Rising health spending is adding more pressure to government budgets according to a recent health data report by the OECD.

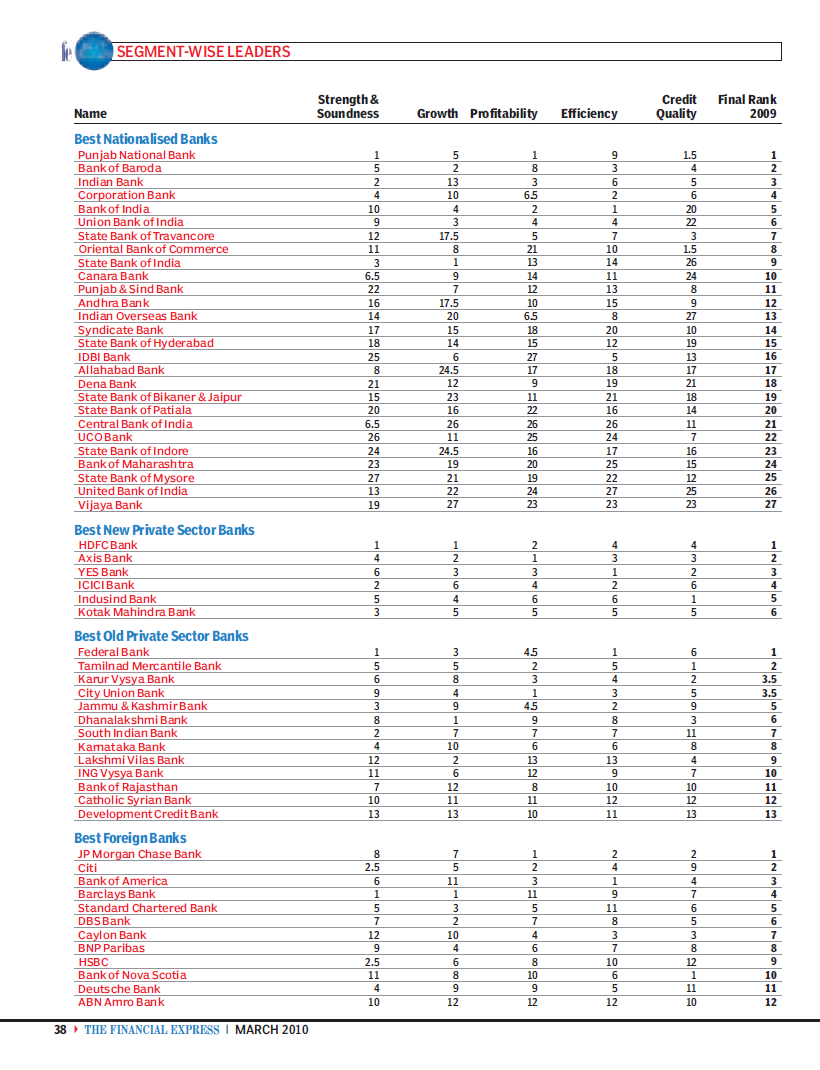

In all OECD countries health spending is rising faster than economic growth. The average ratio of health spending to GDP rose from 7.8% in 2000 to 9.0% in 2008. Growing health care costs with falling GDP growth have led to a sharp increase in the ratio of health spending to GDP in some countries such as Ireland and Spain. In Ireland it rose from 7.5% in 2007 to 8.7% in 2008 and in Spain it increased from 8.4% to 9.0%.

Health Expenditure as % of GDP

Click to Enlarge

Source: OECD

Note: The dark blue color in the bar denotes public expenditure on health and the light blue color denotes private expenditure

The total U.S. spending totaled 16.0% of GDP in 2008. Half of this was public spending primarily due to Medicare, Medicaid and other social benefit programs.

Health Expenditure per Capita

In terms of per capita health spending, the US spent $7,538 in 2008, well over double the $3,000 average of all OECD countries. The next biggest spenders were Norway and Switzerland. Both these countries spent much less than the U.S. per capita but still some 50% more than the OECD average.

The OECD report also noted:

Governments of most OECD countries shoulder the lion’s share of healthcare costs. The share of government expenditure devoted to health increased in most countries, rising from an average of 12% in 1990 to an all-time high of 16% in 2008. Given the urgent need to reduce their budget deficits, many OECD governments will have to make difficult choices to sustain their healthcare systems: curb the growth of public spending on health, cut spending in other areas, or raise taxes.

Growing use of medical technologies such as CT and MRI imaging are also contributing to rising health care costs. CT and MRI scanners are expensive to buy and operate. The per capita use of these devices in the U.S. is much higher than other OECD countries. This is primarily due to the practice of defensive treatment by doctors who fear of getting sued. However there are concerns that some of these imaging may not to be useful to the patients.

Unnecessary medical procedures using expensive hi-tech equipment is one of the major factors of soaring healthcare costs in the U.S. This important point is not addressed in the health care reform passed by the Obama administration. In fact the reform does not seem to achieve anything meaningful other than to require the currently uninsured millions of Americans to get insurance. The following excerpt from a news release proves that the administration is still out of touch with reality:

President Barack Obama’s new health coverage for uninsured people with health problems won’t be cheap — monthly premiums as high as $900, administration officials said.

Prices will vary by state and type of coverage from a low of $140 a month to as much as $900, said Richard Popper, deputy director of a new insurance office at the federal Health and Human Services department. Officials provided details of the plan, which starts enrolling people Thursday.

The price range is so wide because premiums will be keyed to standard individual health insurance rates in each state, which can differ dramatically because of medical costs and the scope of coverage. Independent experts estimate premiums will average around $400 to $600 a month. Younger people will pay less.

“There are going to be meaningful premiums that are going to be required to stay in this plan … in the hundreds of dollars,” said Popper, with the Office of Consumer Information and Insurance Oversight.

Despite the cost, consumer advocates are urging uninsured people with health problems to sign up soon, because they cannot be turned away for medical reasons. Family members may be able to help with premiums.

The Pre-Existing Condition Insurance Plan will start taking applications Thursday in many states, the rest by the end of the month. Coverage will be available as early as August 1.

With falling wages, high unemployment and rising cost of living it would be interesting to see how many of the uninsured are able to afford the premiums and sign up for this government-run insurance plan.

Related: Health Care Expenditure As A Percentage Of GDP Among OECD Countries (Nov 11, 2015)