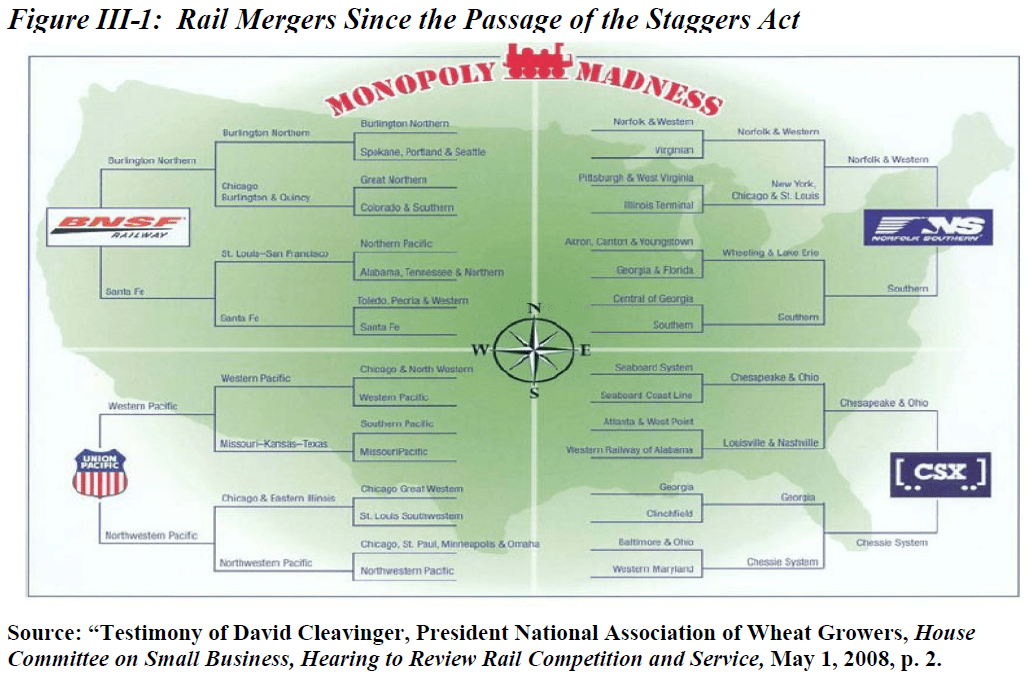

The freight railroad industry in the U.S. is highly concentrated with a handful of full of firms dominating the market. With the passage of the Staggers Rail Act of 1980 which deregulated the industry and sparked an era of mergers and acquisitions, the number of Class I railroads dramatically shrank from over 30 to just four. Contrary to the teachings of the free-market capitalism, U.S. Federal regulators and politicians seem to believe in the “four is few and six is many” phrase with respect to one of the main modes of freight transportation in the country.

Click to enlarge

Source: Bulk Commodities and the Rails: Still Crazy after all these years, Dr. Mark Cooper, Consumer Federation of America

The five Class I US-based freight railroads operating in the country are:

- BNSF Railway

- CSX Transportation (CSX)

- Norfolk Southern Railway (NSC)

Kansas City Southern Railway (KSU)- Union Pacific Railroad (UNP)

Kansas City Southern Railway (KSU) is the smallest of the Class I railroads and operates in ten central U.S. states and Mexico with about 6000 miles of track under its control.

Update (5/29/22): Kansas City Southern was bought out by Canadian Pacific (CP) in Dec, 2021.

The railroad industry can be considered as a oligopoly and for many captive shippers it is actually a monopoly since they are serviced by only one railroad. For example, two-thirds of coal shipped by rail is captive to a single railroad. With over 90% of rail traffic shared among the four rail carriers and healthy competition mostly eliminated, railroads enjoy enormous pricing power.

From an investment standpoint, U.S. railroads offer an excellent opportunity for long-term investment. Among the five US-based Class I railroads, BNSF Railway is privately owned as Warren Buffet’s Berkshire Hathaway bought the company in 2009.

