The Kingdom of Saudi Arabia (KSA) has a population of about 26.0 million. The government type is a monarchy run by King and Prime Minister Abdallah bin Abd al-Aziz Al Saud according to the CIA’s World Factbook. He belongs to the Al Saud family which controlled the country since it was created. In fact, the country is named after the family. As a result hundreds of members of this family and relatives hold almost all of the key positions in the government.

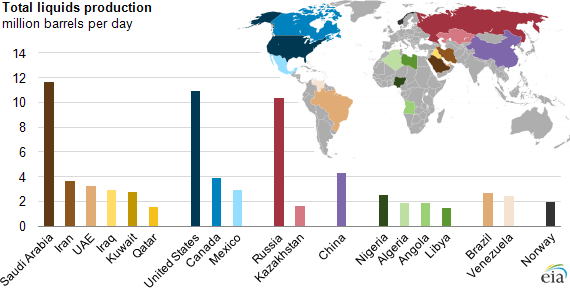

Saudi Arabia has almost one-fifth of the world’s largest proven oil reserves and is the largest producer and exporter of total petroleum liquids in the world. Hence the economy is largely oil-based and the state controls major economic activities. In 2012, the estimated GDP based on purchasing power parity was about $740.0 billion. Saudi Arabia’s trade partners are most of the major developed countries and emerging countries due to their dependence on Saudi oil. The country is also leading member of the OPEC.

Saudi Arabia follows a process called “Petro-Dollar Recycling”. Under this long-standing arrangement between the Kingdom and Western powers, the Kingdom receives US dollars in exchange for selling the oil in the global market. Then after spending some of the funds for running the government and maintenance of the monarchy, the remaining funds are channeled back by Saudi Arabia into Western countries via banks and other avenues. High oil prices in the past few years mean billions of extra dollars pour into Saudi coffers almost on a consistent basis.

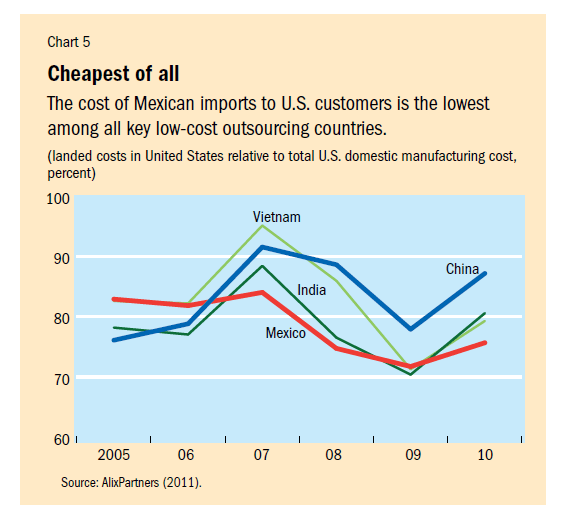

Saudi Arabia was the world’s largest producer of petroleum products and net exporter in 2012 according to a report by the Energy Information Administration (EIA).

Click to enlarge

Source: EIA

From the report:

Saudi Arabia was the world’s largest producer and exporter of petroleum and other liquids in 2012, producing an average of 11.6 million barrels per day (bbl/d) and exporting an estimated 8.6 million bbl/d (net). Saudi Arabia produces more than three times as much of these liquids as the next largest member of the Organization of the Petroleum Exporting Countries (Iran), and as much as the rest of the Arab Middle East put together.

In addition to leading the world in production and exports, Saudi Arabia has an estimated 268 billion barrels of proved oil reserves—over 16% of the global total—and is the only country in the world with extensive spare oil production capacity, which can help cushion market disruptions. While Saudi Arabia has about a hundred major oil and natural gas fields, more than half of its proved reserves are contained in eight fields. Saudi Arabia’s (and the world’s) largest oil field (Ghawar) alone contains an estimated 70 billion barrels of proved reserves, more than the proved reserves in all but seven other countries.

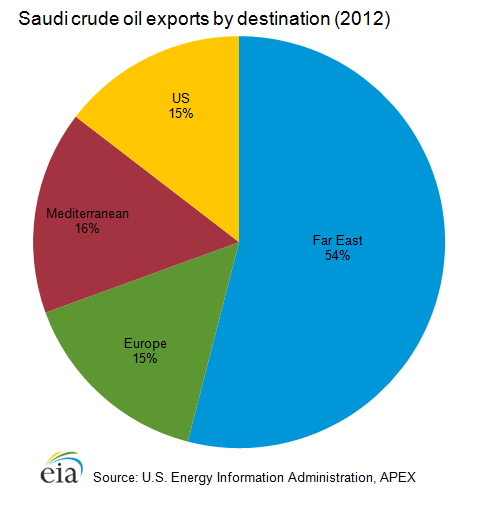

In 2012, 16% of Saudi liquids exports were sent to the United States, accounting for 13% of total U.S. liquids imports. While Canada is the prime supplier of U.S. liquids imports, Saudi Arabia remains an important supplier.

Saudi Aramco, the main oil company of the Kingdom is a National Oil Company (NOC) and is fully owned by the state.Hence it is not possible to invest in the company. For the first 10 months of 2012, Saudi Arabia ranked second in petroleum exports to U.S. after Canada.

The following chart shows the export destinations for Saudi crude oil:

Click to enlarge

How to invest in Saudi Arabian stocks?

Unfortunately none of the Saudi companies are currently listed on the US markets as ADRs or otherwise. Van Eck has filed to launch two country-specific ETFs this year for Saudi Arabia.

For investors that have access to the Saudi Stock Exchange (or Tadawul) one way to invest in the top firms is via The HSBC Amanah Saudi 20 ETF that was launched in 2011.

From an article in the UK-based ETF Strategy site:

The HSBC Amanah Saudi 20 ETF aims to offer investors capital growth over the medium to long-term by replicating the performance of the HSBC Amanah Saudi 20 Equity Index.

The index, created by Standard & Poor’s, is made up of the top 20 Shariah-compliant Saudi companies listed on Tadawul.

The fund, which comes with a Total Expense Ratio (TER) of 0.75%, will use physical replication in tracking its index – thereby physically owning the underlying securities of the index it is tracking.

The fund is up 4.3% YTD according to a factsheet by FE Trustnet Offshore.

Disclosure: No Positions