Portugal used to be called The Sick Man of Europe before the economy recovered in the 1990s. However in 2007 The Economist magazine dubbed the country as the “new sick man of Europe”. More recently traders made it a member of the PIGS group of countries. Despite being part of the EU and appearance of prosperity Portugal is still dominated by agriculture and industrial development lags behind. Illiteracy remains a major issue and the high school dropout rate is too high. A recent article in the Journal noted that lack of educated professionals remains a major stumbling block to economic recovery.

From the article:

The state of Portuguese education says a lot about why a rescue is likely to be needed, and why one would be costly and difficult. Put simply, Portugal must generate enough long-term economic growth to pay off its large debts. An unskilled work force makes that hard.

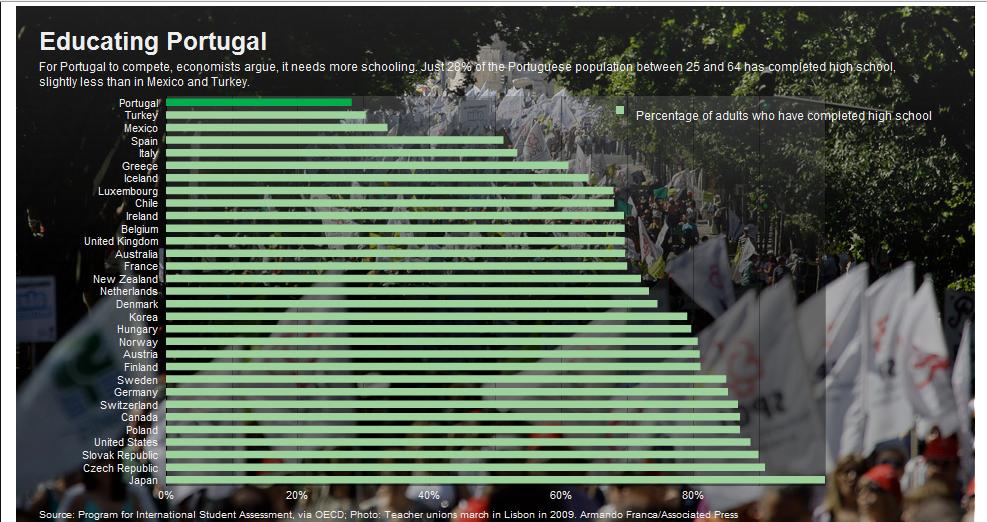

Cheap rote labor that once sustained Portugal’s textile industry has vanished to Asia. The former Eastern Bloc countries that joined the European Union en masse in 2004 offer lower wages and workers with more schooling. They have sucked skilled jobs away.Just 28% of the Portuguese population between 25 and 64 has completed high school. The figure is 85% in Germany, 91% in the Czech Republic and 89% in the U.S.

“I don’t see how it is going to grow without educating its work force,” says Pedro Carneiro, an economist at University College London who left Portugal to do his postgraduate studies in the U.S. The education woes in Portugal show the extent of Europe’s challenge as it tries to right itself amid the sovereign-debt crisis.

Click to enlarge

Ireland has an educated workforce but the economy crashed due to the work of greedy bankers and incompetent regulators. Greece has a chronic corruption problem and has been the poorest country in Europe for many decades now.

Among the Portuguese ADRs trading on the US markets, electric utility Energias de Portugal (EDPFY) has a 4.91% dividend yield and telecom services provider Portugal Telecom(PT) pays a 6.02% dividend.

Disclosure: No Positions