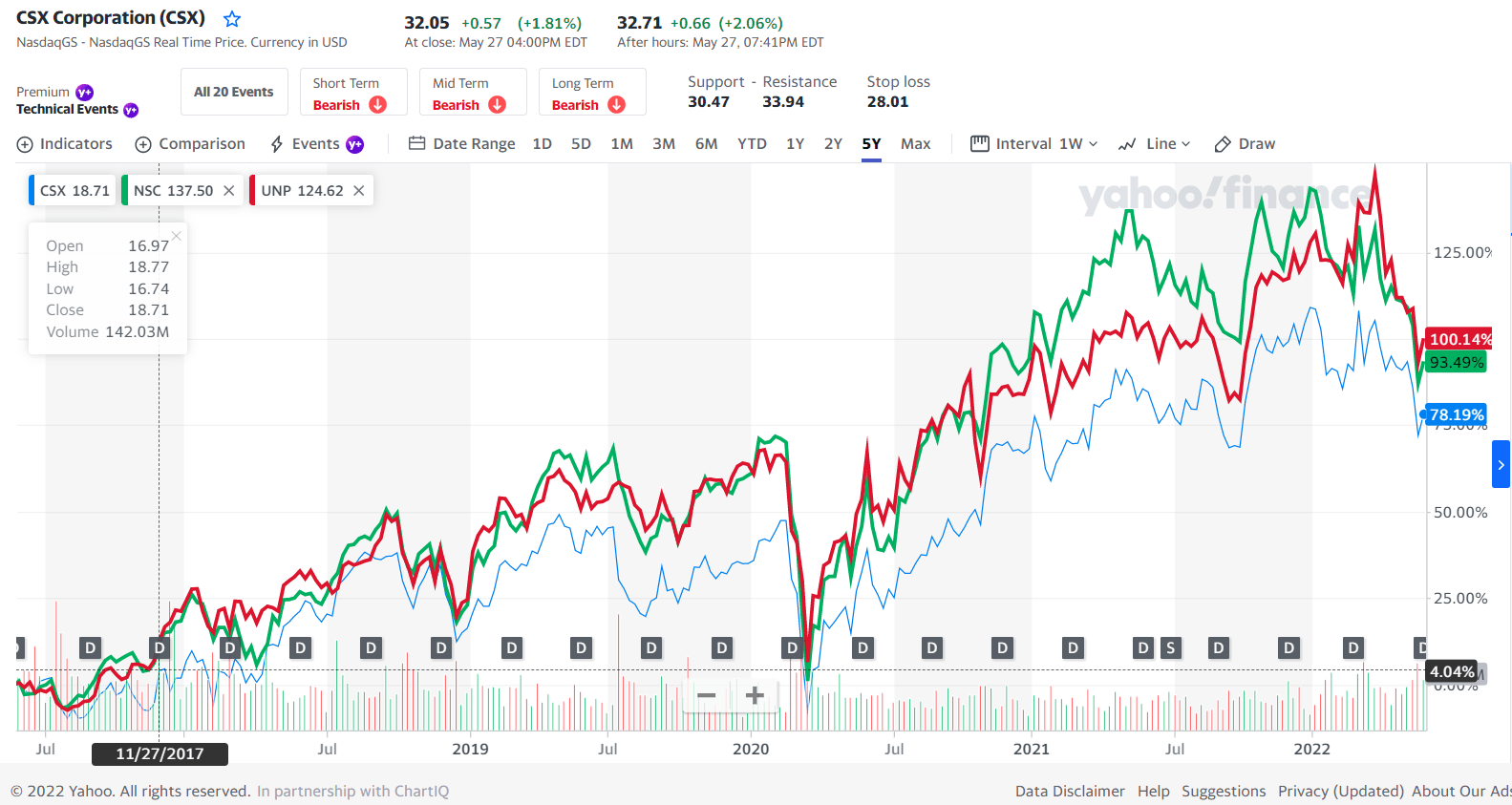

The following chart shows 5-year return of the other three railroads as of May 29, 2022:

