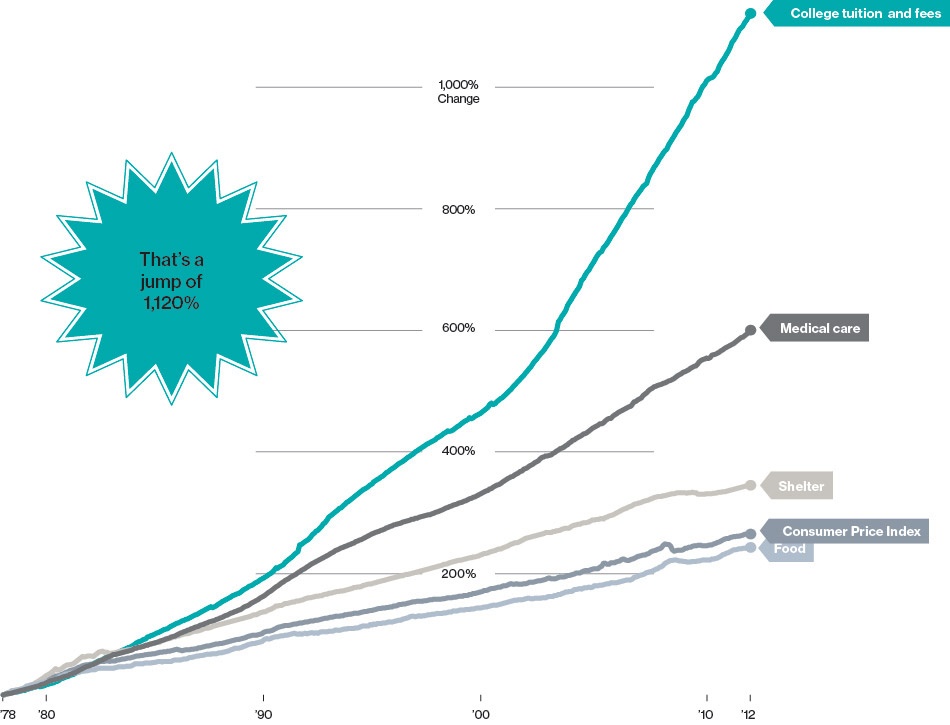

The cost of college education continues to increase year-after-year. In fact, the inflation in college tuition is higher rate than other products and services including heatlhcare as shown in the chart below from one my earlier posts on this subject.

Click to enlarge

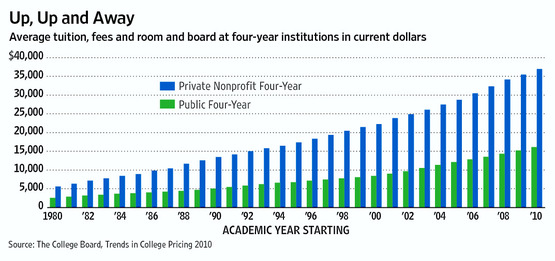

The chart below shows the growth of college tuition from the 1980s:

