The US and UK Central Banks were complicit in inflating the housing bubble by keeping the interest rates too low for a long time. While this theory has been discussed by many, Albert Edwards of Société Générale takes a different angle on why the Central Bankers kept encouraging the housing bubble.

A post in FT Alphaville quotes Albert with his following argument:

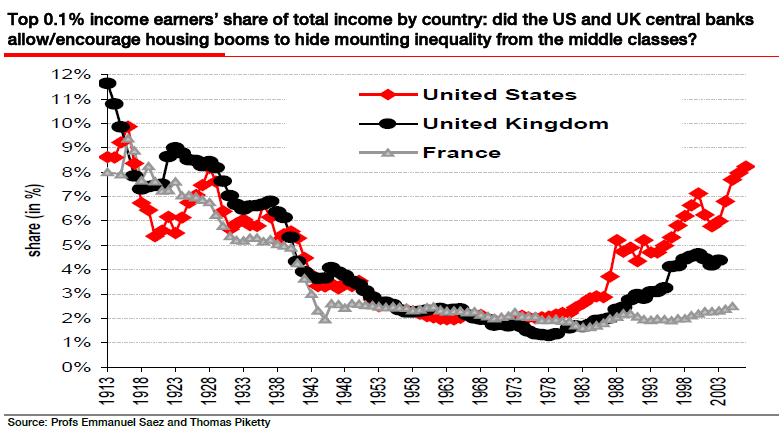

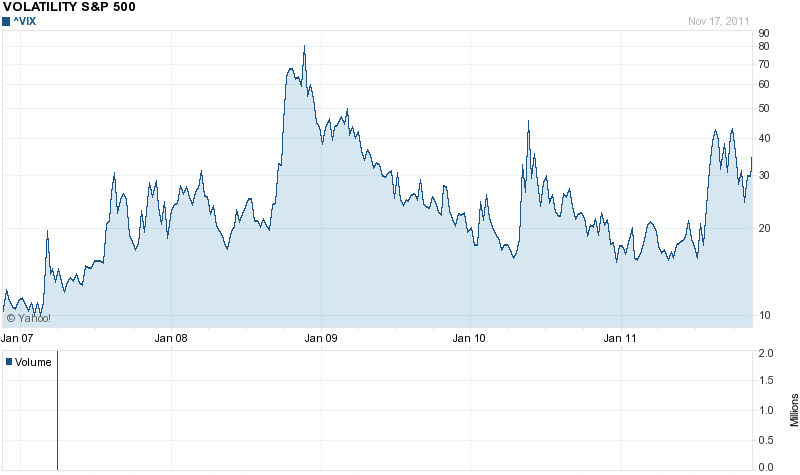

The US and UK have seen a huge rise in inequality over the last two decades, as growth in national income has been diverted almost exclusively to the top income earners (see chart below). The middle classes have seen median real incomes stagnate over that period and, as a consequence, corporate margins and profits have boomed.

Some recent reading has got me thinking as to whether the US and UK central banks were actively complicit in an aggressive re-distributive policy benefiting the very rich. Indeed, it has been amazing how little political backlash there has been against the stagnation of ordinary people’s earnings in the US and UK. Did central banks, in creating housing bubbles, help distract middle class attention from this re-distributive policy by allowing them to keep consuming via equity extraction?

Click to enlarge

Source: FT Alphaville

I believe that the central bankers did not help encourage the housing bubble to divert attention from the growing inequality. However they failed to perform their duties leading the financial system to almost collapse a couple of years ago.