Click to enlarge

Source: Yahoo Finance

Disclosure: Long NSC, UNP and CSX

Update (5/29/22):

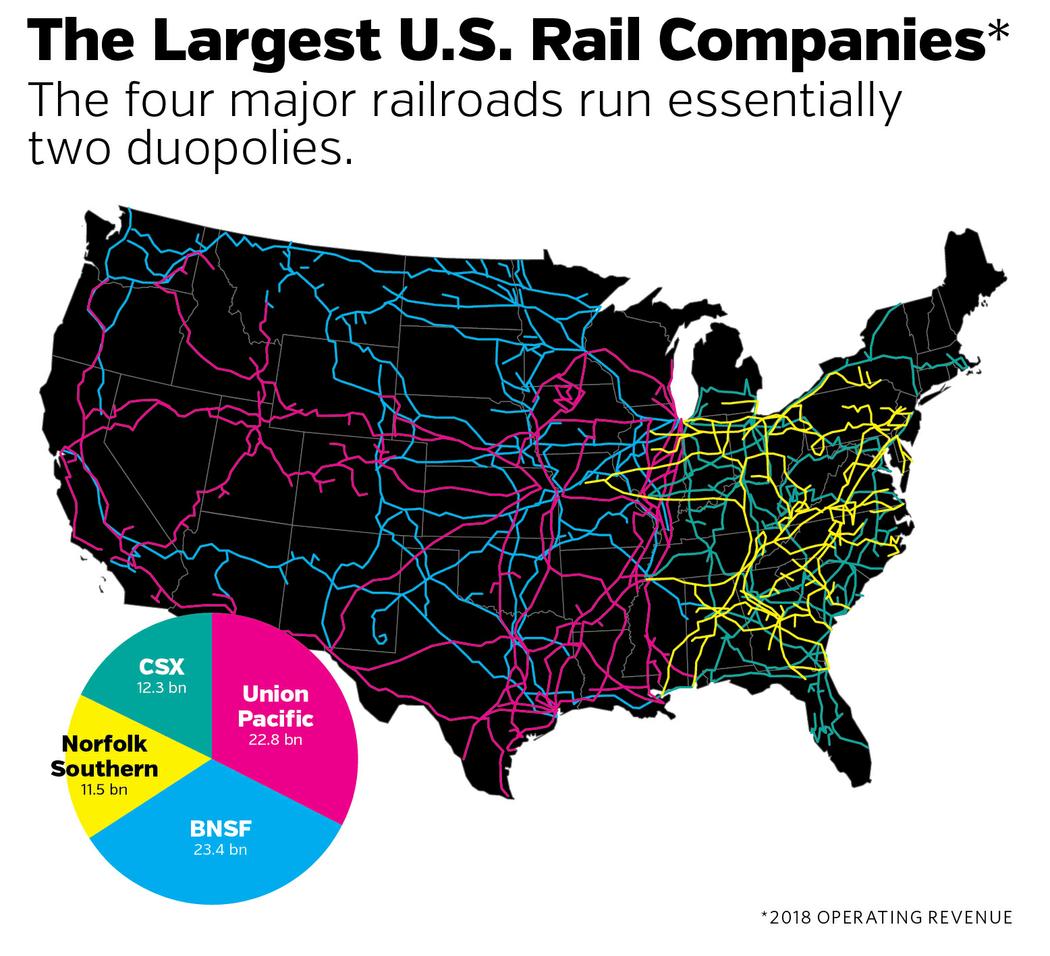

1.The Largest US Railroad Companies:

