Going to college in the U.S. is an expensive proposition for most students. Unlike other developed and even emerging countries, college education is not free in the U.S.. Students take out thousands of dollars in student loans to get a degree. State colleges are funded by tax-payers. However they too charge tuition which in many cases is astronomical. The majority of the fees collected are used to pay atrocious pay to school administrators who sit around and push papers, sports coaches who are considered like some form of Hollywood stars, high salaries and lavish benefits to professors and others, sports facilities, five-star type student student accommodations, Olympic-grade stadiums, etc.

It should be noted however high-school education is still free and publicly-funded. Only when a student tries to get into college tuition becomes mandatory no whatever which college they go to. Not all the students are born geniuses to get a scholarship or skip college altogether and start their own business. In fact, a recent article in Bloomberg discussed how colleges soak poor students to offer aid to rich students.

Much of the soaring college tuition can be attributed to the government involvement in offering cheap and easy student levels. While the idea has noble intentions, in reality schools have figured out how to milk the system and dump as much as debt possible on unsuspecting students and their parents. Hence the little “angles” who run thousands of universities and colleges across the country as able to spend lavishly on everything mentioned above by increasing the tuition year-after-year like clockwork. Since students take out loans to pay tuition and not pay from their own pocket it seems like free money to them until they graduate.

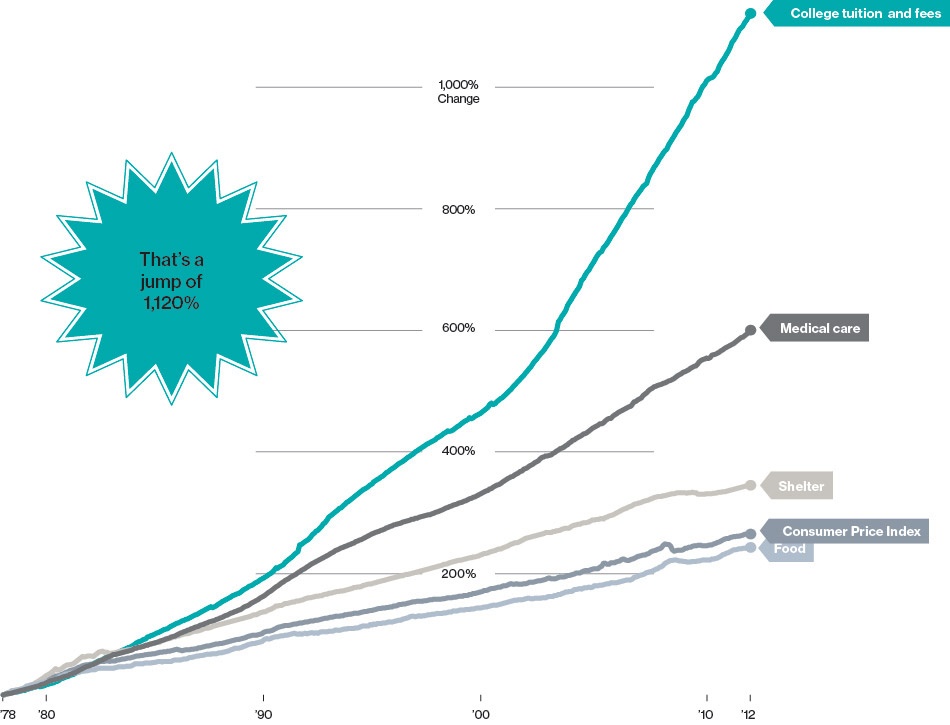

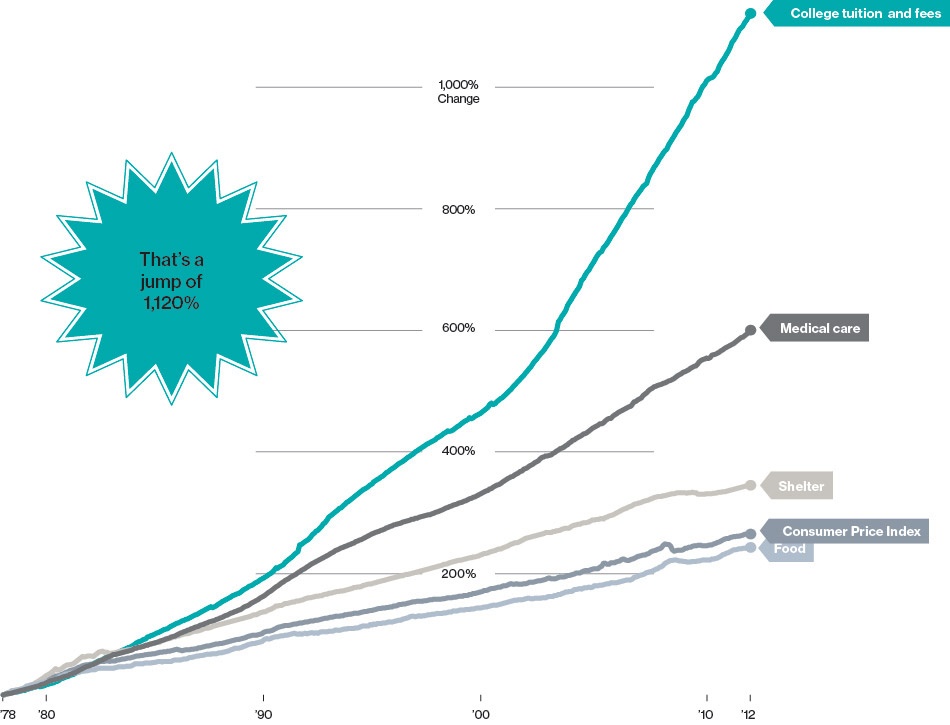

I posted the following chart late last year showing how college tuition has been increasing relative to other expense categories of a typical American:

Source: Bloomberg BusinessWeek

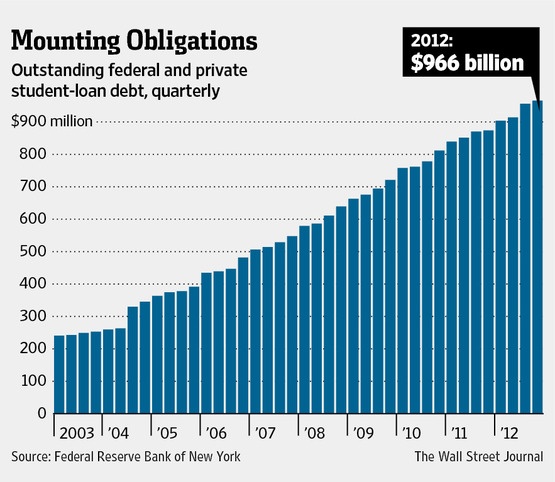

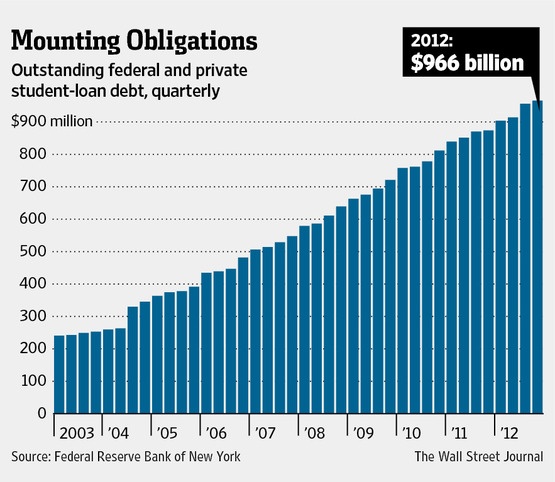

As college tuition increases the outstanding student loans continue to rise as well as shown in the chart below:

