Guest post: 10 consequences of the commodity crash (FT beyondbrics)

Should I Stay or Should I Go: Global Diversification Could be 2015’s Winner (Charles Schwab)

The Philippines’ Cinderella story (MoneyWeek)

A Few Words on Greece (Mark Mobius)

Why investors need to change their attitude when they reach retirement (Trustnet)

America dumbs down (MaCleans) Also see Americans Don’t Know Much About Science (The Big Picture)

Can active share improve your investment returns? (Money Observer)

When Bond Funds Jump the Fence (WSJ Moneybeat)

Why Foreign Stocks Are Primed For A Comeback (Forbes)

The 2014 oil price slump: Seven key questions (vox)

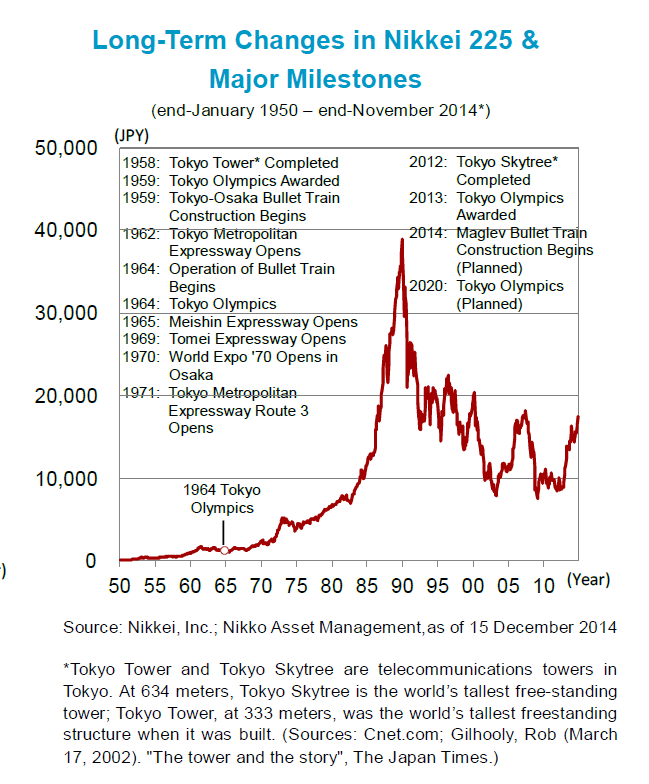

Nikkei Long-term Chart

Click to enlarge

Source: Nikko Asset Management

Punta Cana Beach Resort, Dominican Republic