The 10 Most Traded Stocks on the OTC Market are:

China’s Infrastructure and Real Estate Spending Continues to Remain High

The World Bank released its latest China Quarterly Update last month. The following are some of the key takeaways from this report:

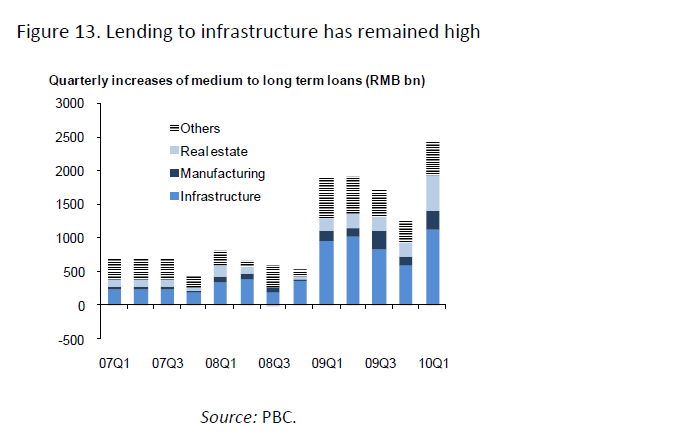

1. In the first quarter of this year, a large portion of lending still went to local government investment platforms (LGIPs) as the chart below shows.

After infrastructure, local governments invest heavily in real estate. At the end of 2009, the total local government debt stood at RMB 8 trillion. This type of liberal lending by local governments may cause some of the loans turn into non-performing loans. Heavy government involvement in the real estate sector helps to maintain the current bubble. Hence when the inevitable crash occurs it will be severe. Despite being called the workshop of the world, lending to the manufacturing sector is the lowest.

2. The GDP is projected to grow 9.5% this year and 8.5% in 2011.

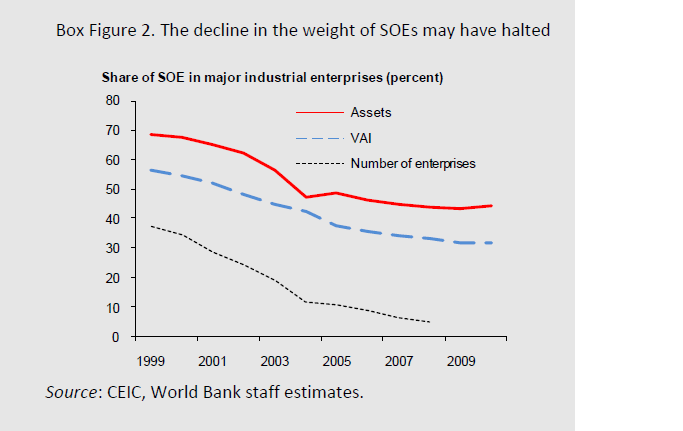

3. State-owned enterprises (SOEs) increased their role in the economy during the massive government last year. However in the long term, the weight of SOEs has declined both in terms of assets and production.

4. Consumption is likely to remain strong due to the vibrant and growing labor market.

5. Rising property prices have forced the government to implement new measures to cool down the market. Some of these measures include raising the minimum required and mortgage interest rates.

6. Stock prices have declined sharply on worries about policy tightening. The Shanghai Composite index is one of the worst performers in the world this year YTD and the index is well inside the bear market territory.

7. Despite the expansionary monetary policies undertaken since the end of 2008, inflation is likely to remain contained this year.

Bloomberg BusinessWeek: Top 50 Stocks In The S&P 500

The table below lists Bloomberg Businessweek‘s ranking of 50 companies in the S&P 500 index with the best total returns for shareholders over the last five years as of Mar. 31, 2010:

[TABLE=516]

Of all the companies in the S&P 500 it is surprising to see Priceline.com(PCLN), a dot-com company, top the list with the total return of 911.9%. Other notable hi-tech winners in this list include Apple (APPL), Amazon.com (AMZN) and Akamai Technologies (AKAM).

Five Latin American ADRs Yielding More Than 6% Dividends

The following five Latin American ADR stocks have dividend yields of more than 6% as of July 1, 2010:

1.Company:Compania Cervecerias Unidas SA (CCU)

Current Dividend Yield: 6.03%

Sector: Alcoholic Beverages

Country: Chile

2.Company: Grupo Radio Centro SAB de CV (RC)

Current Dividend Yield: 6.48%

Sector: Broadcasting & Cable TV

Country: Mexico

3.Company: TAM SA (TAM)

Current Dividend Yield: 6.47%

Sector: Airlines

Country: Brazil

4.Company: Alto Palermo SA (APSA)

Current Dividend Yield: 8.83%

Sector: Real Estate Operations

Country: Argentina

5.Company:YPF SA (YPF)

Current Dividend Yield: 7.32%

Sector: Oil & Gas Operations

Country: Argentina

World GDP Change Over The Last 500 Years

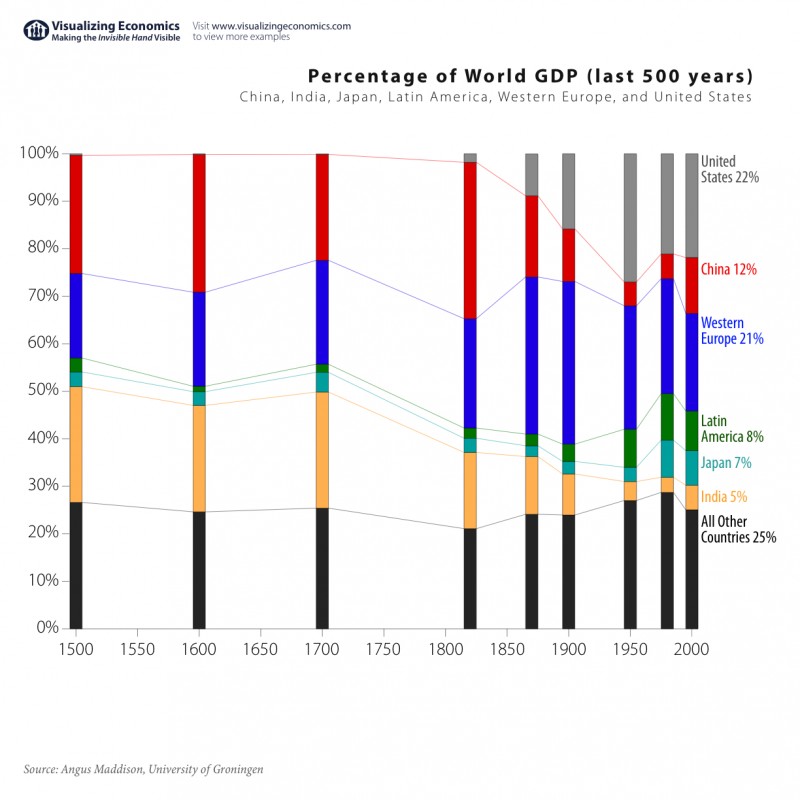

The graphic below shows the change in composition of World GDP over the last 500 years. The economy of China and India were much larger in the 16th,17th, 18th and 19th centuries than they are today.Both the economies started to shrink from the 1850s. However they are growing at an increasing pace with China’s GDP reaching 12% of global GDP in 2000 and India reaching 5%.

It is interesting to note that the U.S. economy grew dramatically from early 1800s thru 1950. As China takes a larger portion of the world’s economic growth, the US share of the global output may decline.

Click to Enlarge