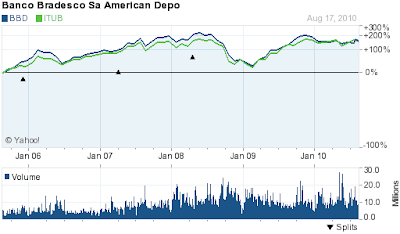

The charts below show the performance comparison of two of the largest private sector banks in Brazil: Banco Bradesco(BBD) and Itau Unibanco (ITUB).

5-Year Performance Comparison

1-Year Performance Comparison

For the most part, BBD and ITUB track each other. However in the last one year, Itau Unibanco has performed slightly better than Bradesco. Both the banks hold considerable potential for growth in the future as the Brazilian middle-class expands. Bradesco and Unibanco stocks are attractive at current levels.