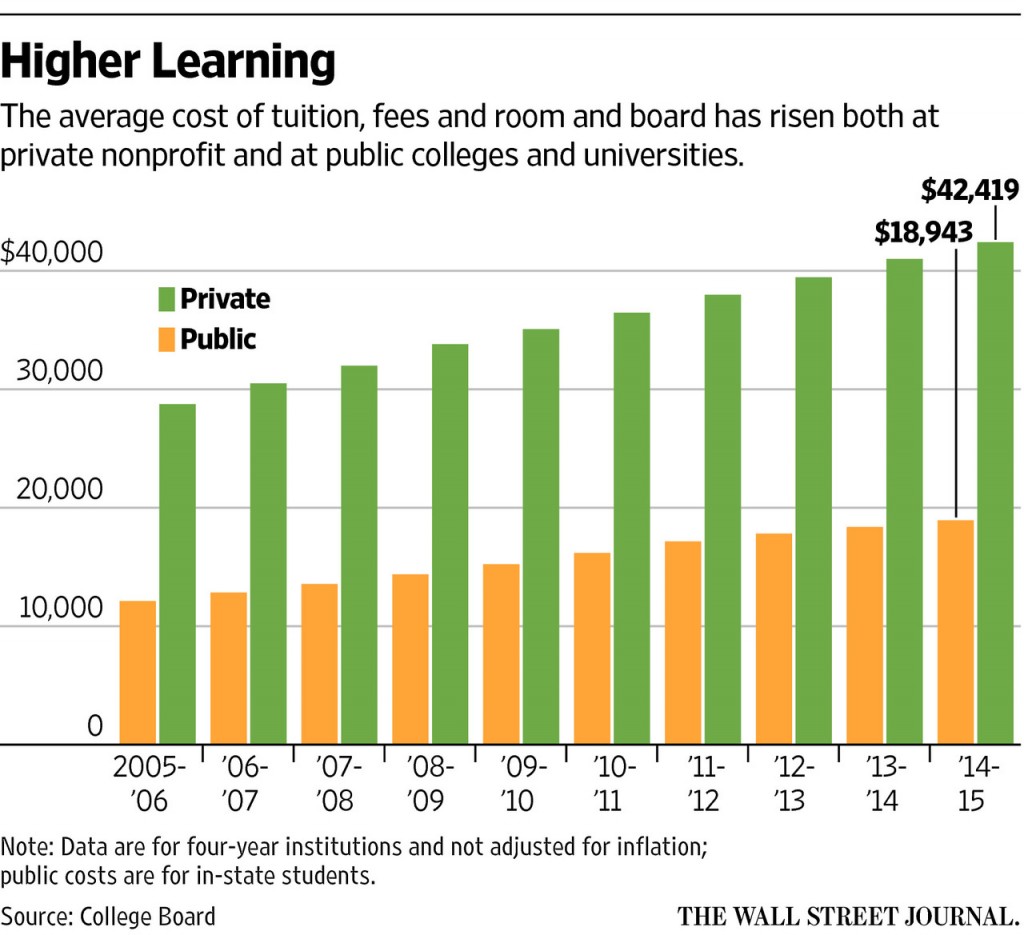

From a weekend article in the Journal on college tuition and aid:

Financial-aid policies vary widely among schools. Last month, Stanford University in Palo Alto, Calif., said undergraduate students’ parents who have annual income below $125,000 generally won’t have to pay tuition, though the students must contribute at least $5,000 a year toward room and board and other costs. But total costs, including tuition, at some private universities can exceed $60,000 a year, and financial assistance is much less generous.

Click to enlarge

The average annual cost of tuition, fees and room and board at private nonprofit four-year colleges and universities totaled $42,419 in 2014-15, up 3.6% over a year prior, according to data from the College Board. At public four-year colleges, that figure was $18,943 for in-state students, up 3%. Financial aid can include a mix of need-based and merit-based assistance.

Source: How to Play the College Financial-Aid Game, April 17, 2015, The Wall Street Journal

Why is the cost of college education is so high and shows no sign of decreasing any time soon?

There are a multitude of reasons for why college tuition is rising. I have listed below four of them below:

- The annual salary and other compensation of university presidents is very high.Some colleges pay them millions as if they are running a public corporation. So just like their CEO peers in the private industry these noble men and women try to milk as much as possible before their retirement.

- Just like so many other industries, plenty of paper-pushers now work in universities. These “Administrators” are also paid lavish salary and benefits and most of them do not contribute anything to education. Many schools employ more of these people than actual professors or instructors.

- Sports is a big business for colleges and its not uncommon to see even a third-rate university spend millions on a stadiums or other things related to sports. The money for this has to come from somewhere and one source is tuition paid by students.

- The Federal government hands out unlimited amounts in student loans to anyone who has a pulse and enrolls in college.Despite recent changes to the student loan program, it is still easy to get student loans. Some unemployed people even enroll in college and take student loans to use on other things like paying bills and other expenses. Colleges know that since students have access to this easy Federal money they can raise tuition and just add it to the student’s account.