China’s success challenges a failed economic consensus

America’s Dirty War Against Manufacturing (Part 2): Carl Pope

‘Speculation Is an Important Cause of High Prices’

‘I have 90% of my portfolio in emerging markets’

10 top U.S. dividend stocks to own until retirement

The uncoupling of decoupling: Latin America’s experience

U.S. grows while Europe stumbles

The corn flake way to higher employment

Diamonds aren’t forever: Oppenheimers leave De Beers

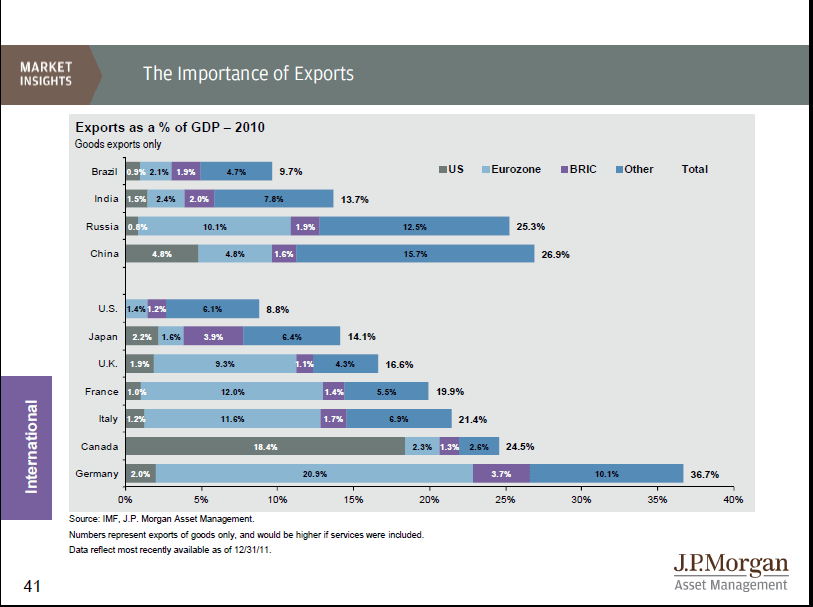

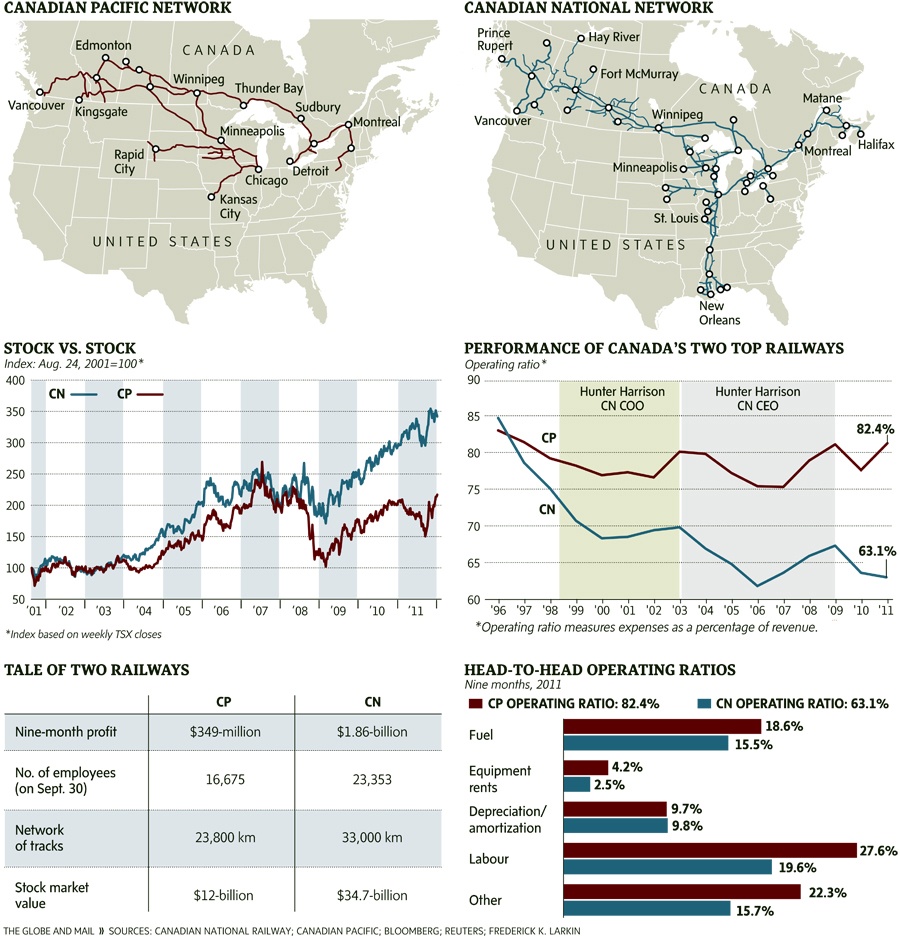

Click to enlarge

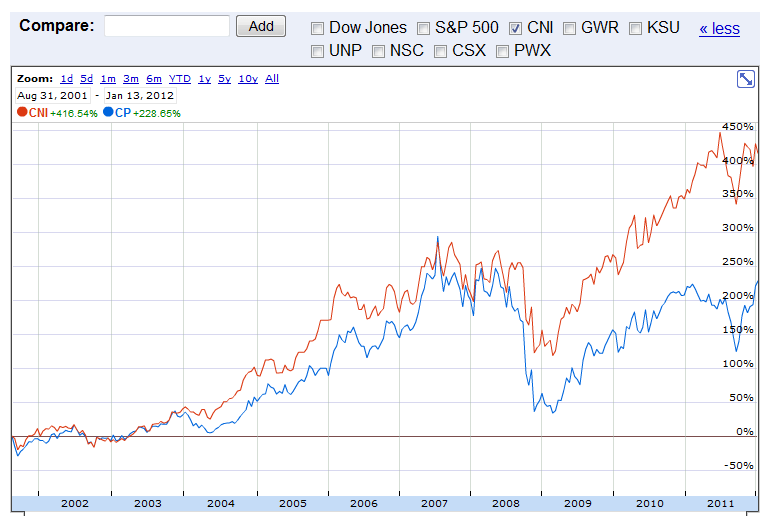

Volkswagen’s Autostadt Center, Wolfburg, Germany