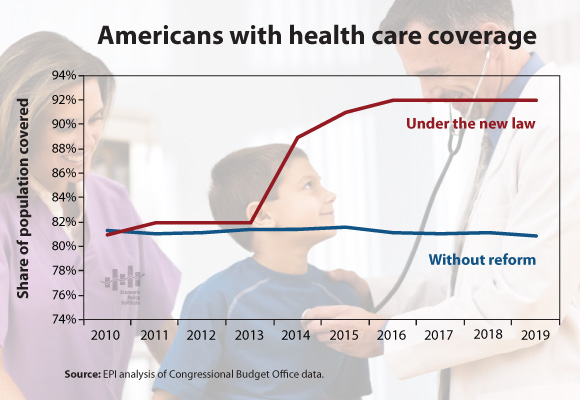

Health-Care Cost Lies Make Us Sing the Blues

Which way emerging market equities?

Health stocks earn good prognosis from analysts

China’s demand for oil products to grow 5% annually

Shanghai, China