Click to enlarge

Source: How America’s Supply Chains Got Railroaded, The American Prospect

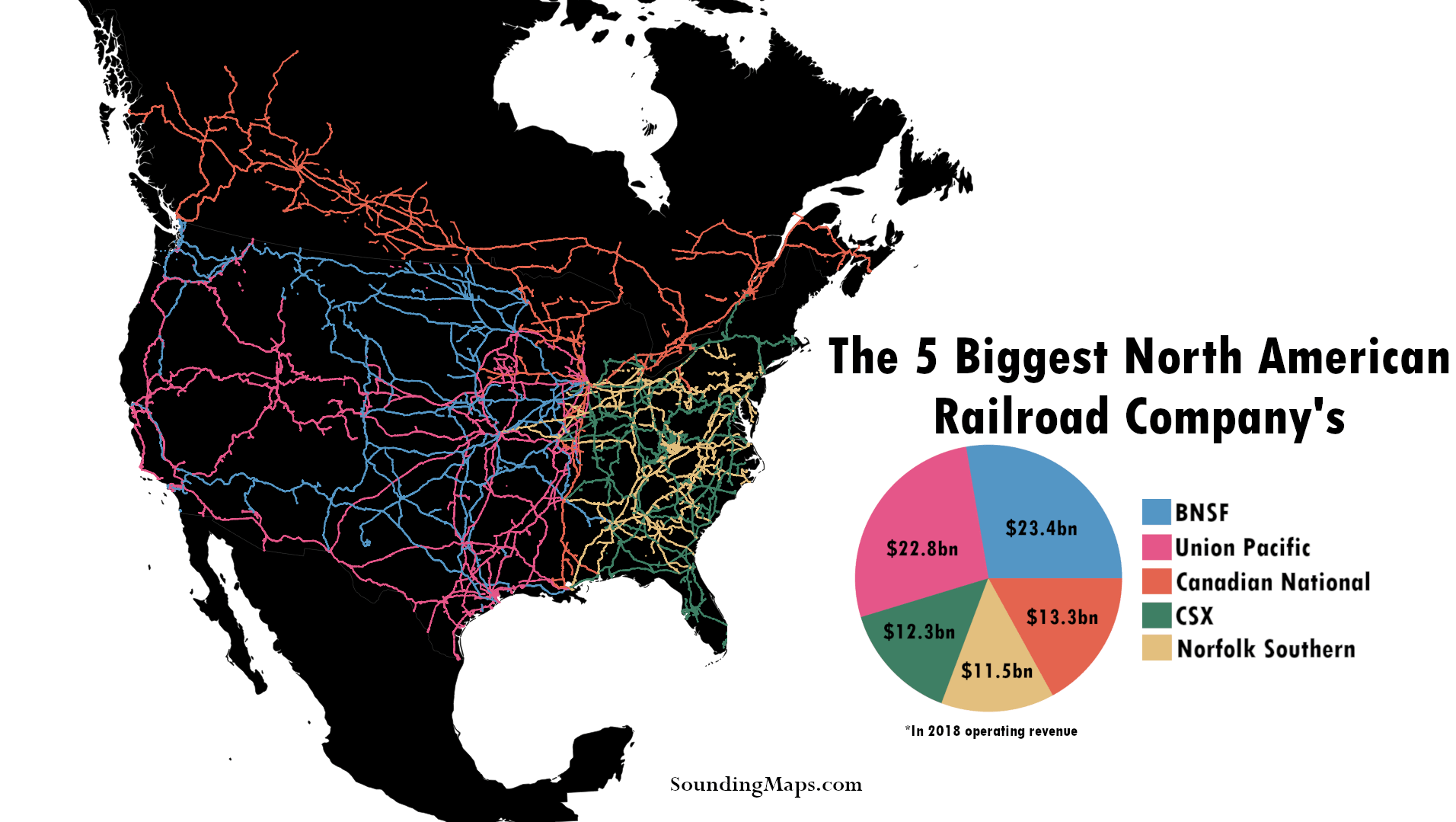

2. The 5 Biggest Railroads in North America:

