Just a few months ago the Chinese equity market plunged dramatically almost overnight. Global markets followed suit as fears of a collapse in China’s economy and equity markets would lead the world into a depression. Stocks of developed world companies which have nothing to China were also trashed during the selloff.

However a recent Journal article told us that Chinese stocks have entered a bull market. From going to a complete and utter disaster Chinese stocks are roaring again. To be sure, the bull market means that stocks have recovered by at least 20% from the troughs reached during the crash.

From the Journal article:

China entered a bull market Thursday, a surprising milestone after a volatile summer wiped out trillions of dollars in value from mainland equities and rattled global markets.

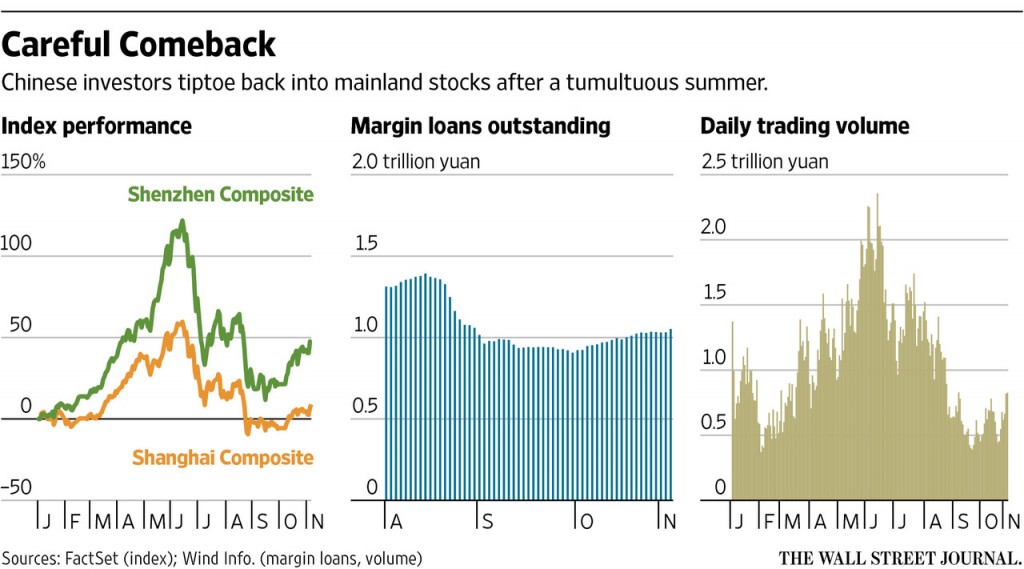

The Shanghai Composite Index has gained 20.3% since Aug. 26, the bottom of the summer selloff. A bull market is defined as a rise of 20% from a recent low.

The benchmark finished up 1.8% at 3522.82 on Thursday, bringing its year-to-date gains to 8.9%, but it is still down 32% from its 2015 high reached on June 12.

China’s smaller Shenzhen Composite Index and a gauge of China’s volatile startup shares have rallied 32% and 43%, respectively, from their recent lows on Sept. 15. On Thursday, the Shenzhen Composite closed up 0.2% at 2093.47, while the ChiNext Price Index slipped 0.8% to 2564.72. The Shenzhen market has gained 48% this year, while the ChiNext is up 74%.

Investors have gradually returned to the market after the summer selloff, which Beijing scrambled to stem. Trading volumes have reached their highest level since mid-August and Chinese investors are borrowing from their brokerages again to buy stocks.

Click to enlarge

Margin loans have climbed to their highest level in roughly two months after dropping sharply in the throes of the rout, but are still down roughly 54% from a June 18 peak of 2.27 trillion yuan ($358 billion), according to Wind Information Co. On Wednesday, margin loans totaled 1.05 trillion yuan.

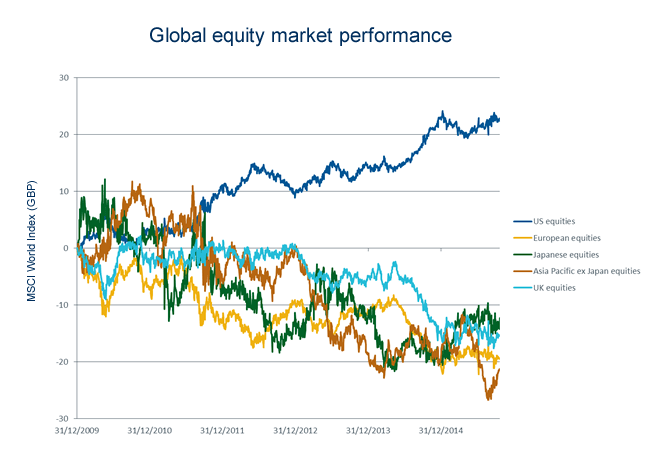

Global stocks have also been rebounding from a tumble in August, when China devalued its yuan in a surprise move that raised doubts about Beijing’s ability to transition the world’s second-largest economy to a more market-oriented system. The MSCI World Index has risen almost 11% since late September.

Chinese officials dug deep into their playbook for ways to stabilize domestic markets, including pumping money into state-backed funds that bought blue-chip stocks and cracking down on short sellers and suspending initial public offerings. They even pledged to keep buying stocks until the Shanghai Composite Index reached 4500—a goal still roughly 1,000 points away.

Source: Rebounding Chinese Shares Enter a Bull Market, WSJ, Nov 5, 2015

Before an investor jumps into this bull market here are a few points to remember:

- The majority of investors in China are domestic retail investors – not foreign investors. These local investors are not in for the long haul and consider the equities a quick way to get rich. So violent moves on the upside and downside should be expected.

- Unlike Brazil and India, foreign investors are not the main shareholders in Chinese stocks due to various state restrictions.

- As an emerging country, the Chinese stock market is a classic follower of boom and bust cycles. The market has crashed many times in the past only to rebound sharply. So one should expect falls of 50% of more quickly anytime.

- The relationship between economic performance and equity markets is very weak. Hence even when the economy is growing slowly stocks can soar for any number of reasons. This is what has happened in China. Though the economy has not grown sharply in just a few months, stocks have entered a bull market.

- Unlike other countries, China follows a unique political and economic model. As a communist country at least politically, the communist party runs the country and can impose arbitrary rules on the functioning of the markets. Since the majority are local average retail investors, the party may not allow the market to plunge by 99% for example to prevent social uprisings. During the recent state intervention all forms of silly rules were enacted including the complete suspension of trading certain stocks.

- The Shanghai Composite Index closed at 3,590.03 on Friday. In August it reached as low as 2,927 and in June it peaked at 5,166. Stocks shot up to the moon from starting the year at 3,350 levels only to start the plunge after the peak in June. Now they are back in bull market mode. This one year performance of the index shows the extreme volatility of the Chinese equity market.

- Over 50% of the Chinese exchange-listed ADRs trading on the US markets are at below $10 a share. Many of these stocks were priced at at least $10 or more when they had their IPOs a few years ago. This shows that diving into Chinese IPOs is another worst idea for overseas investors. Some of the Chinese stocks have completely disappeared from US markets due to delisting or reverse mergers.

So in summary, though Chinese stocks have entered a bull market investors have to very cautious investing in China.

Related: The Full List of Chinese ADRs