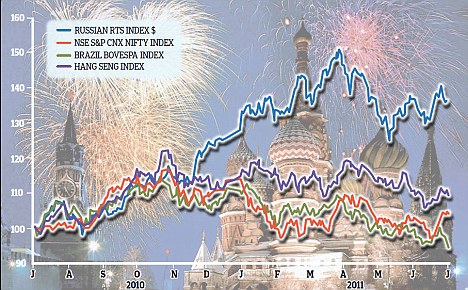

The fall of European equities in the past few weeks due to the sovereign debt crisis has made some of the equities cheap. Many German companies especially are worth a look at current levels. The export-driven German economy is weathering the crisis well and is poised to expand further once the dust settles.

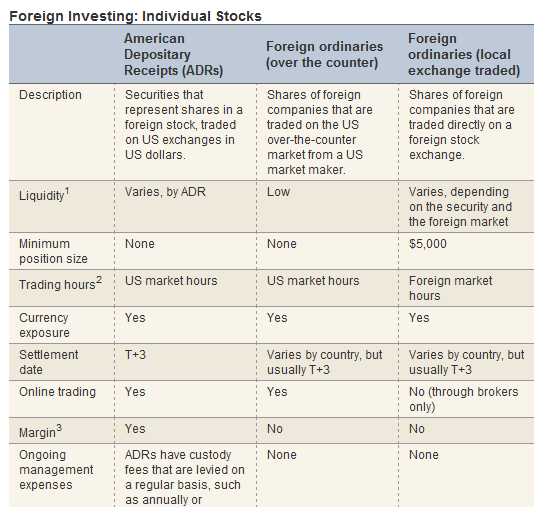

According to the BNY Mellon DR site, only six German ADRs trade on the organized exchanges. 27 other German firms trade as sponsored ADRs on the OTC markets. In addition, 42 more firms trade as unsponsored ADRs on the OTC exchanges.

Trading in unsponsored ADRs can get tricky since daily trading volumes may be very thin and some stocks may not trade at all for days. Hence investing in such stocks may not for some investors.

The following are 10 unsponsored ADRs from Germany that investors can review for potential investment opportunities:

1.Company: Bayerische Motoren Werke (BAMXY)

Sector:Automobiles & Parts

Current Share Price: $35.18

maker of BMW, Mini and Rolls-Royce brands of cars and also motobikes

2.Company: Wacker Chemie (WKCMY)

Sector: Speciality Chemicals

Current Share Price: $20.10

3.Company: ThyssenKrupp (TYEKY)

Sector:General Industrials

Current Share Price: $11.49

4.Company: Munich Re Group (MURGY)

Sector:Insurance and reinsurance services

Current Share Price: $15.25

5.Company: Metro (MTTRY)

Sector: Retail

Current Share Price: $11.20

6.Company: Man (MAGOY)

Sector: Industrial Transports

Current Share Price: $12.33

7.Company: Rheinmetall (RNMBY)

Sector:Automobiles & Parts

Current Share Price: $18.24

8.Company: Hamburger Hafen Und Logistik (HHULY)

Sector:Logistics

Current Share Price: $20.56

9.Company: Fraport AG (FPRUY)

Sector: Frankfurt Airport Operator

Current Share Price: $41.23

10.Company: Bilfinger Berger (BFLBY)

Sector:Construction & Materials

Current Share Price: $19.81

Note: Price noted are as of market close July 25, 2011

Disclosure: No Positions