Click to enlarge

Apparently the Federal government is considering a plan to help students with their student loans according to a recent piece in The Wall Street Journal. From the article:

The White House proposes that the government forgive billions of dollars in student debt over the next decade, a plan that cheers student advocates, but critics say it would expand a program that already encourages students to borrow too much and stick taxpayers with the bill.

The proposal, included in President Barack Obama‘s budget for next year, would increase the number of borrowers eligible for a program known casually as income-based repayment, which aims to help low-income workers stay current on federal student debt.

Borrowers in the program make monthly payments equivalent to 10% of their income after taxes and basic living expenses, regardless of how much they owe. After 20 years of on-time payments—10 years for those who work in public or nonprofit jobs—the balance is forgiven.

Under the program, most borrowers with loans issued since October 2007 are eligible to participate. The budget proposal—which requires congressional approval—would let all borrowers with pre-2007 loans participate and would make tax exempt any debt forgiven through the program. (Loan forgiveness can be considered taxable income.)

Source: Cutting Down Student Debt, The Wall Street Journal, May 10, 2013

The article noted that one student raked up $300,000 in student loans to get a law degree. One thing that shocked me was that student loans seem to be an easy option Uncle Sam offers to students to use for all kinds of living expenses, even to fund a luxurious lifestyle such as spending on home improvements. This particular student apparently took “emergency student loans” to spend on home repairs, unexpected medical costs, health-insurance bills, etc. While spending on medical expenses is understandable it is not clear how student loans can be used to make home improvements. It appears that this Federal student program is riddled with plenty of loopholes. Obviously wise students are taking advantage of it while the going is good.

Related:

Dear Class of ’13: You’ve been scammed, MarketWatch