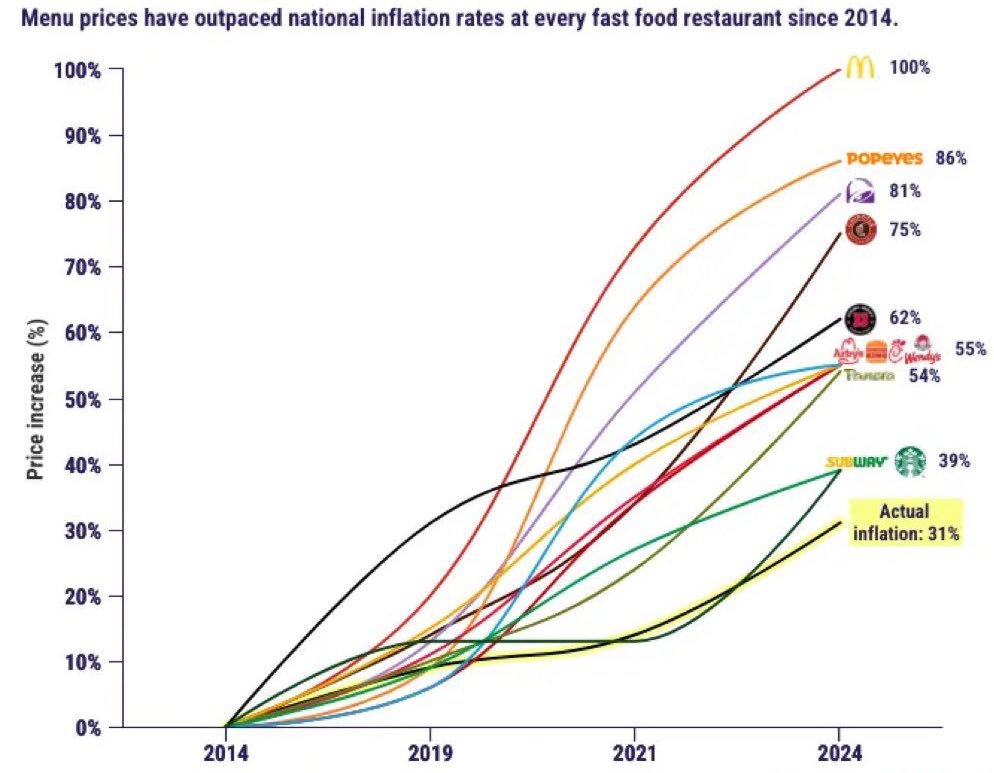

Fast food used to cheap in the US many years ago. That is no longer the case. Fast food which is basically “junk” and unhealthy food has become incredibly expensive in the past few years especially since the pandemic. Multiple factors have led to menu prices soaring. These include higher labor costs, inflation, rising food costs, increasing commercial rents, insurance costs, etc. I came across the following chart that shows how fast food prices have outpaced inflation since 2014:

Click to enlarge

Source: @MichaelAArouet via syz Group

Higher food prices have not led to a significant decrease in sales among the major chains. However due to rising consumer backlash McDonald’s for instance is launching a $5 meal in June for a month. Burger King is also joining the battle with a $5 meal.

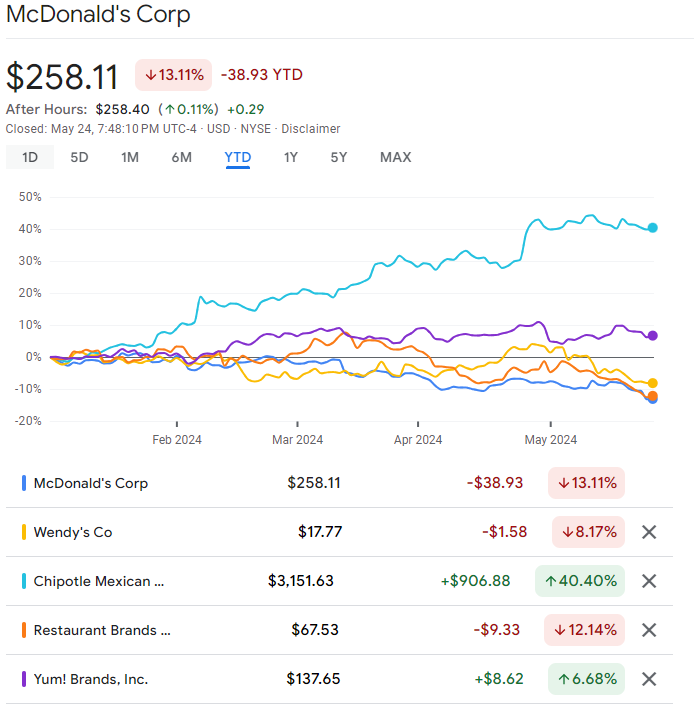

In terms of stock returns, Chipotle Mexican Grill(CMG) is the best performer YTD and also in the past 5 years as the charts below show:

Select fast-food restaurant stock returns YTD as of May 24, 2024:

Click to enlarge

Select fast-food restaurant stocks 5-returns as of May 24, 2024:

Click to enlarge

Source: Google Finance

Related Companies:

- Chipotle Mexican Grill Inc. (CMG)

- McDonald’s Corporation (MCD)

- Restaurant Brands International Inc.(QSR)

- Wendy’s Company (The) (WEN)

- Yum! Brands Inc. (YUM)

Disclosure: No positions