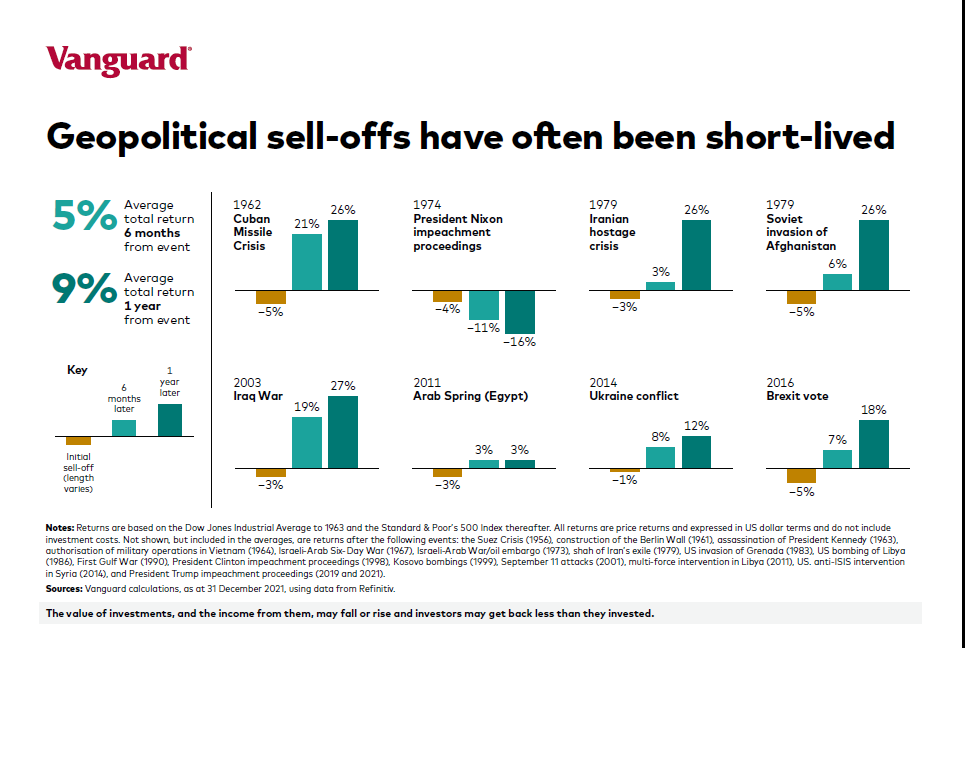

Investing in equity markets comes with a variety of risks. One of the risks that investors have to deal with occasionally is the risk of political crisis events. Unlike other factors, these are beyond the control of any investors. Hence it is important to analyze and determine how to react to such events. Panicking and selling out during crises is not a wise strategy. According to research by Vanguard, past equities have performed well in the past geopolitical crises. After the initial sell-off stocks recovered and were in the positive territory after 6 months and also 1 year as shown in the chart below:

Click to enlarge

Source: Vanguard UK

So the key takeaway is that geopolitical events are to be expected in our highly interconnected world and selling equities such events should not be a strategy. Instead it is wise to ride out political storms and focus on the long-term goal of an investment. To take it further, it is smart move to acquire some companies on the cheap when other investors panic and liquidate their holdings. For instance, during the Brexit saga a few years ago many quality stocks were trading at throw-away prices.

Related ETF:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

Disclosure: No positions