Click to enlarge

Source: SoundingMaps.com

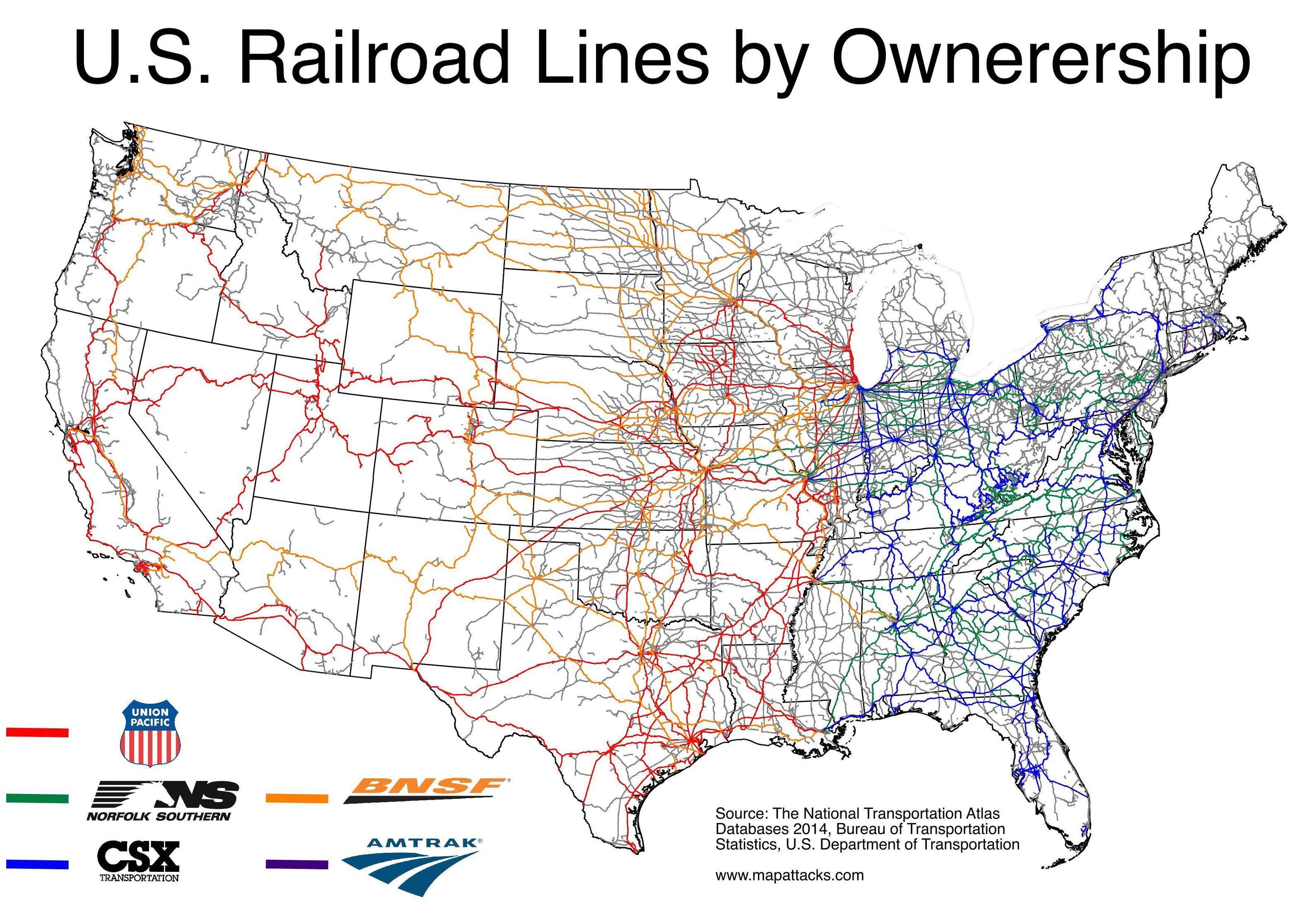

3. US Railroad lines by Ownership:

Click to enlarge

Source: Unknown