Despite the rise and fall of the hi-tech industry in the 90s, the incredible boom and the subsequent bust of the housing market, the vast majority of Americans are actually worse now than before. Two recent articles in The Wall Street Journal confirms this theory.

From an article titled “Obstacle to Deficit Cutting: A Nation on Entitlements“:

“As recently as the early 1980s, about 30% of Americans lived in households in which an individual was receiving Social Security, subsidized housing, jobless benefits or other government-provided benefits. By the third quarter of 2008, 44% were, according to the most recent Census Bureau data.

That number has undoubtedly gone up, as the recession has hammered incomes. Some 41.3 million people were on food stamps as of June 2010, for instance, up 45% from June 2008. With unemployment high and federal jobless benefits now available for up to 99 weeks, 9.7 million unemployed workers were receiving checks in late August 2010, more than twice as many as the 4.2 million in August 2008.”

Charts:

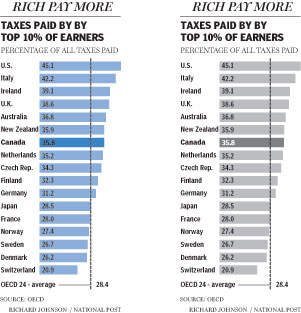

Amazingly the article completely fails to mention the billions of tax payer funds given to companies in the form of various bailouts and other corporate handouts. Not surprisingly among the developed countries Americans receive the lowest income from government benefits.

Back in December I wrote a post on A Lost Decade for U.S. Stocks. It turns out that it was a lost decade not just for stocks but for the family income as well. From another piece in the Journal titled “Lost Decade for Family Income“:

“The bureau’s annual snapshot of American living standards also found that the fraction of Americans living in poverty rose sharply to 14.3% from 13.2% in 2008—the highest since 1994. Some 43.6 million Americans were living below the official poverty threshold, but the measure doesn’t fully capture the panoply of government antipoverty measures.

The inflation-adjusted income of the median household—smack in the middle of the populace—fell 4.8% between 2000 and 2009, even worse than the 1970s, when median income rose 1.9% despite high unemployment and inflation. Between 2007 and 2009, incomes fell 4.2%.

“It’s going to be a long, hard slog back to what most Americans think of as normalcy or prosperous times,” said Nicholas Eberstadt, a political economist at the right-leaning American Enterprise Institute.

The data, released Thursday, underscore the extent to which U.S. households relied on government benefits—and each other—to weather the recession and how living standards at the middle of the middle class have stalled. The report comes as the economy is at the center of a vigorous debate over how government policy can best help the poor and unemployed.”

Since the unemployment situation continues to be horrible and the economy is mired in recession, households’ dependence on government may rise further leading to higher deficits.Unless some bold and structural changes are made by the current administration, we can expect to have many years of anemic economic growth.

Updates:

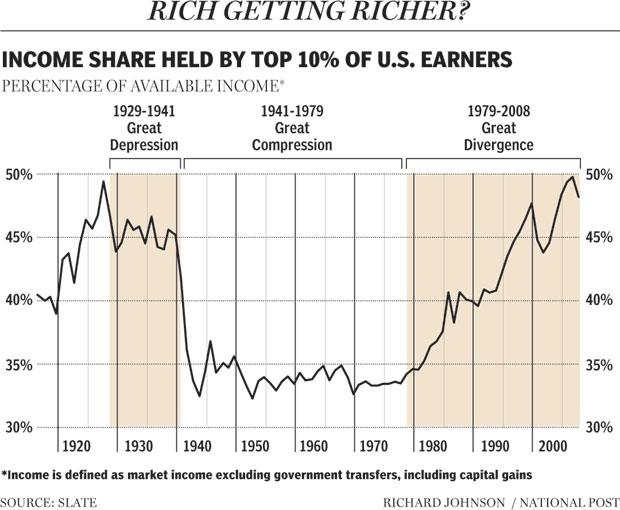

Source: Timothy Noah: The great income divergence is changing America for the worse

Source: Terence Corcoran: The U.S. income ‘divergence’ myth