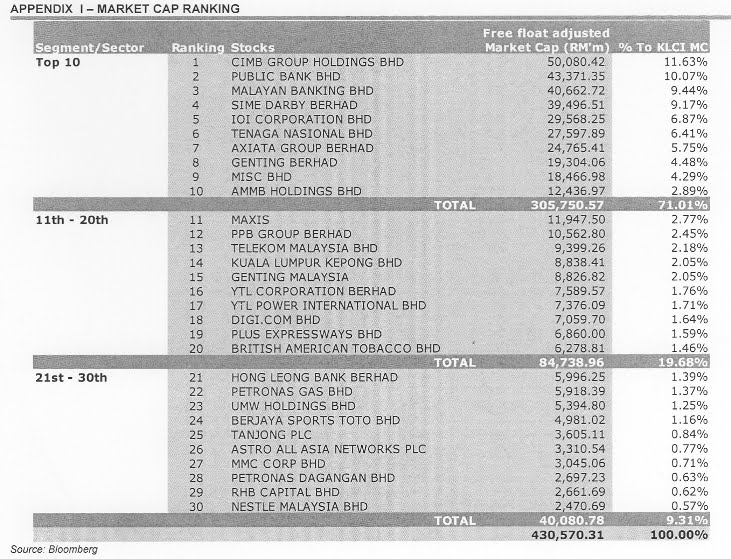

The 30 largest Malaysian companies based on market cap in the domestic currency Malaysian Ringgit is shown below:

Click to enlarge

Source: Malaysia Finance Blog

The top three companies are from the banking sector – CIMB Group, Public Bank and Malayan Banking(OTC: MLYBY). Only a handful of Malaysian companies trade on the OTC markets in the U.S. The country-specific ETF is the iShares MSCI Malaysia Index Fund (EWM).