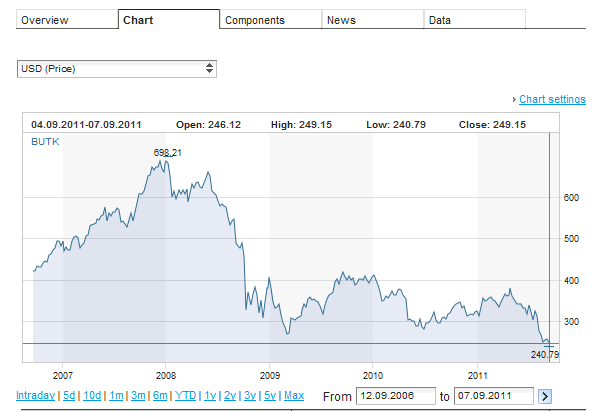

Most of the oil and natural gas producers and related players in the energy sector are down year-to-date. In addition to the weakness of economies around the world, the fall in crude oil prices have contributed to this poor performance.

The table below lists all the exchange-traded energy ADRs together with their YTD returns:

[TABLE=1040]

Source: Bank of New York Mellon

Disclosure: Long PBR, EC