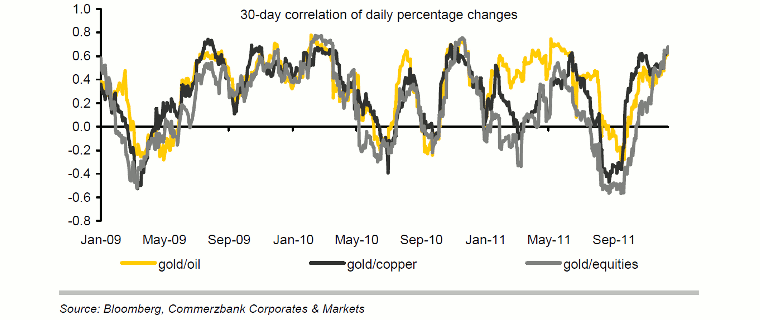

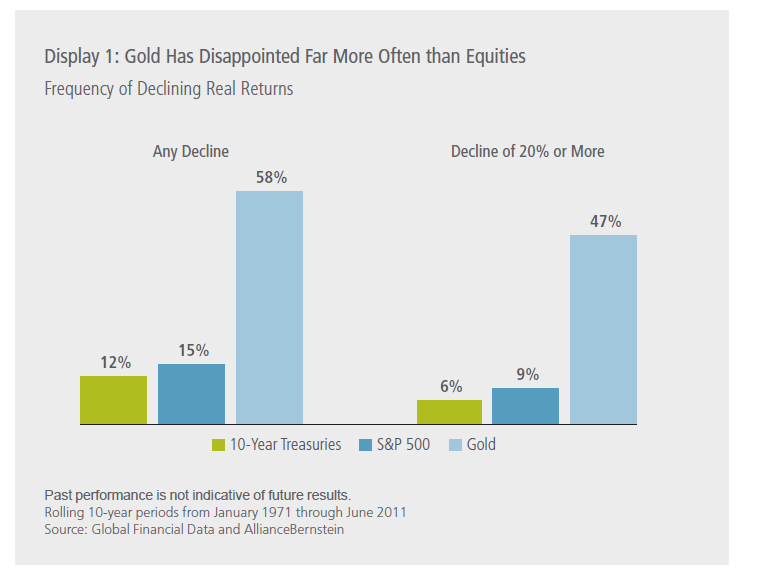

Gold is considered as a “safe haven” asset. This implies that the yellow metal’s performance should be inversely related to risky assets such as stocks and commodities. However the expected divergence is decreasing in recent years and gold’s correlation with stocks and commodities is reaching historic highs, according to a research report by Germany-based Commerzbank(CRZBY). This is another reason for investors to hold diversified portfolio and not over-weight one class of asset over another.

Click to enlarge

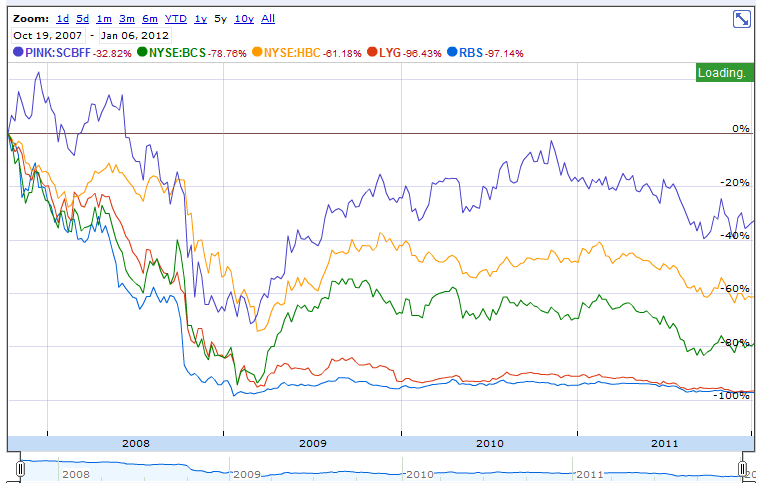

Source: CityWire Money, UK

Related ETFs:

SPDR Gold Shares ETF (GLD)

iShares COMEX Gold Trust (IAU)

Disclosure: No Positions