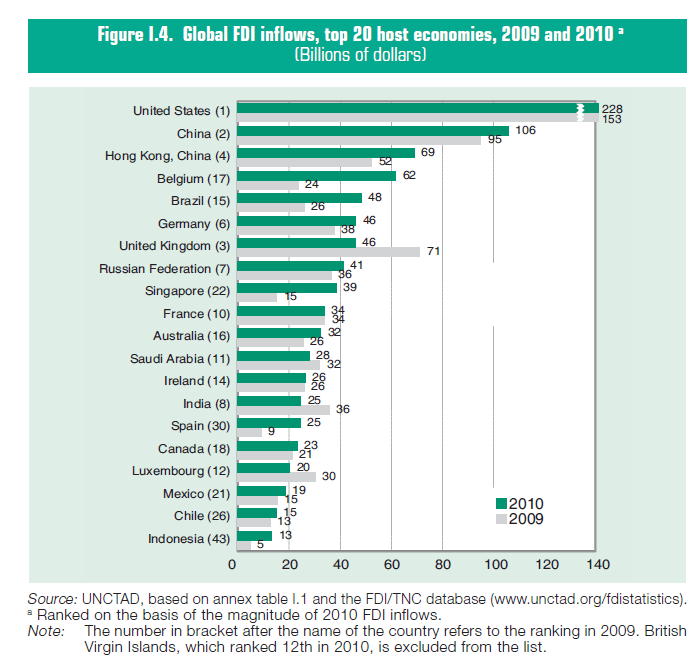

The chart below shows the top 20 FDI recipients in 2010:

Click to enlarge

In 2010, half of the top 20 host economies were from developing countries. China and Brazil continue to attract the most capital among developing countries. For the first time, Indonesia entered the top 20 list underscoring its growing significance in the global economy.

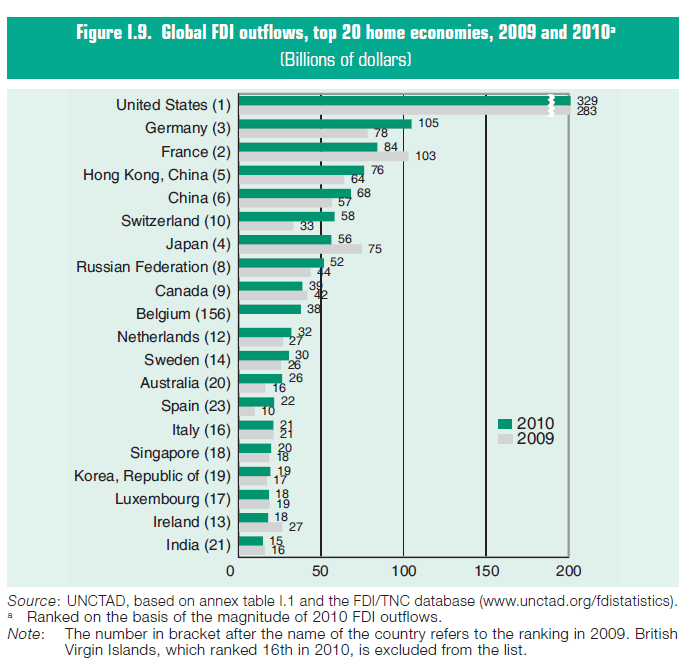

The chart below shows the top 20 FDI investors in 2010:

The U.S. maintains the top position in investing abroad. While high FDI helps the U.S. economy in some ways in other ways it hurts the economy. For example, companies pouring billions of dollars into developing countries create millions of jobs in those countries leading to lack of job growth in the U.S. In addition, companies are unwilling to repatriate most of the profits earned abroad due to tax implications. As a result, billions of profits earned by U.S. corporations overseas remain there. Developing countries such as China, Russia and India are in this list as they become major investors themselves.

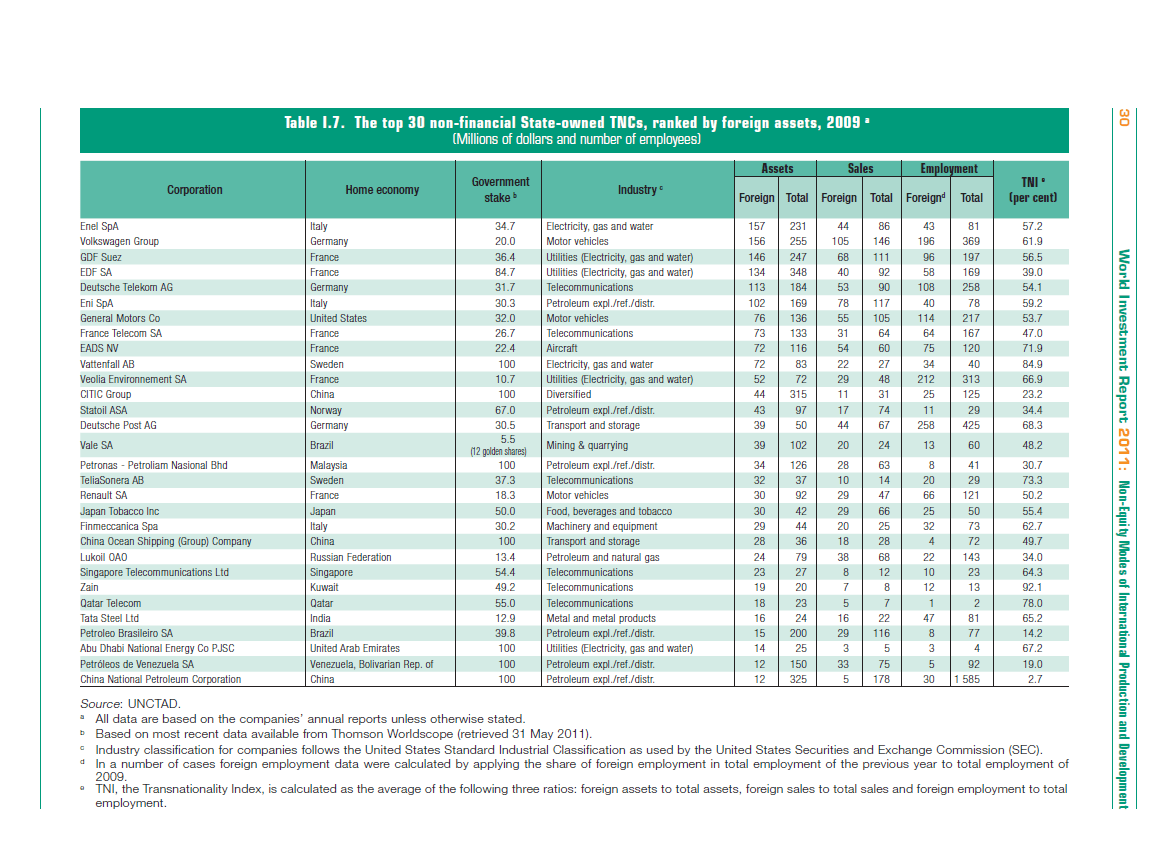

Source: World Investment Report 2011, UNCTAD