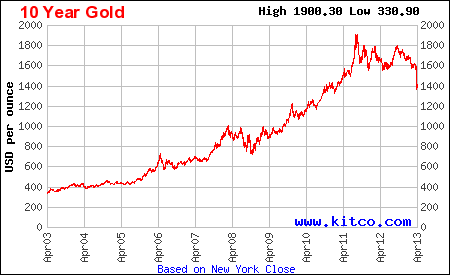

Gold futures closed at $1,406.50 an ounce in New York yesterday. Recently gold prices plunged by over $200 in just two days before recovering slightly. Over the past 10 years, gold soared from about $330.00 an ounce to a record high of $1900.00 in 2011.

Click to enlarge

Source: Kitco

From 2002 thru early March this year, gold was one of the best performing asset classes climbing nearly 500% according to a report by CIBC World Markets.

But why did Gold prices rise to astonishing levels in the past decade? The authors of the CIBC report noted two reasons for investors’ attraction towards the yellow metal:

1. Concerns about inflation and

2. Currency depreciation

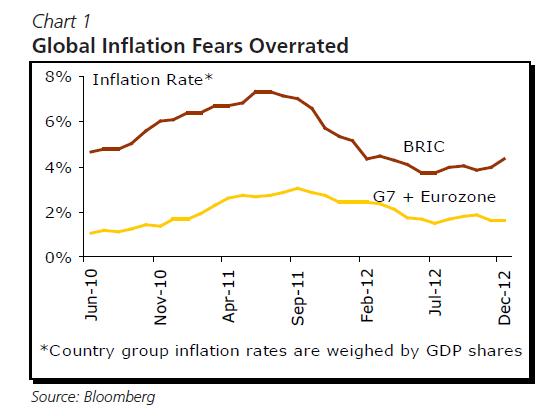

Fears about soaring inflation globally has been unfounded. CPI Inflation has declined in the US and other developed countries as shown in the chart below. Though inflation has been rising in the emerging markets especially the BRIC countries, at the end of last year it was below where it stood in 2011.

Source: Why Gold’s Lustre Will Fade, CIBC World Markets

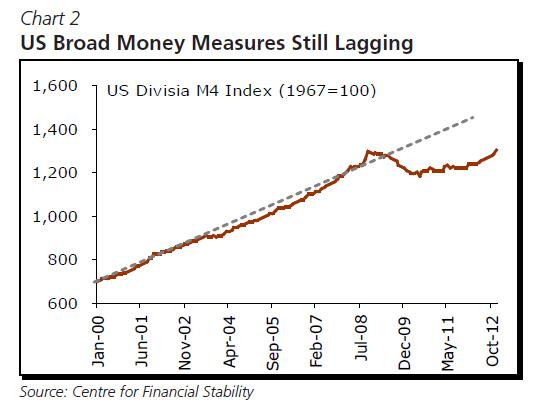

Another popular myth is that Central banks, particularly the Federal Reserve is printing money recklessly which would cause inflation further. However money growth has not increased tremendously. Though the money growth has increased since 2000, as measured by the Divisia M4 Index, it is still below the pre-crisis level as shown in the following chart :

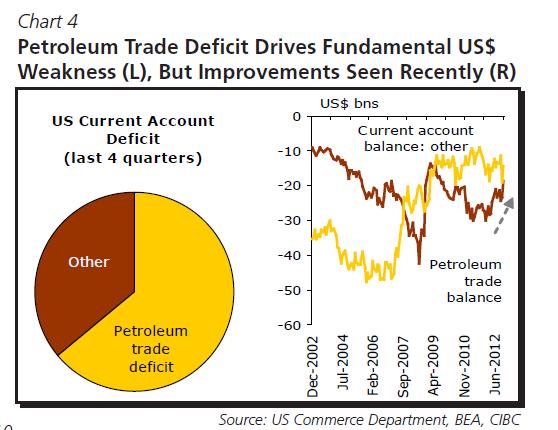

On the fear of depreciation of the US dollar the authors wrote that most the dollar decline has already occurred. From the report:

Investors might not fear inflation, but instead hold gold as an alternative to the dollar for fear that the greenback will weaken sharply against other currencies. That wasn’t just fear, but was reality for the US dollar from 2002 to 2008, a period in which the greenback experienced a steady slide against most other majors.

But that slide was as much about where the dollar started, an overvalued level relative to trade fundamentals, one that generated an unsustainable trade and current account deficit. While the dollar might still be overvalued against some trade counterparties, including the Chinese yuan, the devaluation now behind us looks to have addressed much of the imbalance with other majors.

True, the US still sports an annual current account deficit of some $480 bn or 3% of GDP. But the bulk of that is now the trade deficit in petroleum products (Chart 4, left). The petroleum balance is now making progress as US crude production and dampened gasoline demand growth cut into import requirements (Chart 4, right). Add it all up, and trade fundamentals suggest that most of the broad dollar decline is behind us.

In summary, investors pushed gold prices far too high due to unfounded fears and hence gold may not be the safe heaven that investors are looking for anymore. Gold prices will stabilize at some level and prices reaching $2,000 an ounce that was suggested at its peak in 2011 seems unlikely now.

Related ETFs:

SPDR Gold Trust ETF (GLD)

Disclosure: No Positions